Reliance Industries Limited (RIL), one of India's largest and most diversified conglomerates, has always been a favorite among investors. Whether it is the Reliance share, Reliance Industries share, or the day-to-day updates on the Reliance share price, the buzz around this giant rarely fades. In this article, we will explore the journey of Reliance Industries, its recent market performance, and what the future holds for investors.

A Brief Overview of Reliance Industries

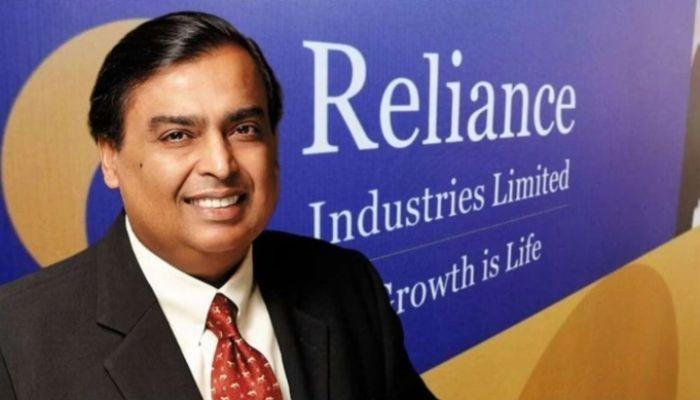

Reliance Industries Limited, founded by Dhirubhai Ambani in 1973, has transformed from a textile company into a sprawling empire that spans energy, petrochemicals, retail, and telecommunications. Today, under the leadership of Mukesh Ambani, RIL continues to innovate and expand into new sectors like green energy and technology.

The Reliance Industries share price reflects not just the company's past successes but also the high expectations for its future. Investors, both domestic and international, closely monitor the RIL share price as a bellwether of India's economic growth and industrial prowess.

Recent Trends in Reliance Share Price

The Reliance share price has shown significant volatility in recent years, primarily due to global oil price movements, regulatory changes, and major business announcements. In 2024 and 2025, Reliance made strategic moves in the green energy sector and expanded its retail and telecom arms, leading to renewed investor confidence.

For instance, when Reliance Jio launched new 5G services and Reliance Retail acquired several mid-sized retail chains, the Reliance share saw a substantial uptick. Such events prove that market sentiment is highly sensitive to Reliance's business strategies.

Key Factors Influencing Reliance Share Price:

- Energy Markets: As a major player in oil refining and petrochemicals, Reliance’s profits often correlate with global crude oil prices.

- Retail and Telecom Growth: Jio and Reliance Retail have been major contributors to RIL’s non-oil revenues, diversifying its income streams.

- Sustainability Initiatives: With heavy investments in green hydrogen, solar energy, and sustainable technology, Reliance is positioning itself for a carbon-neutral future, which can positively impact the Reliance Industries share price.

- Regulatory Environment: Government policies, both at home and abroad, significantly affect RIL's operations and stock performance.

Reliance Industries Share: A Solid Long-Term Investment?

Investors often debate whether to hold, buy, or sell Reliance shares. Historically, the Reliance share has rewarded long-term holders. Over the last decade, Reliance shares have multiplied several times, driven by consistent expansion and profitability.

When considering an investment in Reliance, it’s crucial to analyze both the macroeconomic environment and the company’s internal growth drivers. The firm's massive investments in green energy, for example, could unlock tremendous shareholder value over the next 10 to 15 years.

Moreover, Reliance's strong balance sheet, robust cash flow, and diversified revenue base make the Reliance Industries share less vulnerable to sector-specific downturns compared to many peers.

RIL Share Price Forecast: What Analysts Say

Most financial analysts remain optimistic about the RIL share price trajectory. Several leading brokerage firms have set bullish targets for the next 12 to 18 months, citing:

- Growth in retail and telecom sectors.

- Successful execution of green energy projects.

- Strategic global partnerships.

- Continued innovation and expansion into high-growth sectors.

However, they also caution that external factors like crude oil price crashes, currency volatility, or global recessions could temporarily impact the Reliance share price.

Should You Buy Reliance Shares Now?

If you are a long-term investor aiming for stability with potential for high returns, Reliance could be a valuable addition to your portfolio. Given the company's diversified business model and aggressive future strategies, experts suggest accumulating Reliance Industries shares on dips.

Short-term traders, however, must stay cautious and closely watch market sentiment and quarterly results.

Conclusion

The journey of Reliance Industries from a small textile manufacturer to a global powerhouse is nothing short of inspirational. Today, tracking the Reliance share price, understanding the dynamics behind the Reliance Industries share, and analyzing forecasts are essential for every serious investor.

As Reliance continues to innovate and invest in future technologies, its shares are likely to remain attractive for years to come. Whether you are a seasoned investor or a beginner exploring blue-chip stocks, Reliance deserves a prominent place on your watchlist.

.jpg)

Comments