Medicare, the federal health insurance program for seniors and certain individuals with disabilities, provides essential coverage for medical expenses. However, even with the comprehensive coverage offered by Medicare, there can be gaps in coverage that leave beneficiaries with unexpected healthcare costs. In this article, we will explore the concept of Medicare coverage gaps, identify common coverage gaps, and provide tips on how to address and mitigate these financial challenges.

What Are Medicare Coverage Gaps?

Medicare coverage gaps, often referred to as "Medicare coverage exclusions" or "out-of-pocket expenses," are areas of healthcare costs that are not covered by the Medicare program. While Medicare Part A (hospital insurance) and Part B (medical insurance) provide a wide range of coverage, there are instances where beneficiaries are responsible for certain costs. These gaps can include copayments, deductibles, coinsurance, and services that are not covered at all by Medicare.

Common Medicare Coverage Gaps

Part A Deductible: Medicare Part A covers inpatient hospital care. However, beneficiaries are responsible for a deductible for each benefit period. In 2023, the deductible amount is $1,556 per benefit period.

Part A Coinsurance: After the deductible, beneficiaries may still be responsible for daily coinsurance costs if their hospital stay exceeds 60 days.

Part B Deductible: Medicare Part B covers medical services and outpatient care. Beneficiaries must meet an annual deductible, which is $233 in 2023.

Part B Coinsurance and Copayments: After meeting the deductible, beneficiaries typically pay 20% of the Medicare-approved amount for most Part B services, including doctor visits, lab tests, and durable medical equipment.

Prescription Drug Costs: Medicare Part D provides prescription drug coverage, but it includes a coverage gap, also known as the "donut hole." Beneficiaries are responsible for a percentage of their drug costs until they reach the catastrophic coverage phase.

Dental, Vision, and Hearing Services: Original Medicare does not cover routine dental, vision, or hearing services, which can result in significant out-of-pocket expenses for beneficiaries in need of these services.

Long-Term Care: Medicare does not cover the cost of long-term care services, such as nursing home care or assisted living facilities.

Strategies to Address Medicare Coverage Gaps

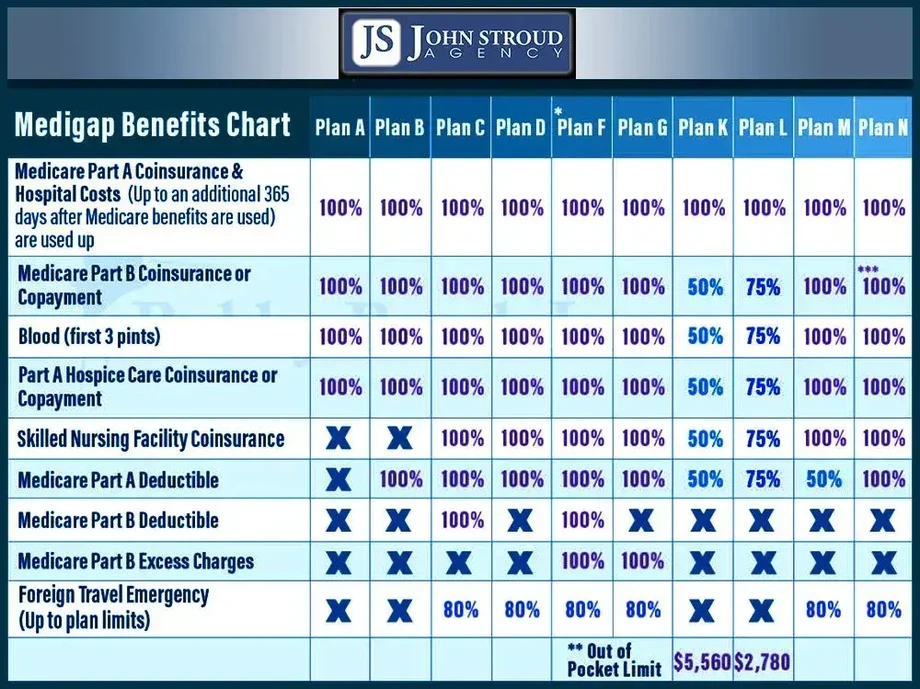

Medigap (Medicare Supplement) Plans: Medigap plans, also known as Medicare Supplement plans, are insurance policies offered by private insurers to fill the gaps in Original Medicare coverage. These plans can help pay for deductibles, coinsurance, and copayments, depending on the specific Medigap plan chosen.

Medicare Advantage Plans: Medicare Advantage plans (Part C) are private health insurance plans that combine the benefits of Medicare Parts A and B, often including prescription drug coverage (Part D). These plans may offer additional benefits that can help address coverage gaps, such as dental, vision, and hearing care.

Prescription Drug Coverage: Enrolling in a Medicare Part D plan can help cover the costs of prescription drugs. It's essential to choose a plan that covers the specific medications you need to minimize your out-of-pocket expenses.

Wellness and Preventive Care: Staying proactive about your health by scheduling regular wellness visits and preventive screenings can help detect health issues early, reducing the need for more expensive treatments later.

Savings and Assistance Programs: Some beneficiaries may qualify for extra help with Medicare costs through programs like Medicaid, the Medicare Savings Program, or low-income subsidy programs. These programs can help lower or eliminate certain coverage gaps.

Planning for Long-Term Care: Since Medicare does not cover long-term care services, individuals may want to explore long-term care insurance policies or alternative planning methods for potential future needs.

Research Medicare Advantage Plans: As mentioned earlier, Medicare Advantage plans can provide comprehensive coverage and additional benefits that can help address various coverage gaps. Be sure to research and compare the options available in your area to choose a plan that aligns with your healthcare needs and budget.

Consult with a Medicare Counselor: Medicare counselors, available through State Health Insurance Assistance Programs (SHIP), can provide free and unbiased guidance to help you understand your options and make informed decisions about your Medicare coverage.

For More Info:-

Comments