- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Career & Finance Fridays

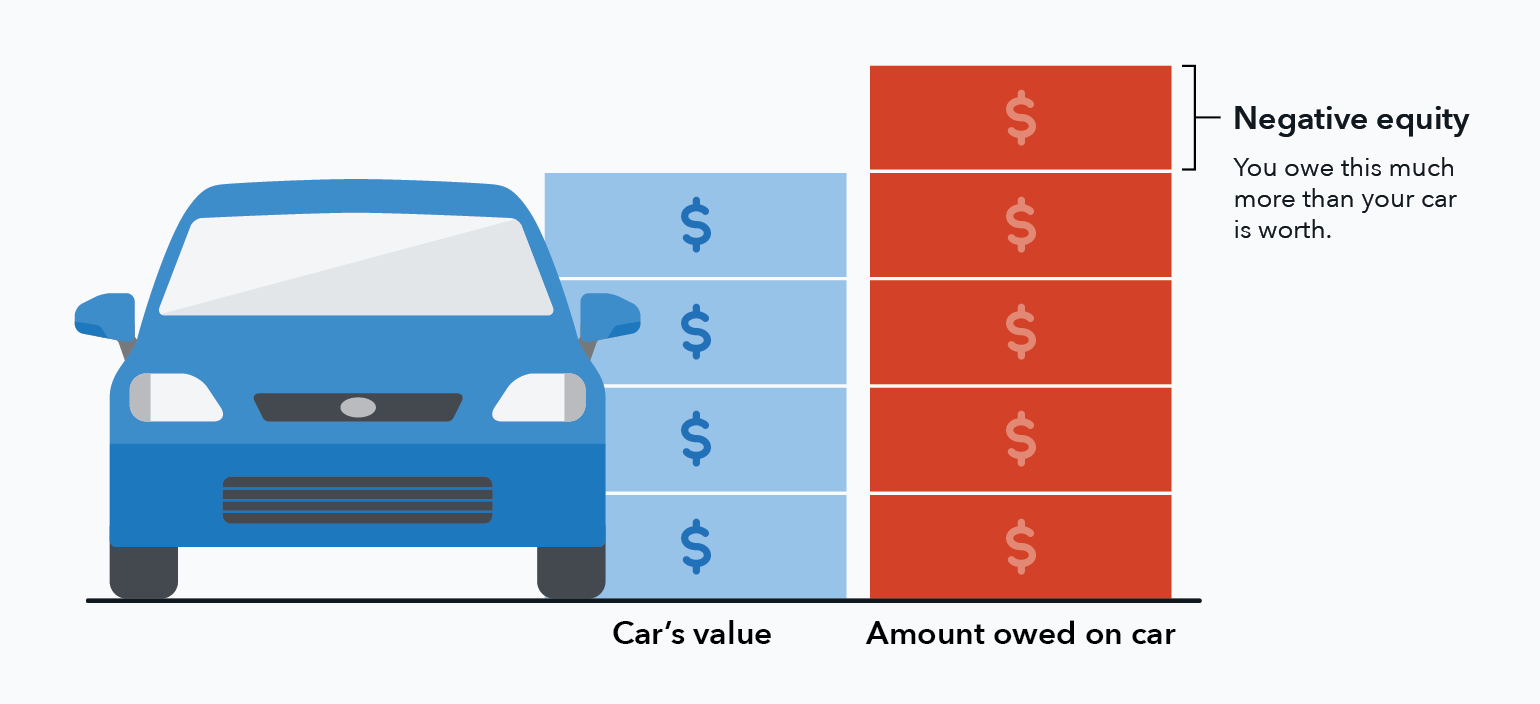

Negative Equity In Vehicles

Have you ever made a bad decision on a vehicle? Like signing the paperwork and then realizing that the car payment might be a bit of stretch on your monthly budget?

Some friends of mine just got sucked into a new-to-them vehicle a few months back. They were out vehicle shopping with shiny object syndrome one afternoon. She was pregnant with their second child and all they could think about was the difficulty in getting a car seat out of the small back seat of their current car.

In all fairness, I get it! Having a baby in a small car is tight. Those rear facing car seats take up a LOT of room.

So, they landed at the dealership and got shown a van that was a few years old - it had all the bells and whistles.

They must have had a great (or greasy) salesman working with them because he somehow convinced them that they couldn’t live without this new van. They ended up trading both their cars in to buy this van.

The biggest trouble is that they had negative equity in both their cars that got rolled up into the new payment on the van. In hindsight, they realized that they didn’t have a great grasp on what negative equity is. The easiest way to put it, is they had debt on those cars. That debt got added to an even bigger loan that they needed to purchase the van.

They got roped into a 7 year payment plan that costs them over $1000/month…all on a USED vehicle!

I’m by no means against having a good vehicle to drive - but I am against rolling negative equity into a new loan for a new(ish) vehicle. A vehicle is a depreciating asset, so the more debt you add to a vehicle loan, the harder it is ever going to be to pay it off.

What’s your worst vehicle mistake that you’ve ever made?

Interesting Fact #1

The share of Americans who are upside down on their auto loans is on the rise. 24.2% of trade-ins toward new vehicle purchases had negative equity, up from 23.9% in Q2 2024 and 18.5% in Q3 2023.

Interesting Fact #2

Consumers who are underwater on their car loans owe more money than ever before. The average amount owed on upside-down loans climbed to an all-time high of $6,458, compared to $6,255 in Q2 2024 and $5,808 in Q3 2023.

Interesting Fact #3

More than 1 in 5 consumers with negative equity owe more than $10,000 on their auto loans. 22% of vehicle owners with negative equity owed $10,000+ on their car loans, and 7.5% of vehicle owners with negative equity owed $15,000+.

Quote of the day

“It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong.” ― George Soros

Article of the day - Car Loan Trouble: The Average Amount Owed on Upside-Down Auto Loans Hits an All-Time High in Q4 2024, According to Edmunds

Analysts say nearly 1 in 4 vehicle trade-ins toward new-car purchases with negative equity are underwater by $10,000 or more

SANTA MONICA, CA — January 16, 2025 — A growing share of Americans with auto loans owe more than their cars are worth, according to the car shopping experts at Edmunds. Q4 2024 data from Edmunds1 reveals:

- 1 in 4 new vehicle trade-ins are underwater. 24.9% of trade-ins toward new-car purchases had negative equity, up from 24.2% in Q3 2024 and 20.4% in Q4 2023.

- Americans with upside-down car loans owe more money than ever before. The average amount owed on upside-down loans climbed to an all-time high of $6,838, surpassing Q3 2024's record of $6,458. In Q4 2023, the average amount owed on upside-down loans was $6,054.

- 1 in 4 consumers with negative equity owe more than $10,000 on their auto loans. 24.6% of vehicle owners with negative equity who purchased a new-car replacement owed $10,000+ on their car loans in Q4 2024, an increase from 22.2% in Q3 2024. 8.5% of vehicle owners with negative equity owed $15,000+ in Q4 2024, an increase from 7.5% in Q3 2024.

"Negative equity isn't a brand-new phenomenon in the auto lending space — in fact, it wasn't too long ago when more than a third of trade-ins toward new-car purchases were upside down," said Jessica Caldwell, Edmunds' head of insights. "What's particularly alarming in the Q4 figures is that a growing share of trade-ins are hitting the double-digit mark in thousands of dollars owed, making the cycle far more challenging for consumers to escape."

To illustrate the repercussions of rolling an upside-down auto loan into a new purchase, Edmunds experts calculated the differences in cost between consumers who financed a new vehicle involving a trade-in with negative equity in Q4 and the industry average for all financed new vehicles. On average, buyers whose trade-ins had negative equity took on an additional $159 in monthly payments and $12,388 more in total amount financed than the industry average for all financed new vehicles. Both of those figures represent all-time records.

Edmunds experts advise that consumers who have an existing loan and are considering a new vehicle purchase take a close look at the value of their current vehicle and compare it against their payoff amount (found on their most recent loan statement) to determine if they are underwater.

"The ramifications for trading in a vehicle well below sea level for a brand-new vehicle can be drastic and lead to a cycle of poor auto financing decisions," said Ivan Drury, Edmunds' director of insights. "If you find yourself significantly underwater on your loan, your best opportunity to rise to the surface is to hold onto the vehicle while keeping up with payments and maintenance."

Shoppers interested in determining the value of their current vehicle can use an Edmunds appraisal tool like the one on Edmunds. Consumers can also track their vehicle's historic value over time on Edmunds here.

Edmunds Q4 Negative Equity Data

| Year | Share of New Vehicles Purchased with a Trade-in | Share of Trade-ins with Negative Equity | Average Amount of Negative Equity | Average Trade-in Age (Years) |

| 2024 | 43.6% | 24.9% | -$6,838 | 3.3 |

| 2023 | 44.7% | 20.4% | -$6,054 | 3 |

| 2022 | 43.9% | 17.7% | -$5,353 | 2.8 |

| 2021 | 49.0% | 14.9% | -$4,147 | 2.7 |

| 2020 | 48.3% | 31.4% | -$5,063 | 3.2 |

| 2019 | 44.4% | 32.7% | -$5,658 | 3.3 |

Question of the day - What is the worst vehicle mistake that you’ve ever made?

Money & Finances

What is the worst vehicle mistake that you’ve ever made?