In managing payroll for employees, accurate and reliable pay stubs are essential. A United States employee pay stub generator can simplify this process, providing a quick, compliant way to create detailed pay stubs. Choosing the right pay stub generator is important for ensuring accuracy, compliance with federal and state laws, and employee satisfaction.

Why Use an Employee Pay Stub Generator?

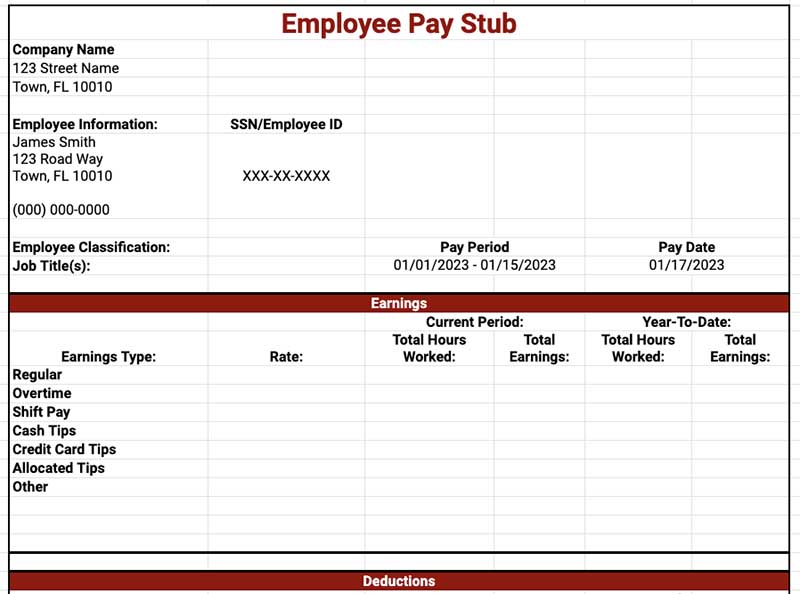

Employee pay stubs are crucial documents that provide a breakdown of earnings, deductions, taxes, and net pay. They help employees understand their compensation and provide necessary records for tax purposes, loan applications, and other financial documentation. A pay stub generator saves time, reduces human error, and ensures each pay stub complies with legal standards.

Key Features to Look for in a Pay Stub Generator

- Compliance with U.S. Laws: The generator you choose should adhere to federal and state requirements. In the U.S., regulations vary by state, and some states mandate specific information on pay stubs, such as total hours worked or itemized deductions. Ensure that the pay stub generator is flexible enough to incorporate state-specific details as needed.

- Customization Options: A good pay stub generator should allow for customization to match your company's branding and specific needs. This includes the ability to add details like employee information, hours worked, overtime, bonuses, and various deductions. Customization not only enhances professionalism but also ensures clarity and transparency.

- Accuracy and Reliability: Precision is critical for a United States employee pay stub generator. Calculations of gross pay, tax withholdings, deductions, and net pay must be accurate. Select a generator that automates calculations to minimize errors, helping you maintain accurate payroll records.

- Security of Data: Employee pay information is sensitive. Choose a pay stub generator that prioritizes data security, uses encryption, and follows best practices in data protection. This will ensure that employee information remains confidential and protected from potential breaches.

- User-Friendly Interface: Ease of use is another important factor. A user-friendly pay stub generator simplifies the process for payroll teams, reducing the time spent on manual tasks and ensuring pay stubs are generated efficiently. Look for software that has an intuitive layout and offers clear instructions or tutorials.

- Cost-Effectiveness: Finally, consider the costs associated with a pay stub generator. Some options charge per pay stub, while others may have a flat monthly fee. Assess your business needs, frequency of payroll, and employee count to determine which payment structure works best.

Making the Right Choice

Choosing the right United States employee pay stub generator can improve payroll efficiency, ensure compliance, and enhance employee satisfaction. By focusing on compliance, customization, accuracy, security, usability, and cost, you can select a pay stub generator that aligns with your business needs and simplifies payroll management. This investment in efficiency not only saves time but also promotes trust and transparency with your employees.

Comments