Saudi Arabia Foreign Exchange Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

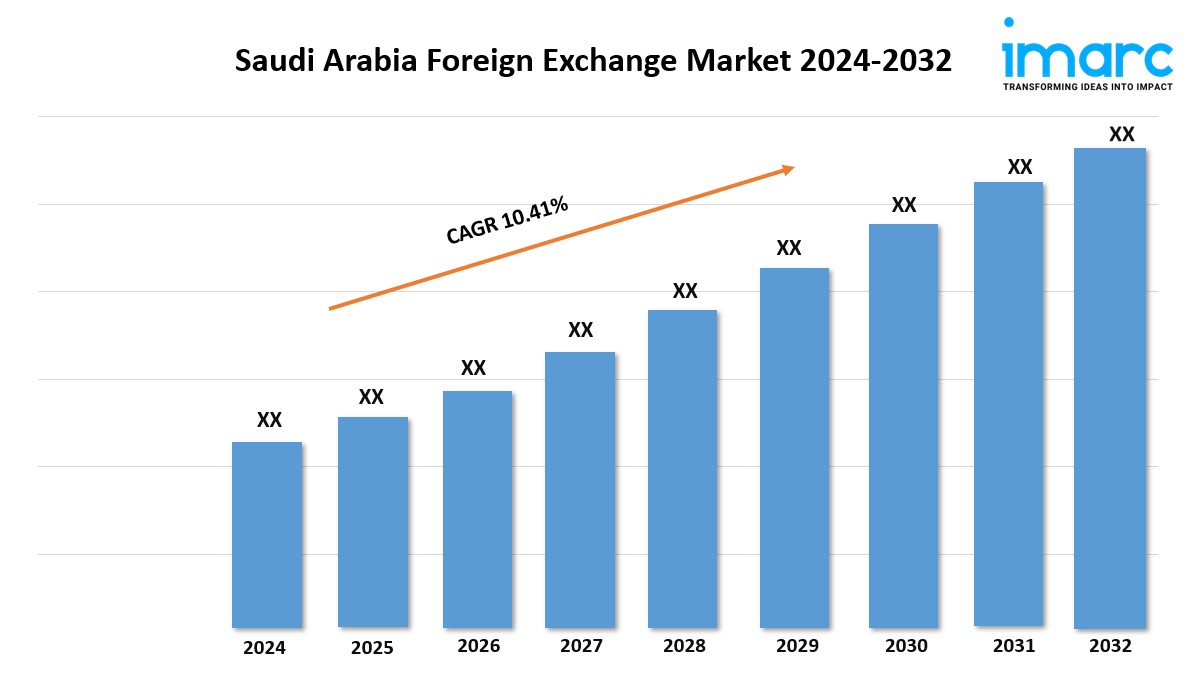

Market Growth Rate: 10.41% (2024-2032)

The Saudi Arabia foreign exchange market is expanding, supported by increased international trade, financial sector reforms, and growing demand for foreign currencies amid economic diversification efforts. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 10.41% from 2024 to 2032.

Request for a sample copy of this report: https://www.imarcgroup.com/saudi-arabia-foreign-exchange-market/requestsample

Saudi Arabia Foreign Exchange Market Trends:

The Saudi Arabia foreign exchange market is a key component of the country's financial system, reflecting its status as a major oil exporter and its influence on the global economy. The Saudi Riyal (SAR) is the official currency, and its value is pegged to the US Dollar (USD) at a fixed rate. This peg provides stability to the Saudi currency and facilitates trade and investment flows. The foreign exchange market in Saudi Arabia is regulated by the Saudi Arabian Monetary Authority (SAMA), which oversees monetary policy, currency reserves, and exchange rate stability.

Factors driving the Saudi Arabia foreign exchange market include fluctuations in oil prices, economic diversification efforts, and investment flows. As a leading oil exporter, changes in global oil prices significantly impact the Saudi economy and, consequently, the foreign exchange market. The Saudi government's Vision 2030 plan aims to reduce the country's reliance on oil by diversifying the economy into sectors such as tourism, technology, and entertainment, which could influence future currency dynamics and investment patterns.

Saudi Arabia Foreign Exchange Market Scope & Growth Analysis:

The market scope encompasses various currency trading activities, including spot transactions, forwards, and options, catering to both corporate and individual investors. Market analysis highlights the role of Saudi Arabia's economic policies, global oil market trends, and international trade relationships in shaping the foreign exchange landscape. Additionally, the integration of digital financial technologies and increasing foreign investment are contributing to the evolution of the market. Despite the stable peg to the US Dollar, the Saudi foreign exchange market remains sensitive to global economic conditions and geopolitical developments, which could impact currency exchange dynamics and investment flows.

Saudi Arabia Foreign Exchange Industry Segmentation:

The report has segmented the market into the following categories:

Counterparty Insights:

- Reporting Dealers

- Non-financial Customers

- Others

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=20585&flag=E

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments