- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Health & Wellness Wednesdays

Buying A New Car

Buying a new car can be a very exciting adventure. It can also be highly stressful.

Sometimes purchasing a new car is a very thoroughly thought out process. You’ve crunched the numbers and decided on a make and model. You’ve evaluated payment options and sold or traded in the old car.

Other times it is an act of desperation. I know people who have had a car break down and they need transportation to get to and from work. I also know people who have found themselves with an expanding family and their current car just is no longer big enough. They make a snap decision and buy a car under pressure.

The people I know who have made decisions about cars while under pressure usually end up regretting some part of the decision. They either tend to regret the amount of money they spent or the actual car they ended up buying.

In fact, I would say that most decisions made under pressure when you feel like you have little to no options end up being less than desirable outcomes.

So if you find yourself in need of a new vehicle, do yourself a favor and remind yourself that you have more options than you think. It’s not a brand new car or bust.

You could rent a car for a few days until you figure something out. You could ask to borrow a car from a friend or family member if possible. You could take public transportation. You could take a cab for a few days.

The point is that it’s better to take your time and make a well informed decision than to make a snap decision under pressure.

Interesting Fact #1

Silver sits atop the mountain of color choices when it comes to used cars. Black is a close second, with white, red, blue, and gray rounding things out.

Interesting Fact #2

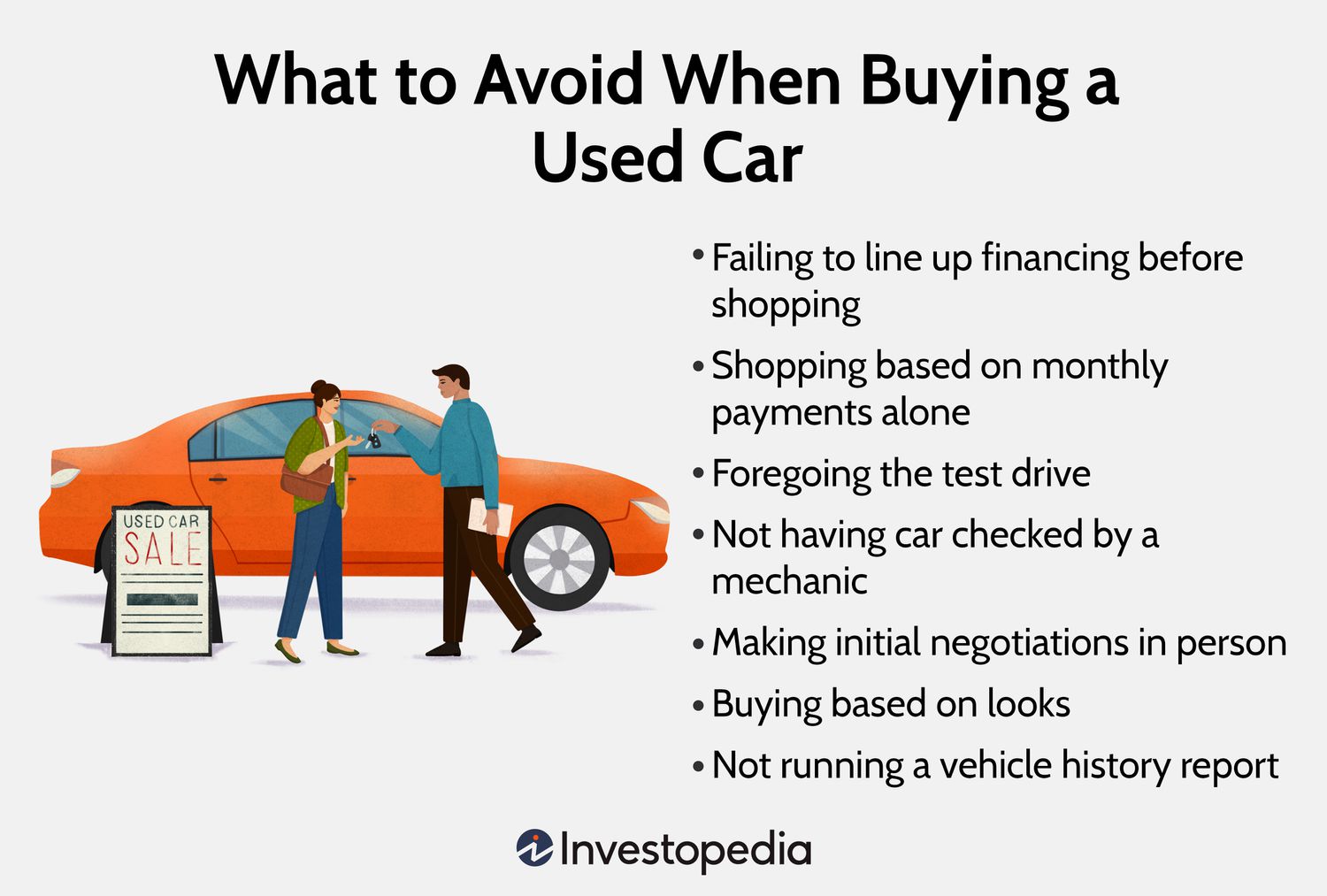

The image of an unscrupulous used car seller dialing back the odometer is not just something found in cartoons. People actually do defraud buyers by taking miles off of a car in an attempt to make it look more desirable, typically to the tune of billions of dollars a year in fraudulent transactions.

Interesting Fact #3

Automatic cars outnumber manual vehicles by 10 to 1. It’s pretty obvious that just about everyone prefers driving an automatic car, and the number of people that even know how to operate a manual vehicle is on the decline.

Quote of the day

“Buy a used car. It could be really depressing to have to do this. But when it’s your decision, to reach your goals, that’s another story. And it will save you thousands of dollars. That “new-car smell” is the most expensive fragrance in the world.” ― Andrew Tobias

Article of the day - What Do I Need To Know Before Buying A Car?

Whether you’re buying a new or a used car, upgrading from your old vehicle is always satisfying. And if you’re a first-time buyer, it’s a huge milestone in your life.

Unfortunately, it’s easy to make mistakes when buying a car. For example, many car buyers upgrade to a new vehicle before they’ve paid off their current vehicle. This often leaves them holding debt and paying interest for a car they’re not driving anymore by carrying negative equity into a new car loan.

So, what do you need to know before buying a car? Here are some helpful tips.

Get Preapproved For Financing

The number one thing you can do to smooth out the car buying process is to apply for a loan preapproval. There are many ways to do this, whether you want to visit a local bank or credit union, apply at a national bank, or even go through an online lender.

The primary benefit of pre-approval is getting a better idea of what cars you can afford. You’ll find out what kinds of interest rates you can qualify for, which will dictate your monthly payment. And if you have any issues with your credit, you’ll have an opportunity to clear up those issues before you walk into the dealership.

Another benefit of preapproval is that the dealerships will often offer you a higher rate than what you may actually qualify for. In this example, you might be eligible for a rate of 5%, but the dealership gives you a rate of 9% instead. Salespeople get a commission for this since that extra interest is split between the dealership and their finance company.

In that scenario, and having not gotten preapproved, you would have no idea that you’re paying a higher rate than necessary. If your lender preapproved your loan, you would have the option to decline the dealership’s financing offer and stick with your original lender. In some cases, the dealership may even be willing to negotiate and offer you a lower rate than your lender preapproved.

Negotiate Price First

When you go to a dealership, the salesperson will often ask you many questions during the sales process. Some of these are designed to help smooth things out for both parties. For example: “What kind of car are you looking for?” On the other hand, other questions are designed to help them potentially get a leg up on you during the negotiation process.

Salespeople will often ask you upfront whether you have a trade-in and whether you will be financing through the dealership. Do not answer these questions until you have first negotiated a price.

A salesperson will sometimes be less willing to negotiate on price if you’re not financing with them or trading a vehicle in. If someone has a trade-in or is going to want to finance, they will often charge less for the car, then offer less for the trade-in and less-favorable financing terms. Playing your cards close to your vest gives the dealer as little advantage as possible in the negotiation process.

Avoid Dealership Add-Ons

Add-ons are another method dealerships use to make extra money on their sales. When selling add-ons, dealers will often take advantage of the fact that you’re already tired of negotiating by handing you off to a fresh, cheerful finance manager.

A finance manager’s job has two parts. The first is to facilitate loans for the dealership’s customers. The second is to sell “premium” features to package with the vehicle sale. These add on’s run the gamut, from paint protection and corrosion-proofing to extended tire warranties.

They’re almost always overpriced, and finance managers will try to make the cost look cheaper by telling you that they only cost a few dollars per month. But even an $8 per month charge, spread out over a 60-month loan, comes to $480.

Extended factory warranties can be a good deal, but you can buy them any time before your standard warranty expires. If you decide to purchase one later, shop around with different dealers since different dealers will offer different prices.

Stick With A Shorter Loan Term

Longer-term car loans are becoming more and more common these days. They come with lower interest rates, making them popular, particularly with younger buyers and those living on a fixed income.

Unfortunately, long-term loans have a couple of drawbacks. To begin with, the longer the loan term, the more you pay in interest, even if the individual monthly payments are lower. Not only that, but with a seven-year loan, there’s a higher chance you’ll want to sell the car before you pay it off.

For new cars, it’s best to stick with traditional five-year auto loans. You’ll pay more monthly, but you’ll save money in the long run. For used cars, 36-month loans are ideal because they’re more likely to be paid off before the vehicle requires any serious repairs.

Know Your Budget

Most financial advisors recommend that your total car expenses cost no more than 20% of your monthly take-home pay. That includes gas, insurance, maintenance, and other costs, so spending 10% or 15% of your income on your car loan is more realistic.

Of course, you also need to pay your other monthly bills. If it turns out that you can’t afford a brand-new car, don’t be afraid to widen your horizons. Today’s cars last far longer than those of the 80s and 90s. Depending on its condition, a used car with 100,000 miles can still be an excellent value.

Many people go their entire lives without ever buying a brand-new car. You can then use the money saved to buy other things.

Summary

The car buying process has many potential traps for unwary buyers. By following these tips, we’ll better equip you to navigate that process and avoid pitfalls. Now, all you have to do is decide what car you want.

Question of the day - What is the worst car you’ve ever purchased and why?

Experience & Adventure

What is the worst car you’ve ever purchased and why?