Global Letter of Credit Confirmation Industry: Key Statistics and Insights in 2025-2033

Summary:

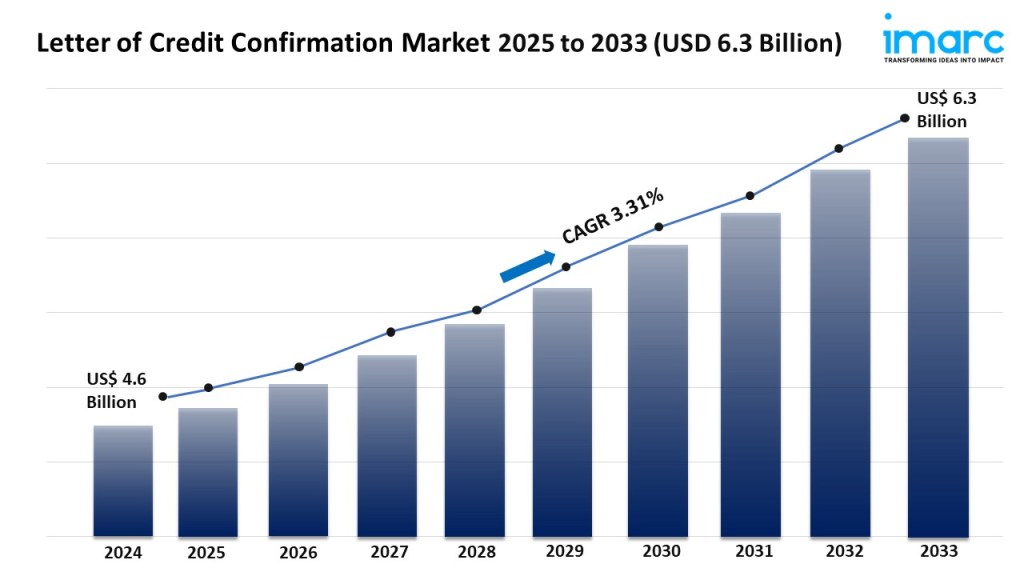

- The global letter of credit confirmation market size reached USD 4.6 Billion in 2024.

- The market is expected to reach USD 6.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.31% during 2025-2033.

- Asia-Pacific leads the market, accounting for the largest letter of credit confirmation market share.

- Sight L/C holds the majority of the market share in the L/C type segment as it is widely trusted and utilized in industries where prompt cash flow is essential.

- Large enterprises exhibit a clear dominance in the letter of credit confirmation industry.

- The expansion of international trade is a primary driver of the letter of credit confirmation market.

- Technological advancements are reshaping the letter of credit confirmation market.

Request for a sample copy of this report: https://www.imarcgroup.com/letter-of-credit-confirmation-market/requestsample

Industry Trends and Drivers:

- Expansion of international trade:

As international trade is increasing, businesses are looking for secure and reliable payment methods to facilitate cross-border transactions. A confirmed letter of credit (LC) offers a safety net for exporters and importers by providing a guarantee of payment from a reputable financial institution. This transparency reduces the time and cost associated with trade finance operations. In markets with political and economic instability, or where there is a lack of trust between trading partners, the need for confirmed letters of credit is becoming more critical, which is impelling the market growth. A confirmed LC assures both parties that the payment will be made upon fulfillment of the contract terms, reducing the risk of non-payment or fraud.

- Technological advancements:

The integration of digital platforms and blockchain technology is streamlining the process of issuing, confirming, and tracking letters of credit. These technologies facilitate real-time tracking and monitoring of the LC process, ensuring that both buyers and sellers are promptly informed about the status of payments and documents. Blockchain provides an immutable, decentralized ledger that can securely record LC transactions, making it easier to verify the authenticity of documents and minimize the risk of fraud. Additionally, the increasing adoption of artificial intelligence (AI) and machine learning (ML) is enabling banks to automate much of the LC confirmation process, which enhances accuracy and reduces administrative overhead, thereby supporting the market growth.

- Regulatory compliance:

Regulatory requirements surrounding anti-money laundering (AML), know your customer (KYC), and trade sanctions are becoming more complex, thereby catalyzing the demand for letters of credit (LCs) that ensure secure finance transactions. LCs are often used to mitigate risks and ensure that both parties in a transaction adhere to these regulatory frameworks. The confirmation of an LC helps safeguard against potential non-compliance by verifying the terms of the credit and ensuring that all necessary legal and financial regulations are met before payment is made. Financial institutions, which are facing increasing regulatory scrutiny, are investing in advanced systems to confirm LCs in compliance with local and international laws, which is bolstering the growth of the market.

We explore the factors propelling the letter of credit confirmation market growth, including technological advancements, consumer behaviors, and regulatory changes.

Letter of Credit Confirmation Market Report Segmentation:

Breakup By L/C Type:

- Sight L/C

- Usance L/C

Sight L/C represents the largest segment as it ensures safe monetary transactions and provides protection for both buyers and sellers.

Breakup By End User:

- Small-sized Businesses

- Medium-sized Businesses

- Large Enterprises

Large enterprises account for the majority of the market share because they engage in high-value cross-border trade and require the security and assurance provided by letter of credit confirmations.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific enjoys the leading position in the market owing to its increasing participation in international trade, advanced banking infrastructure, and government initiatives.

Top Letter of Credit Confirmation Market Leaders:

The letter of credit confirmation market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Citigroup Inc.

- DBS Bank Ltd.

- JPMorgan Chase & Co

- Mizuho Bank Ltd.

- Standard Chartered plc

- Sumitomo Mitsui Banking Corporation

- The Bank of Nova Scotia

- The PNC Financial Services Group Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments