Soybean Oil Price in Netherlands

- Netherlands: $951/MT

In the Netherlands, various factors influenced the price of soybean oil in the last quarter of 2023. Initially, an excess in the domestic market led to surplus trade, prompting merchants to offer discounts to reduce their inventories.

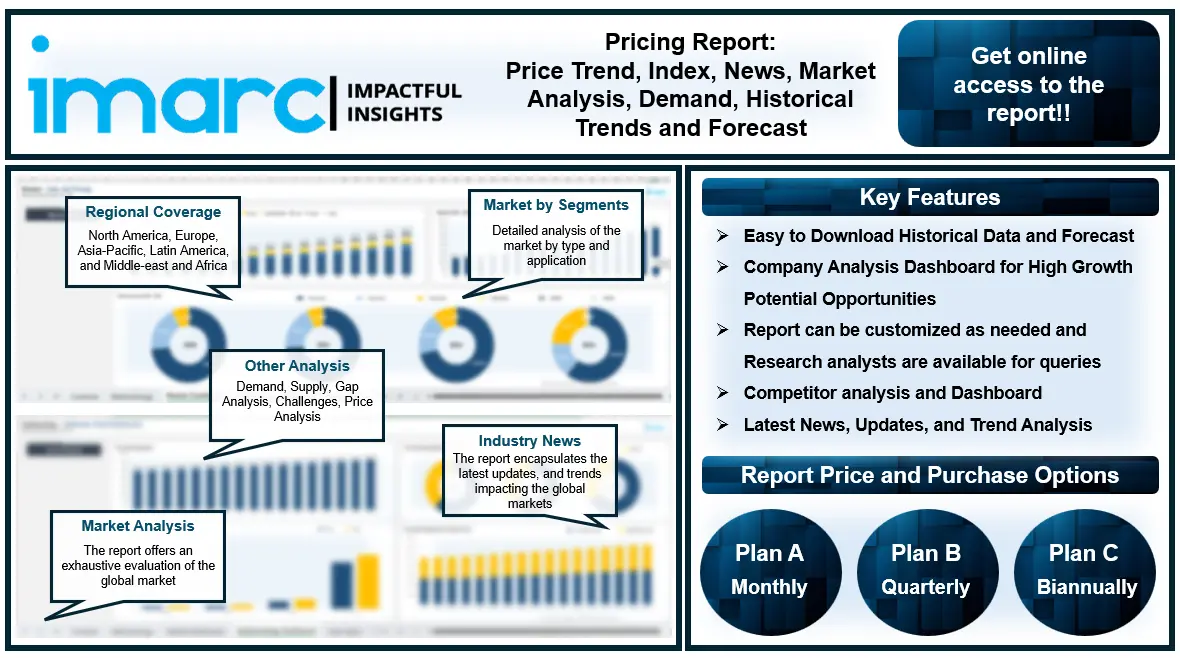

The latest report by IMARC, titled "Soybean Oil Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data" delivers a comprehensive analysis of soybean oil prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Soybean Oil Prices December 2023:

- Netherlands: $951/MT

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting soybean oil price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/soybean-oil-pricing-report/requestsample

Soybean Oil Price Trend- Q4 2023

The soybean oil market is currently experiencing significant growth, primarily driven by a multitude of factors that have shaped its demand and supply dynamics. The increasing adoption of soybean oil across various industries, including food, cosmetics, and pharmaceuticals are contributing to the market growth. Additionally, the growing awareness regarding the health benefits associated with soybean oil, such as its high content of unsaturated fats and omega-3 fatty acids, has further bolstered its consumption. Moreover, the expanding global population and rising disposable incomes have led to higher consumption of processed foods, which often contain soybean oil as a key ingredient. In the first quarter of 2024, the dynamics of soybean oil pricing in North America were shaped by various factors observed in other exporting countries. The market situation in the USA, where price fluctuations were most significant, heavily influenced the overall trend. Besides this, the Asia Pacific region's soybean oil market experienced complex pricing dynamics influenced by various factors. Furthermore, in the Europe region, particularly in Ukraine, the first quarter of 2024 saw a positive trajectory despite weakening prices in the initial months.

Soybean Oil Market Analysis

The global soybean oil market size reached 61.2 Million Tons in 2023. By 2032, IMARC Group expects the market to reach 71.9 Million Tons, at a projected CAGR of 1.70% during 2023-2032. In the first quarter of 2024 March, the pricing dynamics of soybean oil in North America were affected by a variety of factors similar to those observed in other exporting countries. The market conditions in the USA, characterized by notable price fluctuations, had a substantial impact on determining the overarching trend. The quarter commenced with a notable price increase, due to the rising demand in the regional market and sufficient inventories to balance demand. Additionally, steady price increases in other exporting nations led the US market to follow suit to remain competitive, especially in January. Along with this, continuous demand from downstream food and other industries further contributed to this trend. Top of Form The market rebounded later in the quarter, aligning with other exporting nations such as Brazil. This upward trend was facilitated by reduced freight costs and the appreciation of the dollar against other currencies, making goods more affordable for merchants and buyers.

In the Asia Pacific region, the soybean oil market underwent intricate pricing dynamics that were influenced by a multitude of factors. Top of Form In China, prices were generally lower due to seasonal factors post the Lunar New Year holiday, decreased domestic demand, and competition from rival vegetable oils. Besides this, the abundant domestic supplies and cautious trading due to supply and demand dynamics further contributed to price fluctuations. Geopolitical tensions and economic uncertainties, coupled with increased freight charges and a devaluation of the Chinese currency, also affected market sentiments negatively. Along with this, prices gradually recovered towards the end of the quarter due to increased end-user consumption in oil terminals and favorable forecasts for Malaysian palm oil production.

In Europe, notably in Ukraine, the trajectory of the first quarter of 2024 showed a positive direction, even though prices weakened during the initial months. Top of Form Ukrainian soybean prices declined significantly in January due to global market conditions, leading to reduced exports to maintain competitiveness. Decreased regional purchasing activity, influenced by subdued off-takes from biofuel and feed industries, further dampened market activity. However, towards the end of the quarter, domestic soybean oil prices in Ukraine witnessed a significant increase due to growth in the export market and increased domestic demand. Border blockages constrained exports to Poland, reducing market supply and driving up domestic prices. The decrease in blockages and resurgence of demand fueled an ongoing upward trajectory of soybean oil prices, supported by increased demand from end-user sectors.

Browse Full Report: https://www.imarcgroup.com/soybean-oil-pricing-report

Key Points Covered in the Soybean Oil Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Soybean Oil Prices

- Soybean Oil Price Demand

- Soybean Oil Demand & Supply

- Soybean Oil Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Soybean Oil Price Analysis

- Soybean Oil Industry Drivers, Restraints, and Opportunities

- Soybean Oil News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Browse More Pricing Reports By IMARC Group:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments