- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Career & Finance Fridays

Vehicles

One of the leading causes of financial ruin in North America today seems to be vehicles. Everywhere you look people are trading in their ALMOST new vehicles for an EVEN NEWER one.

It’s become like an obsession to always have the latest and greatest - people are so busy showing off their new cars that they don’t stop to think about the financial hardship that they are causing for themselves by always having the newest vehicle.

Sure, there are people who can afford to drive brand new vehicles - but I would guess that more than 90% of people are driving around in vehicles with payments that are crushing them.

When you search what the average car payment in North America is today, you will find information supporting anywhere from $700-$1300 per month. That’s as much (or more!) than some people pay for their rent or mortgage!

The thing is that a vehicle is an expense no matter what way you shake it down - it costs money to own and operate a car. However, if the cost of your car is forcing you to live on credit to cover the rest of your expenses, then it is time to rethink your car purchase.

I’m not saying you shouldn’t drive a nice car, but I am saying that we need to get back to living within our means…kind of like what Grandma used to say.

Interesting Fact #1

Average car payments for new vehicles increased slightly year over year, while they decreased for used and leased vehicles. Average car payments for new vehicles increased by 0.1%, according to second-quarter 2024 Experian data. In the same period, average car payments for used and leased vehicles decreased by 2.1% and 2.3%, respectively. That puts average monthly car payments at $734, $525 and $586, respectively.

Interesting Fact #2

The price of used cars and trucks decreased. Used car and truck prices are down a significant 10.4% year over year, according to the August 2024 U.S. Bureau of Labor Statistics (BLS) consumer price index, while new vehicle prices dipped 1.2%. Americans borrow an average of $40,927 for new vehicles and $26,248 for used vehicles, according to Experian.

Interesting Fact #3

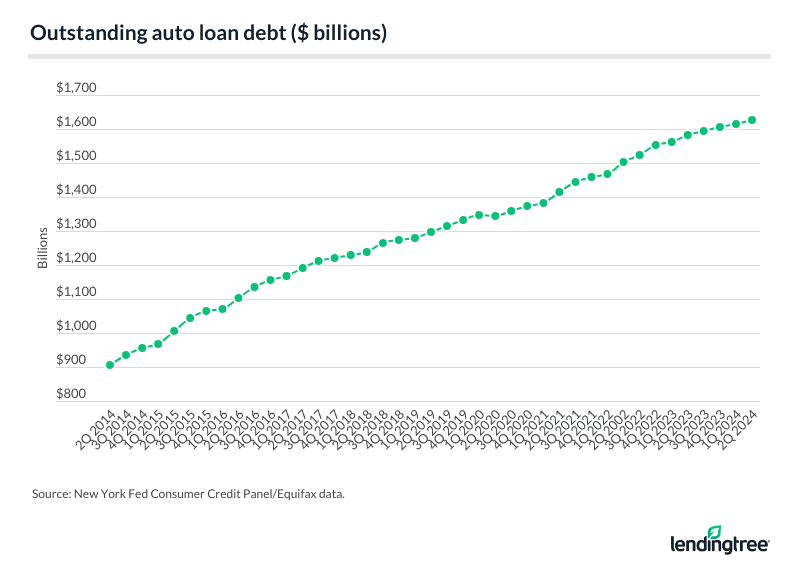

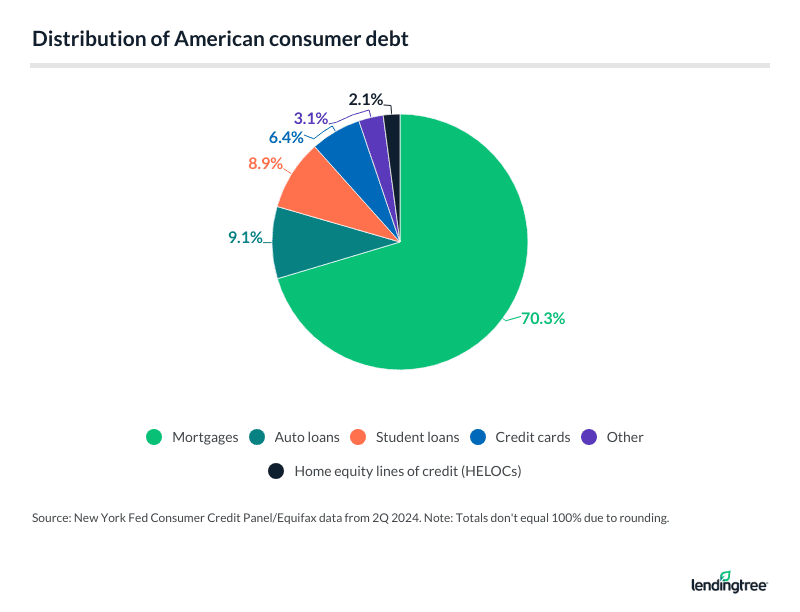

Auto loan debt is the second-largest category behind mortgages. Overall, Americans owe $1.626 trillion in auto loan debt, according to the Federal Reserve Bank of New York, accounting for 9.1% of American consumer debt.

Quote of the day

“If you keep a $495 car payment throughout your life, which is “normal,” you miss the opportunity to save that money. If you invested $495 per month from age twenty-five to age sixty-five, a normal working lifetime, in the average mutual fund averaging 12 percent (the eighty-year stock market average), you would have $5,881,799.14 at age sixty-five. Hope you like the car!” ― Dave Ramsey

Article of the day - Average Car Payment and Auto Loan Statistics: 2024

The average car payment for new vehicles was $734 per month in the second quarter of 2024, a 0.1% increase from the second quarter of 2023. Meanwhile, average car payments for used and leased vehicles decreased by 2.1% and 2.3%, respectively.

LendingTree looked at payments, originations, term lengths, delinquencies and more to get a full picture of U.S. auto loan debt and trends. Here’s our 2024 roundup of auto loan statistics.

Auto loan statistics in 2024: Average car payments to most popular models

- Average car payments for new vehicles increased slightly year over year, while they decreased for used and leased vehicles. Average car payments for new vehicles increased by 0.1%, according to second-quarter 2024 Experian data. In the same period, average car payments for used and leased vehicles decreased by 2.1% and 2.3%, respectively. That puts average monthly car payments at $734, $525 and $586, respectively.

- The price of used cars and trucks decreased. Used car and truck prices are down a significant 10.4% year over year, according to the August 2024 U.S. Bureau of Labor Statistics (BLS) consumer price index, while new vehicle prices dipped 1.2%. Americans borrow an average of $40,927 for new vehicles and $26,248 for used vehicles, according to Experian.

- Auto loan debt is the second-largest category behind mortgages. Overall, Americans owe $1.626 trillion in auto loan debt, according to the Federal Reserve Bank of New York, accounting for 9.1% of American consumer debt.

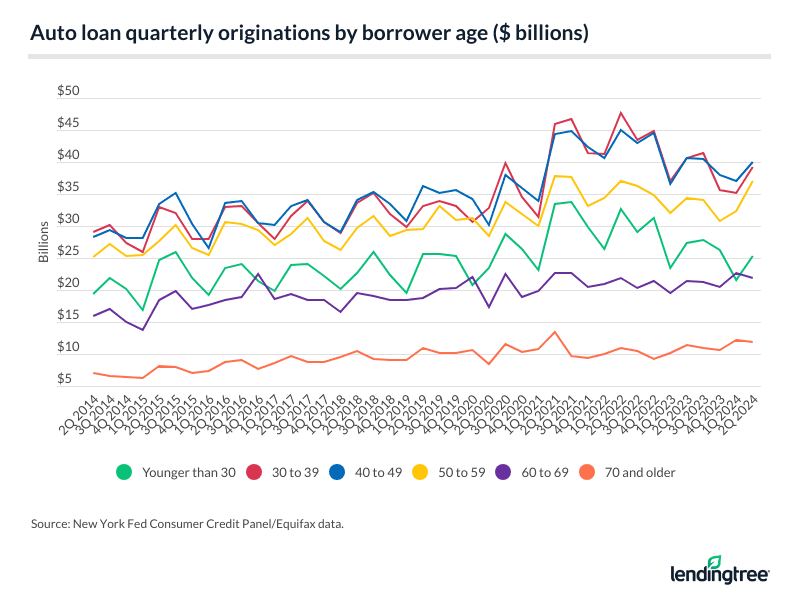

- Americans took out $179.1 billion in new auto loans in the second quarter of 2024. By age, Americans younger than 50 took out $104.5 billion in auto debt during the second quarter, according to the New York Fed, compared with $70.8 billion among those 50 and older.

- Americans are taking many years to pay back their auto loans. The average auto loan term is 68.5 months for new cars, 67.4 months for used cars and 35.9 months for leased vehicles, according to Experian.

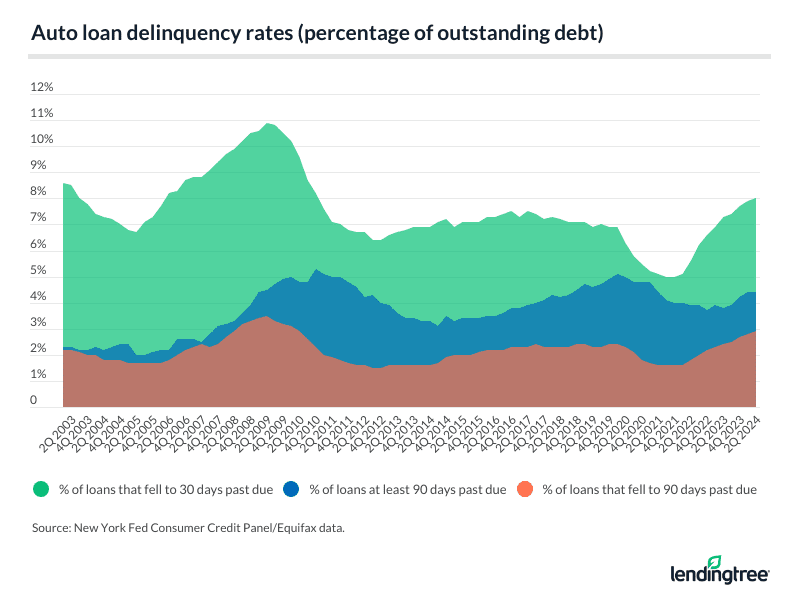

- Auto loan delinquency rates are up compared to last year. 4.4% of outstanding auto debt was at least 90 days late in the second quarter of 2024, according to the New York Fed, up 16.0% from the second quarter of 2023. Meanwhile, the percentage of auto loans that fell to 30 days past due was 8.0% in the second quarter of this year, up 9.2% from 7.3% in the second quarter of last year.

- Borrowers with prime credit scores are responsible for the majority of retail vehicle financing. Borrowers with credit scores of 661 and higher account for 69.4% of retail vehicle financing, according to Experian, versus 14.9% for subprime borrowers with credit scores of 600 or lower.

- The most popular vehicle models consumers considered buying on the LendingTree platform in the second quarter of 2024 were the Ford F-150, Chevrolet Silverado 1500 and Ram 1500. The Ford F-150 maintained the No. 1 spot for the second quarter in a row.

Average monthly car payments for new vehicles jump slightly year over year

The average car payment for a new vehicle is $734 monthly, according to second-quarter 2024 Experian data — up 0.1% year over year. Used cars have an average monthly payment of $525, down 2.1%. Meanwhile, new lease payments average $586, a 2.3% decrease.

Annual changes in average monthly car payments

|

The average car payment for new vehicles was $734 per month in the second quarter of 2024, a 0.1% increase from the second quarter of 2023. Meanwhile, average car payments for used and leased vehicles decreased by 2.1% and 2.3%, respectively. LendingTree looked at payments, originations, term lengths, delinquencies and more to get a full picture of U.S. auto loan debt and trends. Here’s our 2024 roundup of auto loan statistics. Auto loan statistics in 2024: Average car payments to most popular models

Average monthly car payments for new vehicles jump slightly year over yearThe average car payment for a new vehicle is $734 monthly, according to second-quarter 2024 Experian data — up 0.1% year over year. Used cars have an average monthly payment of $525, down 2.1%. Meanwhile, new lease payments average $586, a 2.3% decrease. Annual changes in average monthly car payments

Source: Experian State of the Automotive Finance Market, 2Q 2023 and 2Q 2024. Those with credit scores of 601 to 660 (in the nonprime or fair ranges) and 501 to 600 (in the subprime or poor and fair ranges) saw the highest average monthly payments for new vehicles, at $765 and $749, respectively. Average monthly payments by credit score range

Source: Experian State of the Automotive Finance Market, 2Q 2024.

Tip

Used car and truck prices see significant dipThe used car market was friendlier to consumers as used car and truck prices dropped 10.4% year over year, as reported by the August 2024 BLS consumer price index. A June 2024 Wall Street Journal article says buyers increasingly believe that used cars offer better designs and features that new ones don’t provide. Meanwhile, new vehicle prices dipped 1.2% year over year — similar to the 0.1% decrease in the average new car payment over the past year. A January 2024 Cox Automotive forecast suggested new vehicle inventories could return to prepandemic norms this year. Average auto loan amounts for new vehicles remain above $40,000Average auto loan amounts reached $40,927 for new vehicles and $26,248 for used vehicles in the second quarter of 2024, according to Experian. New and used vehicle loan amounts rose from an average of $40,634 and $26,073, respectively, in the previous quarter. New car buyers in the prime credit tier (661 to 780) take out the largest loans — $42,993, on average. Borrowers with credit scores in the tier above — superprime (781 to 850) — take out the most for used cars, $28,079, down from last quarter ($27,980). Average auto loan amounts by credit score range

Source: Experian State of the Automotive Finance Market, 2Q 2024.

See auto loan rates in your area

Americans owe $1.626 trillion in auto loan debtOverall vehicle debt has increased by 79.7% between the second quarter of 2014 ($905 billion) and the second quarter of 2024 ($1.626 trillion), according to the Federal Reserve Bank of New York. In those 10 years, the only dip came in the second quarter of 2020 — the first full quarter amid the pandemic.

Outstanding auto debt

Search:

Next

Source: New York Fed Consumer Credit Panel/Equifax data. Auto loans account for 9.1% of American consumer debtWhile mortgages take the lion’s share of American consumer debt at 70.3% — according to the New York Fed — auto loans account for 9.1%. Auto loan debt ($1.626 trillion) is ahead of student loan debt ($1.585 trillion) as of the second quarter of 2024.

Americans borrow $179.1 billion in second quarter of 2024Americans took out $125.9 billion in auto loans in the second quarter of 2014. Ten years later in the second quarter of 2024, they borrowed far more: $179.1 billion, according to the New York Fed. Here’s a quarterly look during this period: Quarterly volume of auto loan originations

Search:

Next

Source: New York Fed Consumer Credit Panel/Equifax data. Americans in their 30s and 40s take out biggest auto loansAmericans in their 30s and 40s took out the largest auto loans in the second quarter of 2024, according to the New York Fed, borrowing $39.2 billion and $40.0 billion, respectively. Those in their 50s borrowed billions less ($37.0 billion), and those in their 60s borrowed just $21.9 billion. Young adults 18 to 29 borrowed more than consumers in their 60s ($25.3 billion).

When you combine these, Americans younger than 50 took out $104.5 billion in auto debt in the second quarter of 2024. That compares with $70.8 billion for those 50 and older. Americans with highest credit scores take out biggest auto loansMeanwhile, those with the best credit scores borrow the most. In the second quarter of 2024, borrowers with credit scores of at least 720 took out $93.9 billion in auto loan debt. The remaining credit tiers accounted for $85.3 billion combined, according to the New York Fed. Auto loan originations by credit score

Source: New York Fed Consumer Credit Panel/Equifax data. Average auto loan term shows it’s taking time to pay back these loansThe average auto loan term for new vehicles is 68.5 months, or less than six years, according to Experian. Used car loans, despite being significantly smaller on average, are close behind at 67.4 months. Average term lengths by credit score range (in months)

Source: Experian State of the Automotive Finance Market, 2Q 2024. But auto loans for new vehicles are stretching even longer — topping six years — for nonprime borrowers. Middle-tier credit borrowers with scores of 601 to 660 take out the longest new car loans, at an average of 74.1 months. Top-tier credit borrowers with scores of 781 to 850 have the shortest average new car loan term, at 64.0 months. “That’s such a long time to be stuck paying for a depreciating asset,” LendingTree chief credit analyst Matt Schulz says. “It can have an enormous impact on a family’s finances. That money going toward a car payment isn’t earning interest and funding your emergency savings, your retirement nest egg, a mortgage down payment or your kid’s college fund. Yes, our vehicles are important. In much of the country, you can’t get around without one. And, yes, we love fancy new cars, even new-to-us cars. They’re fun to drive and show off. However, once that initial glow wears off and you’re still making a big monthly payment on that vehicle after five-plus years, it may not seem worth it.” The average new car lease term is 35.9 months. Auto loan delinquency rates still below peaksAccording to data from the New York Fed, 90-day delinquency rates on auto loans peaked in the fourth quarter of 2010 at 5.3%, dropping to 4.4% as of the second quarter of 2024. Meanwhile, the percentage of auto loans that fell to 30 days past due spiked to 10.9% back in the second quarter of 2009. Dating to 2011, it had remained below 8.0% until reaching that in the second quarter of 2024.

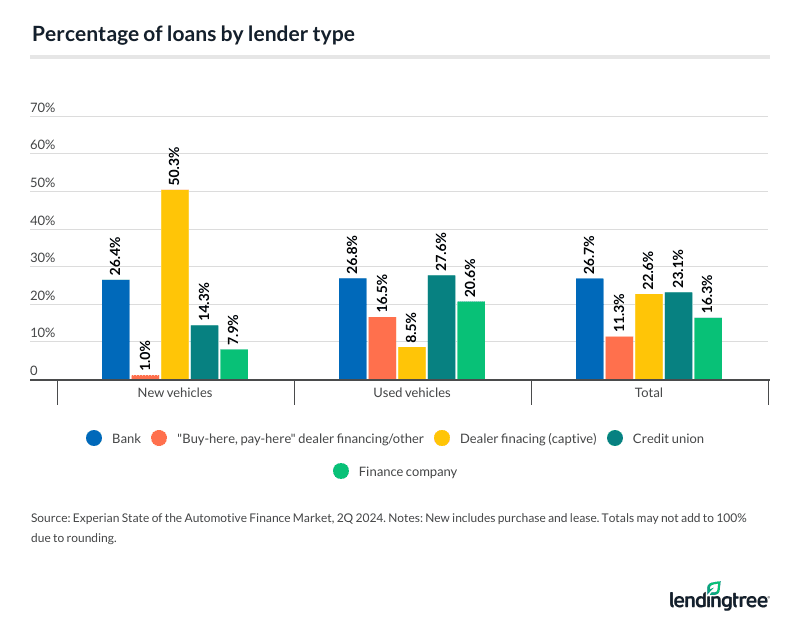

Buyers turn to banks and credit unions the most for auto financingAs of the second quarter of 2024, banks hold the highest market share, at 26.7%, followed by credit unions at 23.1% and captive lenders (manufacturers’ financing arms) at 22.6%. “Buy-here, pay-here” businesses, often known for predatory lending practices, capture up to 16.5% of the used car financing market. In the used car arena, captive lenders only claim 8.5%.

Schulz warns that buy-here, pay-here loans are dangerous. Not only can the sticker price be bigger, but the interest rates can look more like credit card rates than typical auto loan rates, and there may be extra fees. There may be an unusual payment schedule requiring you to pay more often than the typical monthly payment. Some places might even require you to put a tracking device on the car to make it easier to take back if you fall behind on payments. In short, these should be among the last options you’d consider — but your credit score plays a role in what options are available to you. “Good credit means more good options, and that’s a big deal,” Schulz says. “You must shop around. If you finance through the car seller, you’re very likely to overpay. Use sites to compare auto loan offers easily. You could also visit multiple lenders online on your own — consider looking at credit unions if you do. Once you’ve found a deal you’re happy with, get preapproved by the lender. That preapproval gives you leverage over the car seller because they know you won’t be happy with a bad offer.” Sources

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Source: Experian State of the Automotive Finance Market, 2Q 2023 and 2Q 2024.

Those with credit scores of 601 to 660 (in the nonprime or fair ranges) and 501 to 600 (in the subprime or poor and fair ranges) saw the highest average monthly payments for new vehicles, at $765 and $749, respectively.

Average monthly payments by credit score range

| New vehicles | Used vehicles | New leased vehicles | |

|---|---|---|---|

| All | $734 | $525 | $586 |

| 781 to 850 (super prime) | $717 | $522 | $586 |

| 661 to 780 (prime) | $742 | $518 | $583 |

| 601 to 660 (nonprime) | $765 | $535 | $601 |

| 501 to 600 (subprime) | $749 | $536 | $597 |

| 300 to 500 (deep subprime) | $719 | $532 | Not available |

Source: Experian State of the Automotive Finance Market, 2Q 2024.

Used car and truck prices see significant dip

The used car market was friendlier to consumers as used car and truck prices dropped 10.4% year over year, as reported by the August 2024 BLS consumer price index.

A June 2024 Wall Street Journal article says buyers increasingly believe that used cars offer better designs and features that new ones don’t provide.

Meanwhile, new vehicle prices dipped 1.2% year over year — similar to the 0.1% decrease in the average new car payment over the past year. A January 2024 Cox Automotive forecast suggested new vehicle inventories could return to prepandemic norms this year.

Average auto loan amounts for new vehicles remain above $40,000

Average auto loan amounts reached $40,927 for new vehicles and $26,248 for used vehicles in the second quarter of 2024, according to Experian. New and used vehicle loan amounts rose from an average of $40,634 and $26,073, respectively, in the previous quarter.

New car buyers in the prime credit tier (661 to 780) take out the largest loans — $42,993, on average. Borrowers with credit scores in the tier above — superprime (781 to 850) — take out the most for used cars, $28,079, down from last quarter ($27,980).

Average auto loan amounts by credit score range

| New vehicles | Used vehicles | |

|---|---|---|

| All | $40,927 | $26,248 |

| 781 to 850 | $39,172 | $28,079 |

| 661 to 780 | $42,993 | $27,594 |

| 601 to 660 | $42,467 | $25,238 |

| 501 to 600 | $38,045 | $21,918 |

| 300 to 500 | $33,917 | $19,950 |

Source: Experian State of the Automotive Finance Market, 2Q 2024.

Americans owe $1.626 trillion in auto loan debt

Overall vehicle debt has increased by 79.7% between the second quarter of 2014 ($905 billion) and the second quarter of 2024 ($1.626 trillion), according to the Federal Reserve Bank of New York.

In those 10 years, the only dip came in the second quarter of 2020 — the first full quarter amid the pandemic.

Auto loans account for 9.1% of American consumer debt

While mortgages take the lion’s share of American consumer debt at 70.3% — according to the New York Fed — auto loans account for 9.1%. Auto loan debt ($1.626 trillion) is ahead of student loan debt ($1.585 trillion) as of the second quarter of 2024.

Americans borrow $179.1 billion in second quarter of 2024

Americans took out $125.9 billion in auto loans in the second quarter of 2014. Ten years later in the second quarter of 2024, they borrowed far more: $179.1 billion, according to the New York Fed.

Here’s a quarterly look during this period:

Quarterly volume of auto loan originations

Question of the day - How much do you think is too much to spend on a car payment?

Money & Finances

How much do you think is too much to spend on a car payment?