The emergence of decentralized finance (DeFi) has brought about significant changes in the financial landscape. Among these innovations, onchain derivatives protocols have gained substantial traction. These protocols leverage blockchain technology to offer new ways to trade and manage derivative contracts. But how do they impact risk management strategies? Let’s delve into the details.

Enhanced Transparency and Accountability

One of the primary ways an onchain derivatives protocol impacts risk management is through enhanced transparency. Traditional derivatives markets often suffer from a lack of transparency, making it difficult for participants to assess risk accurately. Onchain derivatives protocols operate on public blockchains, where all transactions are recorded on an immutable ledger. This transparency allows for real-time monitoring and verification of trades, reducing the risk of fraud and manipulation. Market participants can access the same information, ensuring accountability and more informed decision-making.

Improved Liquidity and Market Access

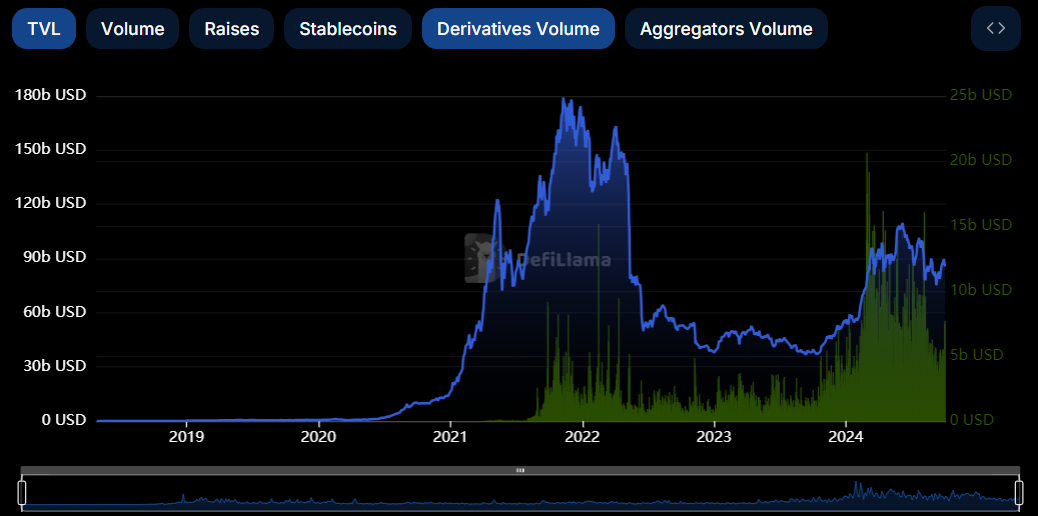

Liquidity is a critical factor in managing risk, and an onchain derivatives protocol contributes to improved liquidity. By enabling continuous and real-time trading on decentralized platforms, these protocols ensure that buyers and sellers can easily find counterparties. This enhanced liquidity reduces the risk of significant price fluctuations and ensures more stable market conditions. Additionally, onchain derivatives protocols democratize access to financial markets, allowing a broader range of participants to engage in trading activities. This increased participation diversifies the market and spreads risk more evenly.

Automated and Efficient Processes

Automation is a key feature of an onchain derivatives protocol, significantly impacting risk management strategies. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, automate various aspects of derivatives trading. This includes margin calls, settlements, and risk monitoring. By automating these processes, onchain derivatives protocols reduce the risk of human error and ensure that transactions are executed precisely as intended. This automation streamlines risk management, making it more efficient and reliable.

Real-Time Risk Monitoring

Real-time risk monitoring is another critical advantage of an onchain derivatives protocol. Traditional risk management strategies often rely on delayed or incomplete information, making it challenging to respond promptly to market changes. Onchain derivatives protocols provide continuous access to market data, allowing traders and risk managers to monitor positions and exposures in real-time. This real-time monitoring enables proactive risk management, allowing for swift adjustments to trading strategies in response to market dynamics.

Robust Security Measures

Security is paramount in derivatives trading, and an onchain derivatives protocol offers robust security features. Blockchain technology ensures that transactions are secure and tamper-proof, significantly reducing the risk of data breaches and fraud. Smart contracts enforce the terms of derivatives contracts automatically, eliminating the need for intermediaries and reducing the risk of counterparty default. The decentralized nature of blockchain also enhances the resilience of the financial system, making it less vulnerable to attacks or failures.

Decentralization and Reduced Counterparty Risk

Traditional derivatives markets often involve a high degree of counterparty risk, where one party may default on their obligations. An onchain derivatives protocol mitigates this risk through decentralization. By enabling peer-to-peer trading directly on the blockchain, these protocols eliminate the need for intermediaries and central counterparties. Smart contracts automatically enforce the terms of the contract, ensuring that both parties meet their obligations. This reduced counterparty risk enhances the stability and reliability of the trading environment.

Enhanced Reporting and Analytics

Accurate and timely reporting is essential for effective risk management. An onchain derivatives protocol provides advanced reporting and analytics tools, allowing market participants to track and analyze their positions, exposures, and performance. These tools offer valuable insights into market trends and potential risks, enabling traders and risk managers to make data-driven decisions. Enhanced reporting and analytics contribute to more effective risk management strategies and better overall market outcomes.

Integration with Traditional Risk Management Tools

Onchain derivatives protocols can be integrated with traditional risk management tools, enhancing their effectiveness. For example, price oracles provide real-time data on the prices of underlying assets, ensuring accurate valuation of derivative contracts. These oracles aggregate data from multiple sources to prevent manipulation and ensure reliability. By integrating onchain derivatives protocols with traditional risk management tools, traders and risk managers can benefit from a comprehensive approach to risk management.

Conclusion

The impact of onchain derivatives protocols on risk management strategies is profound. By offering enhanced transparency, improved liquidity, automated processes, real-time risk monitoring, robust security measures, decentralization, and advanced reporting tools, these protocols transform how risk is managed in the financial markets. As the adoption of onchain derivatives protocols continues to grow, they are poised to play an increasingly important role in shaping the future of risk management, providing traders and investors with more efficient, secure, and reliable ways to navigate the complexities of the financial landscape.

Comments