India Trade Finance Market Overview

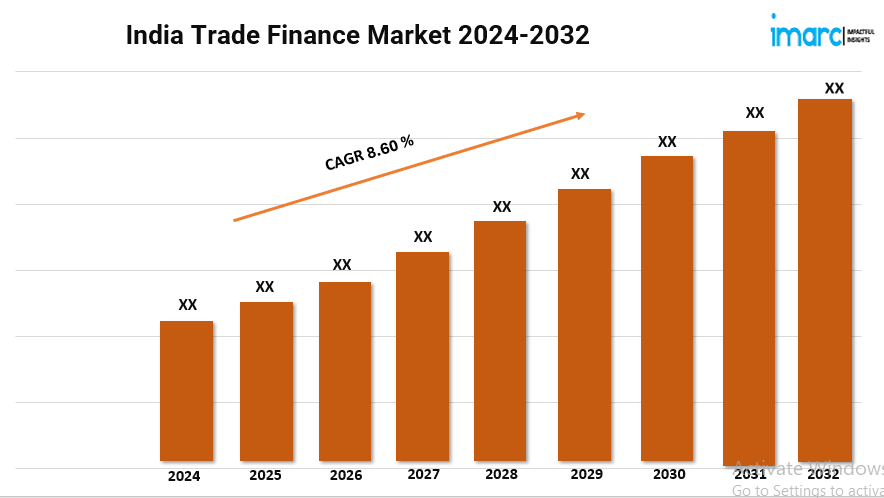

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 8.60% (2024-2032)

India Trade Finance Market is growing rapidly, driven by increasing international trade and government support for financial services. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 8.60% from 2024 to 2032.

Request for a PDF sample of this report: https://www.imarcgroup.com/india-trade-finance-market/requestsample

India Trade Finance Market Trends and Drivers:

The Indian trade finance market is undergoing rapid transformation as the country's export-import activities grow and global trade integration strengthens. This expansion is driven by the rising demand for trade finance solutions that facilitate seamless cross-border transactions. Government initiatives focused on enhancing trade infrastructure and promoting exports through various policies are further boosting the market.

Additionally, the shift towards digital trade finance solutions—offering improved transparency, reduced fraud risks, and faster processing—is a key factor driving this growth. The increasing involvement of small and medium enterprises (SMEs) in international trade amplifies the need for accessible and cost-effective trade finance services. Technological advancements, such as blockchain and artificial intelligence (AI), are shaping the market by enhancing transaction efficiency and security. Moreover, the emergence of digital platforms and online marketplaces is making trade finance more accessible, while a growing emphasis on sustainable trade practices is also influencing the market's direction. These developments are expected to drive continued growth in India's trade finance sector.

India Trade Finance Industry Segmentation:

The report has segmented the market into the following categories:

Finance Type Insights:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Offering Insights:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

Service Provider Insights:

- Banks

- Trade Finance Houses

End User Insights:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players

.

Ask Analyst for Customization and Explore Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=21598&flag=C

Key Highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments