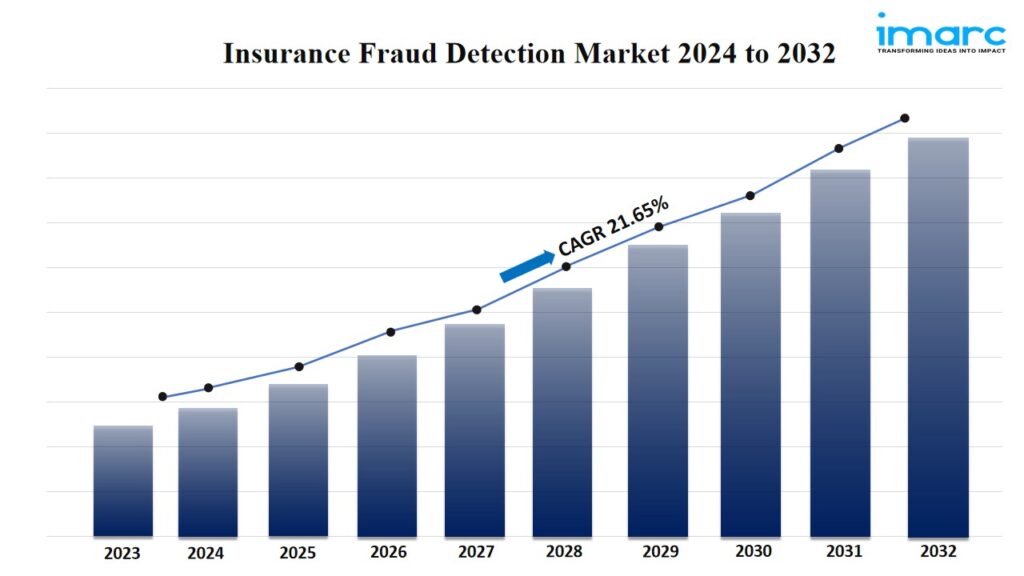

IMARC Group’s report titled “Insurance Fraud Detection Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032”, offers a comprehensive analysis of the industry, which comprises insights on the global insurance fraud detection market share. The global market size is expected to exhibit a growth rate (CAGR) of 21.65% during 2024-2032.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/insurance-fraud-detection-market/requestsample

Factors Affecting the Growth of the Insurance Fraud Detection Industry:

- Advancements in Artificial Intelligence (AI) and Machine Learning (ML) Technologies:

The continuous improvements in artificial intelligence (AI) and machine learning (ML) technologies are enhancing the way insurance companies detect and prevent fraud. AI and ML algorithms can analyze vast amounts of data at unprecedented speeds, identifying patterns and anomalies that may indicate fraudulent activities. This capability allows insurers to rapidly screen claims and transactions, reducing the time and resources traditionally required for manual investigations. Furthermore, AI-driven systems continuously learn from new data, enhancing their accuracy and efficiency over time. This not only helps in identifying sophisticated fraud schemes but also in adapting to evolving fraudulent tactics. AI and ML technologies in fraud detection solutions are enabling insurers to save huge amounts annually by mitigating losses due to fraud.

- Increasing Digital Transactions in the Insurance Sector:

Individuals prefer online platforms for their insurance needs, ranging from purchasing policies to filing claims, which is creating new opportunities for fraudsters. This shift necessitates advanced fraud detection solutions that can monitor and analyze digital transactions in real time to identify and prevent fraudulent activities. The ability to secure digital transactions is paramount for maintaining user trust and ensuring the financial stability of insurance companies. Moreover, the growing demand for sophisticated fraud detection tools that can efficiently handle the complexities of digital insurance transactions is positively influencing the market. These tools employ various technologies, including predictive analytics, data mining, and behavioral analytics, to provide a comprehensive approach to fraud prevention.

- Regulatory Compliance and Pressure to Reduce Losses:

Governing agencies and regulatory bodies in many countries are implementing stricter regulations to combat insurance fraud, mandating the adoption of advanced fraud detection and prevention measures. These regulations aim to protect individuals and maintain the integrity of insurance. Insurance companies, in response, are investing in fraud detection solutions to comply with regulatory requirements and to safeguard themselves against potential penalties and reputational damage. Additionally, the financial impact of insurance fraud, which amounts to huge losses annually, is a critical concern for insurers. By employing advanced fraud detection technologies, insurance companies can reduce these losses, enhancing their profitability and competitiveness in the market.

Leading Companies Operating in the Insurance Fraud Detection Industry:

- ACI Worldwide Inc

- BAE Systems plc

- Equifax Inc.

- Experian plc

- Fair Isaac Corporation

- Fiserv Inc.

- FRISS

- International Business Machines Corporation

- Lexisnexis Risk Solutions Inc. (RELX Group plc)

- SAP SE

- SAS Institute Inc.

Insurance Fraud Detection Market Report Segmentation:

By Component:

- Solution

- Services

Solution exhibits a clear dominance in the market accredited to its crucial role in providing essential tools and technologies needed for detecting and preventing fraudulent activities in insurance claims and processes.

By Deployment Model:

- Cloud-based

- On-premises

On-premises represents the largest segment attributed to its enhanced security features and control over the infrastructure for sensitive data handling in fraud detection.

By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold the biggest market share owing to their substantial resources and higher volumes of claims, making them more likely to invest in comprehensive fraud detection systems.

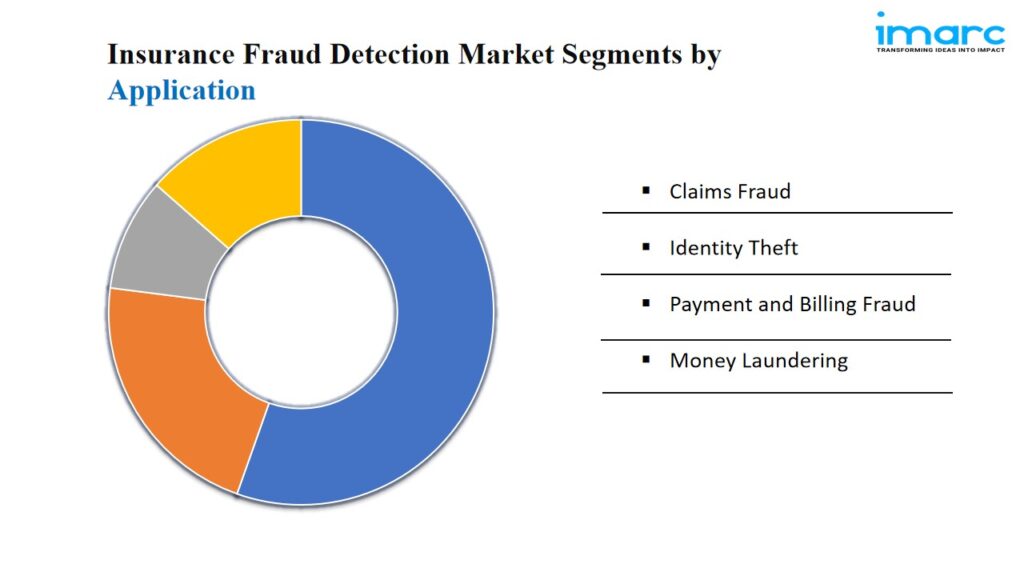

By Application:

- Claims Fraud

- Identity Theft

- Payment and Billing Fraud

- Money Laundering

Payment and billing fraud account for the majority of the market share. They are the most common and financially impactful types of fraud affecting insurance companies.

By End User:

- Insurance Companies

- Agents and Brokers

- Insurance Intermediaries

- Others

Insurance companies represent the largest segment, as they are the primary users of fraud detection solutions to protect their operations and finances.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market due to the high concentration of insurance companies, the implementation of stringent regulatory reforms, and the rising investments in advanced technologies for fraud detection.

Global Insurance Fraud Detection Market Trends:

Blockchain, with its inherent characteristics of transparency, security, and immutability, offers a novel approach to preventing and detecting fraud in the insurance sector. Blockchain technology reduces the potential for fraudulent activities by enabling secure and tamper-proof recording of transactions and claims data. This technology facilitates the creation of a trusted environment where claims can be verified automatically against policy details, thereby streamlining the claims process while enhancing fraud detection capabilities.

Additionally, the adoption of telematics in insurance, particularly in auto insurance, provides a wealth of real-time data on user behavior, vehicle usage, and environmental conditions. This data, when analyzed through advanced analytics, can identify patterns indicative of fraudulent claims, such as discrepancies in reported incidents versus actual driving data.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the companys expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments