Natural Gas Price in China

- China: 3485 USD/1000 MMBtu

The substantial drop in natural gas prices in China can be attributed to ample supply, decreased demand, and record production. By December of Q4 2023, the price of natural gas in China had reached 3485 USD/1000 MMBtu.

T

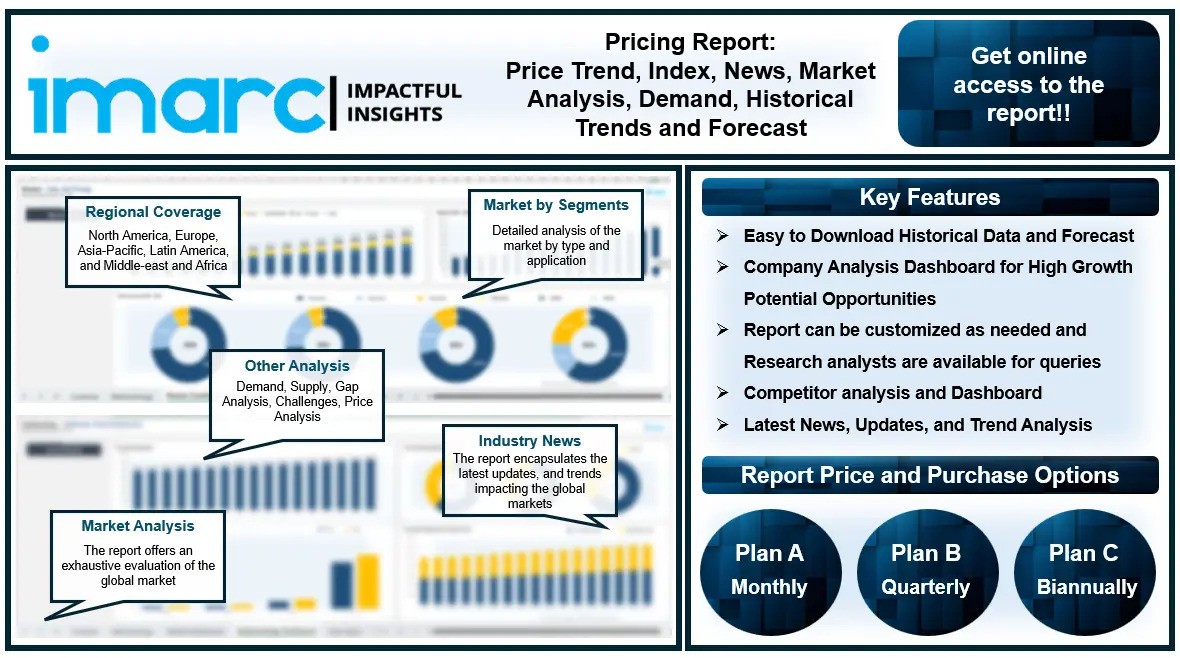

he latest report by IMARC Group, titled "Natural Gas Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data," provides a thorough examination of natural gas price trend. This report delves into the price of natural gas globally, presenting a detailed analysis, along with informative natural gas price chart. Through comprehensive natural gas price analysis, the report sheds light on the key factors influencing these trends. Additionally, it includes historical data to offer context and depth to the current pricing landscape. The report also explores the natural gas demand, analyzing how it impacts market dynamics. To aid in strategic planning, the price forecast section provides insights into price forecast, making this report an invaluable resource for industry stakeholders.

Natural Gas Prices December 2023:

- China: 3485 USD/1000 MMBtu

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting natural gas price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/natural-gas-pricing-report/requestsample

Natural Gas Price Trend- Q4 2023

Natural gas is considered a cleaner alternative to coal and oil and is increasingly favored for its lower carbon emissions, supporting global efforts to combat climate change. On the other hand, there is a growing demand for electricity as natural gas is widely used for power generation due to its efficiency and reliability. Advancements in extraction technologies, such as hydraulic fracturing and horizontal drilling, have boosted natural gas production, particularly in regions like North America, making it more accessible and cost-effective. Additionally, the expansion of liquefied natural gas (LNG) infrastructure has facilitated international trade, allowing countries with limited natural gas resources to meet their energy needs. Government policies and incentives promoting the use of natural gas for energy security and environmental benefits further support market growth. Moreover, the versatility of natural gas, which can be used in residential, commercial, and industrial applications, ensures its sustained demand across various sectors.

Natural Gas Market Analysis

The global natural gas market size reached US$ 1,029.9 Billion in 2023. By 2032, IMARC Group expects the market to reach US$ 2,311.8 Billion, at a projected CAGR of 9.40% during 2023-2032. In Q4 2023, the North American natural gas market was characterized by a bullish trend due to strong demand from Mexico and a colder-than-normal winter forecast. The supply was strained by declining domestic gas storage, leading to price hikes. Besides this, December experienced a bearish trend with a slight price drop. Meanwhile, Asia Pacific (APAC) region prices were influenced by mild weather in Europe and the USA, reducing global demand and prices. The Israel-Hamas conflict and geopolitical issues raised shipment costs. Besides this, increasing power sector demand and dwindling gas inventories during winter also boosted prices. Likewise, China saw a significant price drop due to ample inventory, lower demand, and record production, being better prepared for winter demand. Furthermore, Europe's regional market was bearish due to the ongoing energy crisis and a weak global economy. However, with freezing temperatures in parts of Europe and supply disruptions from Australia, prices in Germany continued to decline. Key factors included the Israel-Hamas conflict, potential sabotage of gas infrastructures, and supply bottlenecks from geopolitical conflicts, alongside high domestic storage reducing usual demand. Along with this, there were no shutdowns of natural gas plants, but the Middle East and Africa (MEA) region's market was notably affected by strong household demand from India during the festive season. In line with this, increased demand for gas supply from the Middle East to Europe and Asia arose due to reduced Russian gas production. In Saudi Arabia, natural gas prices saw a significant rise by the end of September, driven by liquid natural gas (LNG) price increases in anticipation of strong winter demand.

Key Points Covered in the Natural Gas Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Natural Gas Prices

- Natural Gas Price Trend

- Natural Gas Demand & Supply

- Natural Gas Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Natural Gas Price Analysis

- Natural Gas Industry Drivers, Restraints, and Opportunities

- Natural Gas News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Browse More Pricing Reports By IMARC Group:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments