India Used Car Market Overview

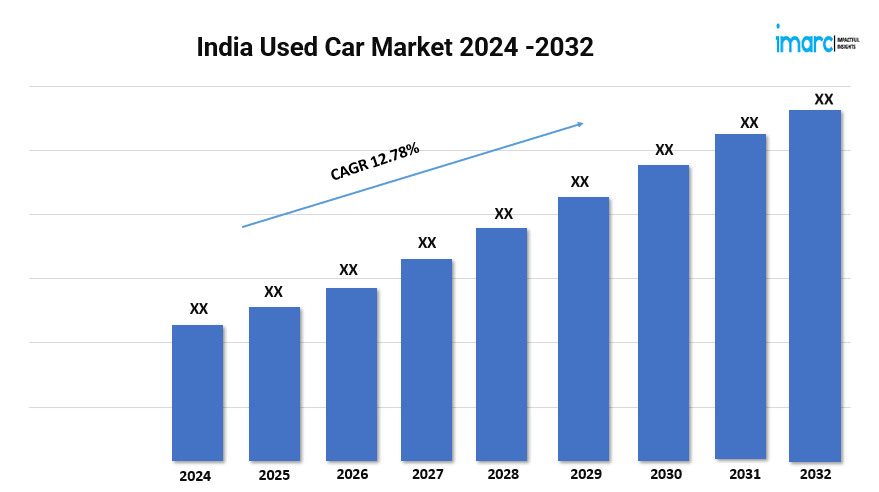

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 12.78% (2024-2032)

The increasing number of online platforms for selling second-hand cars is impelling the growth of the market in India. According to the latest report by IMARC Group, The India used car market size reached US$ 31.6 Billion in 2023 to reach US$ 93.2 Billion by 2032 at a CAGR of 12.78% during 2024-2032.

India Used Car Industry Trends and Drivers:

Online platforms and apps are revolutionizing how people buy and sell used cars. Companies are creating user-friendly platforms that facilitate easy transactions, provide transparent vehicle histories, and offer competitive pricing. This digital shift is enhancing market transparency, reducing the time and effort involved in buying or selling a used car, and broadening the reach of both buyers and sellers. The improved durability and longevity of vehicles are propelling the market growth in the country. Advances in automotive technology and manufacturing processes are resulting in vehicles that last longer and require less frequent maintenance. As a result, used cars are perceived as more reliable and valuable, which boosts buyer confidence in purchasing pre-owned vehicles. This trend is particularly relevant in the Indian market, where long-term reliability and low maintenance costs are critical factors for buyers.

The availability of financing options for used cars is making it easier for buyers to afford pre-owned vehicles. Banks and financial institutions have started offering loans specifically for used car purchases, often with competitive interest rates and flexible repayment terms. Additionally, partnerships between used car dealers and financial institutions are streamlining the loan approval process, making it more accessible for a broader segment of the population. This increased financial accessibility is expanding the pool of potential buyers. Buyer preferences are shifting towards models with advanced features, even in the used car segment. Buyers are increasingly looking for vehicles that offer modern amenities, safety features, and fuel efficiency. This trend is driving the demand for relatively recent models of used cars. As a result, dealers are focusing on procuring and offering vehicles that meet these evolving expectations. This shift is also encouraging sellers to invest in vehicle refurbishments and certifications to enhance appeal and market value. Awareness and education among car buyers are improving significantly, catalyzing the demand for greater transparency in the market in India. Buyers are becoming more informed about the importance of vehicle history reports, comprehensive inspections, and fair pricing. As a result, dealers and online platforms are offering detailed vehicle histories, inspection reports, and warranty options to build trust and credibility. This focus on transparency helps mitigate risks associated with buying used cars and enhances overall market confidence.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-used-car-market/requestsample

India Used Car Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Vehicle Type:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Breakup by Vendor Type:

- Organized

- Unorganized

Breakup by Fuel Type:

- Gasoline

- Diesel

- Others

Breakup by Sales Channel:

- Online

- Offline

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- Big Boy Toyz Ltd

- BMW India Private Limited (Bayerische Motoren Werke AG)

- Cars24

- CarTrade

- Honda Cars India Limited (Honda Motor Co. Ltd.)

- Mahindra First Choice Wheels (Mahindra & Mahindra Limited)

- Maruti Suzuki India Limited (Suzuki Motor Corporation)

- OLX (OLX Group)

- Quikr India Private Limited

- Spinny (Valuedrive Technologies Private Limited)

- Toyota Kirloskar Motor Private Limited (Toyota Motor Corporation)

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments