The global Fuel Cell Catalyst Market Size is poised for remarkable growth over the forecast period of 2024-2032, with an expected compound annual growth rate (CAGR) of 24.70%. This booming market is driven by the increasing need for clean, sustainable energy, innovative technological developments, and growing government support to transition away from fossil fuels. Fuel cell technology offers a promising solution to the global energy crisis, and catalysts play a crucial role in enhancing the efficiency of fuel cells.

This article delves into the key benefits, market dynamics, industry developments, and various factors driving or restraining the fuel cell catalyst market. We will also explore market segmentation, trends, regional insights, and the competitive landscape.

Key Benefits of Fuel Cell Catalysts

Fuel cell catalysts are critical components that facilitate the chemical reaction in fuel cells. The main benefits of fuel cell catalysts include:

- Improved Efficiency: Catalysts reduce the energy barrier for the fuel cell reactions, allowing for faster and more efficient energy production.

- Clean Energy Source: Fuel cells produce electricity with zero harmful emissions, making them a green energy solution.

- Cost-Effectiveness: While catalysts are traditionally expensive, advancements in nanotechnology and alternative materials have been reducing costs over time.

- Versatility: Fuel cells, powered by catalysts, can be used in a wide range of applications, from automobiles to stationary power systems.

- Durability and Longevity: High-quality catalysts enhance the durability and lifespan of fuel cells, making them more viable for long-term usage.

Market Overview

The fuel cell catalyst market is experiencing rapid growth, driven by a global shift toward clean energy solutions. As industries worldwide move toward decarbonization, fuel cell technology has become an attractive option for various sectors, including transportation, industrial machinery, and power generation.

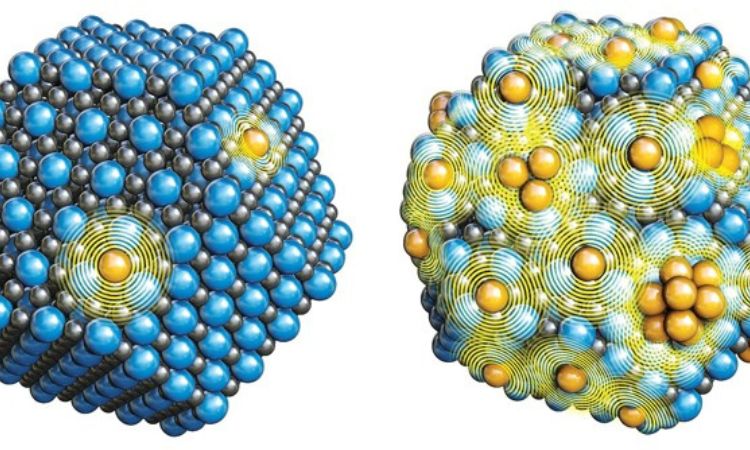

Fuel cells require efficient catalysts, typically platinum-based, to enhance the chemical reactions between hydrogen and oxygen. Research and development (R&D) are focusing on alternatives to reduce reliance on platinum, making the technology more affordable.

Driving Factors

- Growing Demand for Clean Energy: The pressing need to reduce carbon emissions and combat climate change is one of the key drivers of the fuel cell catalyst market. As countries aim to meet their sustainability goals, the adoption of fuel cell technology is becoming widespread.

- Government Incentives and Policies: Governments across the globe are providing subsidies, tax rebates, and other incentives to encourage the use of hydrogen fuel cells. These favorable policies are expected to further drive market growth.

- Technological Advancements: Continuous R&D efforts are leading to breakthroughs in catalyst efficiency, affordability, and durability. The development of non-precious metal catalysts, in particular, holds significant potential for reducing costs and expanding market reach.

- Rising Investments in Hydrogen Infrastructure: Global investments in hydrogen production, storage, and distribution infrastructure are growing, creating an ideal environment for fuel cell technology to flourish.

Restraining Factors

- High Cost of Catalyst Materials: Platinum-based catalysts are highly efficient but extremely expensive, which poses a barrier to widespread adoption. However, advancements in non-platinum catalysts could alleviate this concern over time.

- Hydrogen Storage and Infrastructure Challenges: While the market potential is vast, challenges around hydrogen production, storage, and transport infrastructure remain significant. Developing this infrastructure is capital-intensive and time-consuming.

- Limited Awareness: Despite the potential benefits of fuel cells, many industries and consumers remain unaware of this technology, hampering its widespread adoption.

COVID-19 Impact

The COVID-19 pandemic had a mixed impact on the fuel cell catalyst market. On one hand, supply chain disruptions caused delays in manufacturing and R&D activities. On the other hand, the global economic downturn shifted the focus of many governments toward economic recovery packages that include green energy initiatives. The post-pandemic recovery phase is expected to accelerate the adoption of fuel cell technology as nations prioritize sustainability.

Market Segmentation

The global fuel cell catalyst market is segmented based on product type, application, and region.

By Product Type:

- Platinum-based Catalysts: These are the most commonly used catalysts due to their high efficiency in accelerating reactions in fuel cells. However, the high cost of platinum remains a challenge.

- Non-precious Metal Catalysts: Recent advancements in materials science have led to the development of catalysts that do not rely on precious metals like platinum. These offer cost advantages but may require further optimization for efficiency and durability.

- Carbon-based Catalysts: These are gaining traction for their potential to offer an alternative to metal-based catalysts with a lower environmental footprint.

By Application:

- Automotive: The automotive industry is the largest consumer of fuel cell catalysts, particularly in electric vehicles (EVs) powered by hydrogen fuel cells.

- Stationary Power Generation: Fuel cells are increasingly being used for backup and stationary power applications, including in remote areas where grid power is unreliable.

- Portable Power Systems: Smaller, portable fuel cells are used in applications such as laptops, drones, and other electronic devices.

Market Outlook

The fuel cell catalyst market is expected to experience robust growth during the forecast period, driven by increasing investments in clean energy and hydrogen infrastructure. Technological advancements, particularly in non-precious metal catalysts, will play a pivotal role in expanding market penetration. The automotive sector is likely to remain the largest consumer, while stationary and portable applications are expected to witness significant growth.

Industry Segmentation and Trends

- Automotive Industry Dominance: As the automotive industry pivots toward electric vehicles, fuel cell technology has emerged as a promising alternative to battery-electric vehicles (BEVs). Fuel cell electric vehicles (FCEVs) offer longer driving ranges and faster refueling times compared to BEVs, making them suitable for heavy-duty transport and commercial applications.

- Increased Investment in R&D: Companies and governments are investing heavily in R&D to develop next-generation catalysts. This will likely result in more cost-effective and efficient fuel cells, accelerating their adoption.

- Decarbonization Initiatives: Countries around the world are implementing policies aimed at reducing carbon emissions. Fuel cells offer a zero-emission alternative, and industries such as shipping, aviation, and heavy machinery are exploring their use.

Regional Analysis/Insights

North America:

North America is one of the leading regions in the fuel cell catalyst market, with the United States driving the majority of the demand. The region's focus on reducing carbon emissions, along with strong government support, is fueling the growth of the market. Additionally, North America is home to key players in the fuel cell catalyst industry, contributing to technological innovations and market leadership.

Europe:

Europe is another significant player in the global fuel cell catalyst market. The European Union's stringent regulations on emissions and its commitment to achieving carbon neutrality by 2050 are driving the demand for fuel cell technologies. The region is also investing in hydrogen production and storage infrastructure, further supporting market growth.

Asia-Pacific:

Asia-Pacific is expected to be the fastest-growing region in the fuel cell catalyst market. Countries such as China, Japan, and South Korea are making substantial investments in hydrogen fuel cell technology, particularly in the automotive sector. These countries are also ramping up their hydrogen production capabilities, which will drive the demand for catalysts.

Key Industry Developments

- March 2023: Toyota Motor Corporation announced its collaboration with Ionomr Innovations to develop a next-generation fuel cell stack for commercial vehicles, using advanced non-precious metal catalysts.

- June 2023: Plug Power, a leading hydrogen solutions company, partnered with Johnson Matthey to scale up the production of fuel cell catalysts, focusing on reducing the cost of platinum-based materials.

Challenges and Opportunities

Opportunities:

- Development of Cost-effective Catalysts: Advancements in alternative catalyst materials present an enormous opportunity to reduce the cost of fuel cells and expand their adoption.

- Hydrogen Infrastructure Expansion: The growing investment in hydrogen production, storage, and distribution will create an ideal environment for the widespread deployment of fuel cells.

Challenges:

- Raw Material Constraints: The supply of platinum and other precious metals used in catalysts is limited, posing a long-term challenge for the market.

- Competition from Battery-electric Technology: While fuel cells offer unique advantages, they face stiff competition from lithium-ion battery technology, which has already achieved significant market penetration.

Key Players

Some of the major players in the global fuel cell catalyst market include:

- Umicore

- Tanaka Holdings Co., Ltd

- Clariant Ltd.

- Johnson Matthey

- Others

Comments