In the labyrinthine corridors of the digital world, a shadowy market thrives, dealing in stolen financial information. One prominent name in this clandestine space is "Bclub.st." This term has become synonymous with underground platforms that facilitate the exchange of stolen credit card data, including dumps and CVV2 Shops. Understanding the mechanics and implications of these transactions is crucial for anyone concerned with online security and financial fraud.

The Underground Market: An Overview

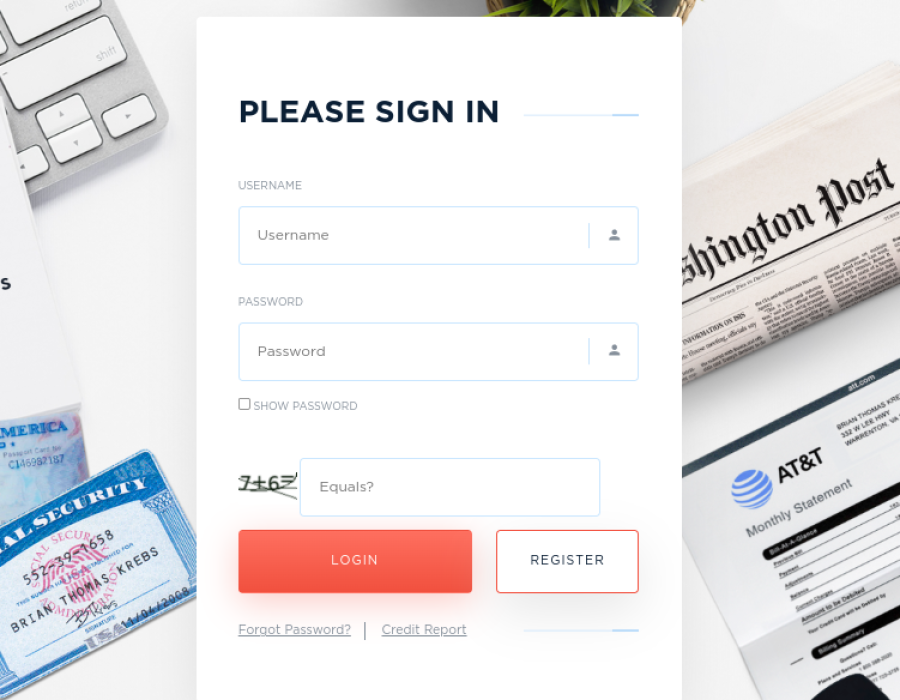

The underground market for financial data is a complex and highly secretive domain. Platforms like Bclub.st are central to this market, offering a marketplace where stolen credit card information is bought and sold. These platforms operate in the dark corners of the internet, using encrypted communications and obscure forums to evade detection and facilitate transactions.

At the heart of this market are two key elements: dumps and CVV2 codes. Dumps refer to the raw data extracted from the magnetic stripes of credit cards. This data typically includes the card number, expiration date, and the cardholder's name. With this information, fraudsters can create counterfeit cards or make unauthorized online purchases.

CVV2 codes, on the other hand, are the three or four-digit security codes found on the back of credit cards. These codes are crucial for verifying the authenticity of a card during online transactions. When combined with the information from dumps, CVV2 codes increase the likelihood of successful fraudulent activities.

The Appeal of Bclub.st and Similar Platforms

Platforms like Bclub.st are appealing to those involved in financial fraud for several reasons. For buyers, these platforms offer access to a wide array of stolen credit card data, which can be used to commit fraud. The data provided is often categorized and sorted, making it easier for buyers to find specific types of information, such as high-limit credit cards or cards from particular regions.

For sellers, Bclub.st provides a marketplace to monetize stolen data. The anonymity offered by these platforms allows sellers to offload their illicit goods without revealing their identities. Transactions are typically conducted using cryptocurrency to further obscure the flow of money and protect both parties involved.

The Risks and Consequences of Engaging with Stolen Financial Data

Engaging with stolen financial data, whether as a buyer or seller, carries significant risks. Legally, the possession, use, or distribution of stolen credit card information is a crime. Law enforcement agencies around the world are actively working to dismantle these underground networks and prosecute individuals involved in financial fraud. The penalties for such crimes can include hefty fines and long prison sentences.

For victims, the impact of financial fraud can be devastating. Stolen credit card information can lead to unauthorized charges, identity theft, and significant financial loss. Victims often face a lengthy and stressful process to resolve these issues and recover their stolen funds.

Moreover, those participating in the underground market may face scams and deception. Many platforms operate with fraudulent intentions, tricking buyers into paying for data that is either non-existent or worthless. Such scams add another layer of risk for individuals involved in the trade of stolen financial information.

Legal and Ethical Considerations

The trade of stolen financial data is not only illegal but also raises serious ethical concerns. The unauthorized use of someone else's financial information is a violation of privacy and trust. It undermines the integrity of financial systems and can cause severe harm to individuals and businesses.

Efforts to combat financial fraud are ongoing and involve multiple stakeholders, including financial institutions, cybersecurity firms, and law enforcement agencies. These efforts focus on enhancing security measures, increasing public awareness, and pursuing legal action against those involved in financial crimes.

Protecting Yourself from Financial Fraud

Given the risks associated with the underground market for financial data, it is crucial to take steps to protect yourself from potential fraud. Here are some strategies to help safeguard your financial information:

- Regularly Monitor Financial Statements: Keep a close watch on your bank and credit card statements for any unauthorized transactions. Report any discrepancies to your financial institution immediately.

- Use Secure Payment Methods: When making online purchases, use secure payment methods and avoid sharing your credit card information on untrusted or unsecured websites.

- Employ Strong Security Measures: Use strong, unique passwords for your online accounts and enable two-factor authentication to add an extra layer of security.

- Be Aware of Phishing Scams: Be cautious of unsolicited emails or messages requesting your financial details. Verify the authenticity of any request before providing personal information.

- Stay Informed: Keep yourself updated on the latest security threats and scams. Awareness is a key component in protecting yourself from financial fraud.

The Future of Financial Security

As technology advances, so do the methods used by criminals to exploit financial systems. The challenge of protecting sensitive financial information is ever-present, and the fight against financial fraud requires continuous innovation and vigilance.

Financial institutions and cybersecurity experts are continually developing new strategies to combat fraud and enhance security. This includes the use of advanced technologies such as artificial intelligence and machine learning to detect and prevent fraudulent activities.

In conclusion, the world of Bclub.st and similar underground platforms represents a significant threat to online financial security. Understanding the nature of these transactions and the risks involved is essential for anyone concerned with safeguarding their financial information. By staying informed and adopting robust security measures, individuals can better protect themselves from the dangers posed by the underground market for stolen financial data.

Comments