CFO Advisory and Consulting Services for Virtual Chief Financial Officers in India

In today's fast-paced business environment, a Chief Financial Officer (CFO) is crucial for strategic decision-making and financial management. However, not all businesses, especially startups and SMEs, can afford a full-time CFO. It is where Virtual CFO (vCFO) services come into play. Offering CFO advisory and consulting services, virtual CFOs provide the expertise and guidance needed to navigate complex financial landscapes without the hefty price tag of a permanent executive.

What is a Virtual CFO?

A Virtual CFO is an outsourced service provider offering high-level financial management and strategic guidance, similar to a traditional CFO but on a flexible, as-needed basis. Virtual CFOs bring a wealth of experience and a fresh perspective, helping businesses manage their finances more effectively and make informed decisions.

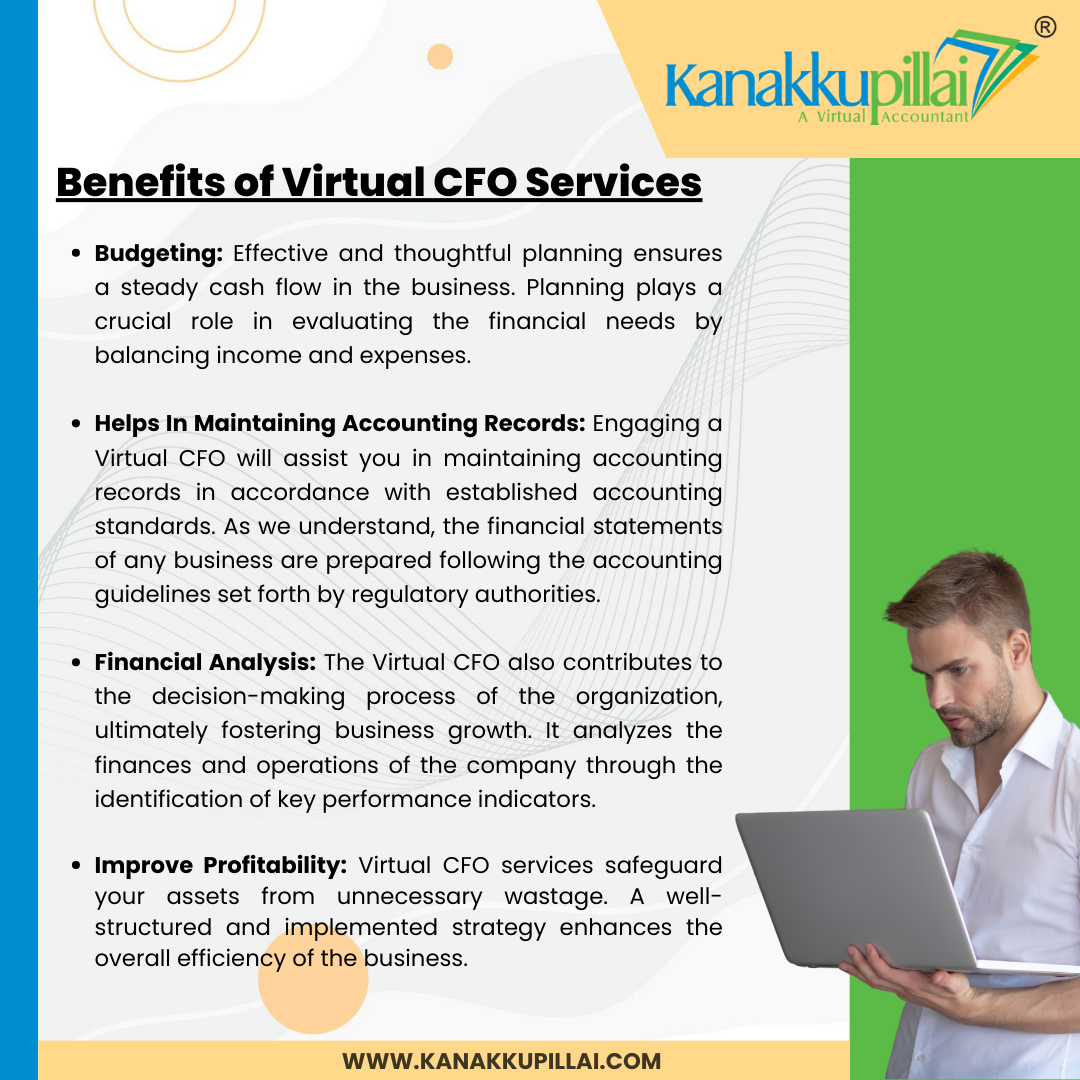

Benefits of Hiring a Virtual CFO

1. Cost-Effective:

- Affordability: Get top-tier financial expertise without the full-time salary, benefits, and overhead costs associated with a permanent CFO.

Flexible Payment: You pay only for the services you need, making it a scalable solution for growing businesses.

2. Expertise and Experience:

- Diverse Skill Set: Access to various financial skills and industry knowledge.

- Strategic Insight: Benefit from strategic advice and insights that drive growth and improve profitability.

3. Scalability:

- Adaptability: Scale services up or down based on your business requirements.

- Customized Solutions: Tailored financial strategies aligning with your business goals.

4. Focus on Core Business:

- Time Management: Free up your time to focus on core business activities while the vCFO handles financial complexities.

- Improved Efficiency: Streamline financial processes and improve overall business efficiency.

Essential Services Provided by Virtual CFOs

1. Financial Planning and Analysis (FP&A):

- Budgeting and forecasting to ensure financial stability and prepare for future growth.

- Analyzing financial data to provide actionable insights and recommendations.

2. Strategic Financial Management:

- Developing long-term financial strategies aligned with business objectives.

- Identifying opportunities for cost reduction and revenue enhancement.

3. Cash Flow Management:

- Monitor and manage cash flow to ensure liquidity and operational efficiency.

- Implementing strategies to optimize working capital.

4. Risk Management:

- Identifying and mitigating financial risks to protect the business.

- Developing risk management policies and procedures.

5. Financial Reporting and Compliance:

- Ensuring accurate and timely financial reporting.

- Maintaining compliance with statutory regulations and standards.

6. Investment Advisory:

- Advising on investment opportunities and funding options.

- Assisting with capital raising and investor relations.

7. Performance Monitoring:

- Establishing key performance indicators (KPIs) to track business performance.

- Conducting regular performance reviews and providing feedback.

8. Tax Planning and Management:

- Strategizing tax planning to minimize liabilities.

- Ensuring compliance with tax laws and regulations.

Industries Benefiting from Virtual CFO Services

Virtual CFO services are versatile and can benefit a wide range of industries, including:

- Startups and SMEs: Providing financial guidance and support crucial for early-stage and growing businesses.

- Technology Firms: Managing rapid growth and complex financial structures.

- Manufacturing: Optimizing production costs and managing supply chain finances.

- Retail: Enhancing financial efficiency in inventory and sales management.

- Healthcare: Managing financial operations in a highly regulated industry.

- Professional Services: Streamlining financial processes and improving profitability.

Choosing the Right Virtual CFO Service

When selecting a virtual CFO service, consider the following:

- Experience and Expertise: Look for providers with a proven track record and expertise in your industry.

- Customized Services: Ensure the provider offers tailored solutions that meet your needs.

- Communication and Availability: Choose a service that provides clear communication and is available when needed.

- Technological Proficiency: Ensure they use advanced financial tools and technologies to enhance service delivery.

Conclusion

Virtual CFO services are a game-changer for businesses in India, providing the financial acumen and strategic insight necessary to thrive in a competitive market. By leveraging the expertise of a virtual CFO, companies can achieve economic stability, drive growth, and focus on what they do best—delivering value to their customers. Whether a startup or an established enterprise, virtual CFO advisory and consulting services offer the flexibility, expertise, and cost-efficiency needed to take your business to the next level.

Comments