Activating a new credit card marks the beginning of new financial opportunities and responsibilities. For new Merrick Bank credit cardholders, activation is the crucial first step to accessing credit facilities and beginning a journey toward improved financial health. This article provides a detailed, step-by-step guide on how to activate your Merrick Bank credit card using merrickbank.com/activate, ensuring a smooth start to your relationship with your new card.

Step 1: Receive Your Merrick Bank Credit Card

Firstly, you need to have received your Merrick Bank credit card in the mail. Merrick Bank sends the credit card through postal mail after you have been approved following your application. The card typically arrives in a plain, nondescript envelope for security purposes.

Step 2: Locate Your Activation Information

Upon receiving your new credit card, look for the activation instructions that are included in the package. These are usually found on a sticker affixed to the front of the card or in a letter included in the envelope. You will find a specific activation phone number and possibly a website address for online activation.

Step 3: Choose Your Activation Method

Merrick Bank offers two primary methods for activating your credit card:

- Phone Activation: To activate your card by phone, call the number provided on the sticker or in your card package. This will typically be a toll-free number. Once connected, you will be directed to follow an automated prompt, or a customer service representative will guide you through the activation process. Be prepared to provide personal information and the credit card number to verify your identity and activate your card.

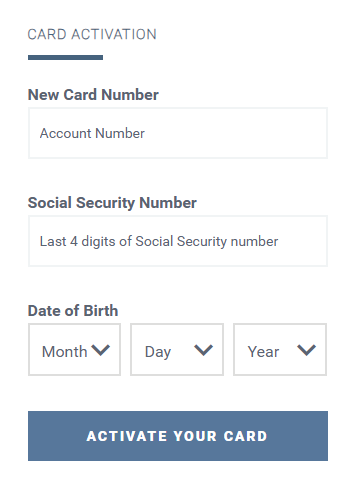

- Online Activation: If you prefer to activate your card online, visit the Merrick Bank activation website provided in your welcome packet. You will need to log in to your account or create a new one if you haven't done so already. After logging in, enter your credit card details as prompted to complete the activation.

Step 4: Sign Your Card

Once your card is activated, sign the back of your credit card with a pen. This is a necessary security step to verify that the card is being used by the rightful owner.

Step 5: Set Up Online Banking (Optional but Recommended)

Setting up online banking can enhance your experience with Merrick Bank. Visit the Merrick Bank website and look for the option to register or enroll in online banking. This service allows you to manage your account digitally, including checking your balance, viewing statements, paying bills, and setting up alerts for your account activities.

Step 6: Familiarize Yourself with Your Card’s Features and Benefits

Take some time to read through the materials sent with your card. Understand your credit limit, any fees associated with the card, the APR for purchases and cash advances, and any rewards or benefits that come with your Merrick Bank credit card. This knowledge will help you use your card more effectively and avoid any unnecessary charges.

Conclusion

Activating your Merrick Bank credit card is a straightforward process that marks the start of your new credit journey. By following the above steps, you can ensure that your card is ready to use as soon as possible. Remember to handle your credit responsibly to build a positive credit history and improve your financial health. Whether you choose to activate your card online or by phone, Merrick Bank has made the process easy and user-friendly, allowing you to quickly start benefiting from your new credit card.

Comments