The Qatar general insurance market is highly competitive, with a mix of domestic and international insurers vying for market share.

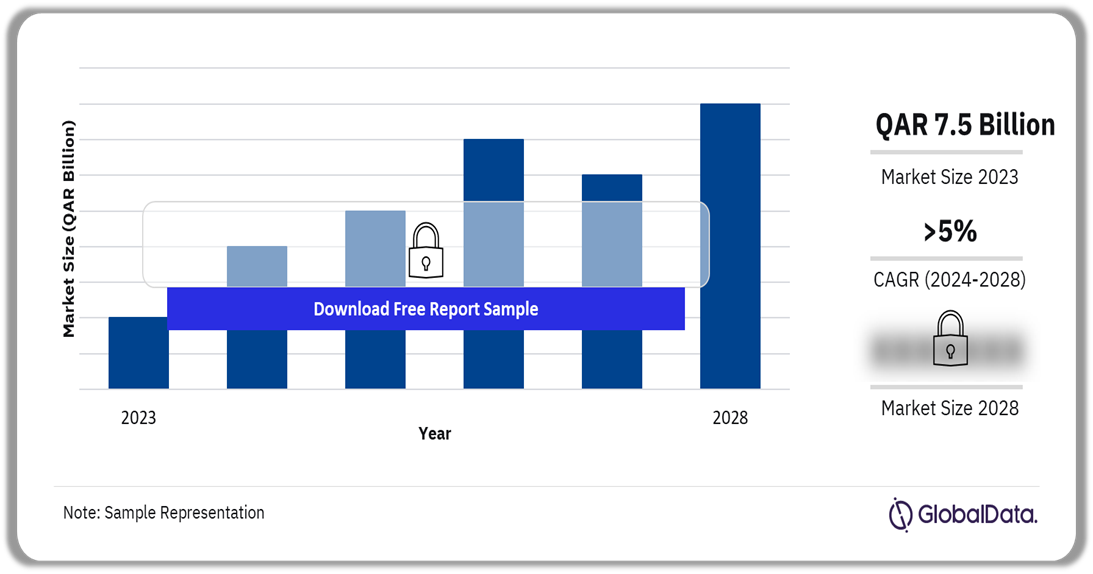

Buy the Full Report to Gain More Information about the Qatar General Insurance Market Forecast

This analysis will examine the key players in the market, their competitive strategies, and their market share.

Leading Insurance Companies

- Qatar Insurance Company (QIC): As one of the largest insurance companies in Qatar, QIC offers a wide range of products, including motor, home, and travel insurance.

- Qatar Reinsurance Company: A leading reinsurer in the Middle East, Qatar Re provides reinsurance services to insurance companies in Qatar and the region.

- Axa Qatar: A subsidiary of the global insurance giant AXA, Axa Qatar offers a variety of general insurance products to individuals and businesses.

- Chartis Qatar: A subsidiary of American International Group (AIG), Chartis Qatar is a major player in the Qatar general insurance market.

- Qatar Islamic Insurance Company (QII): As a leading Islamic insurance company, QII offers a range of Takaful products that comply with Islamic law.

Competitive Strategies

The key players in the Qatar general insurance market employ various competitive strategies to attract and retain customers:

- Product Innovation: Developing innovative insurance products to meet the evolving needs of consumers can differentiate companies from their competitors.

- Distribution Channels: A strong distribution network, including both traditional agents and digital channels, is essential for reaching a wide range of customers.

- Customer Service: Providing excellent customer service is crucial for building trust and loyalty among policyholders.

- Technological Advancements: Embracing technology, such as digital insurance and telematics, can improve efficiency, enhance customer experience, and reduce costs.

- Partnerships and Alliances: Forming strategic partnerships with other companies, such as banks or financial institutions, can help insurers expand their reach and increase sales.

Market Share Analysis

While it is difficult to obtain precise market share data for individual insurers in the Qatar general insurance market, the larger companies typically hold a significant portion of the overall market. However, regional and niche insurers can carve out a niche for themselves by focusing on specific product categories or target demographics.

Conclusion

The Qatar general insurance market is highly competitive, with a wide range of players vying for market share. The ability to innovate, provide excellent customer service, and leverage technology will be crucial for success in this industry.

Comments