The world of cryptocurrencies has experienced unheard-of growth and innovation in recent years. As digital assets continue to gain popularity, crypto fund investment and management have emerged as powerful tools for both seasoned investors and newcomers looking to capitalize on this booming market. In this article, we will explore the fundamentals of crypto fund investment, the importance of sound crypto fund management, and how platforms like this company are facilitating this exciting journey.

A Gateway to Diversification:

Investment in cryptocurrency fundsoffers an avenue for individuals and institutions to access a diverse portfolio of digital assets without the need for in-depth knowledge of each cryptocurrency. These funds are managed by experts who allocate resources across various cryptocurrencies based on market trends, risk assessments, and investment goals.

Investors can participate in crypto funds by purchasing shares or tokens representing a portion of the fund's assets. This approach provides a hassle-free entry point for those who wish to benefit from the potential of cryptocurrencies without the complexities of direct trading.

The Role of Research and Due Diligence:

Before diving into the world of crypto fund investment, it is crucial to conduct thorough research and due diligence. Investors should examine the track record of the fund manager, the fund's historical performance, and its investment strategy. It is also essential to consider factors such as fees, liquidity, and the fund's alignment with your risk tolerance and financial objectives.

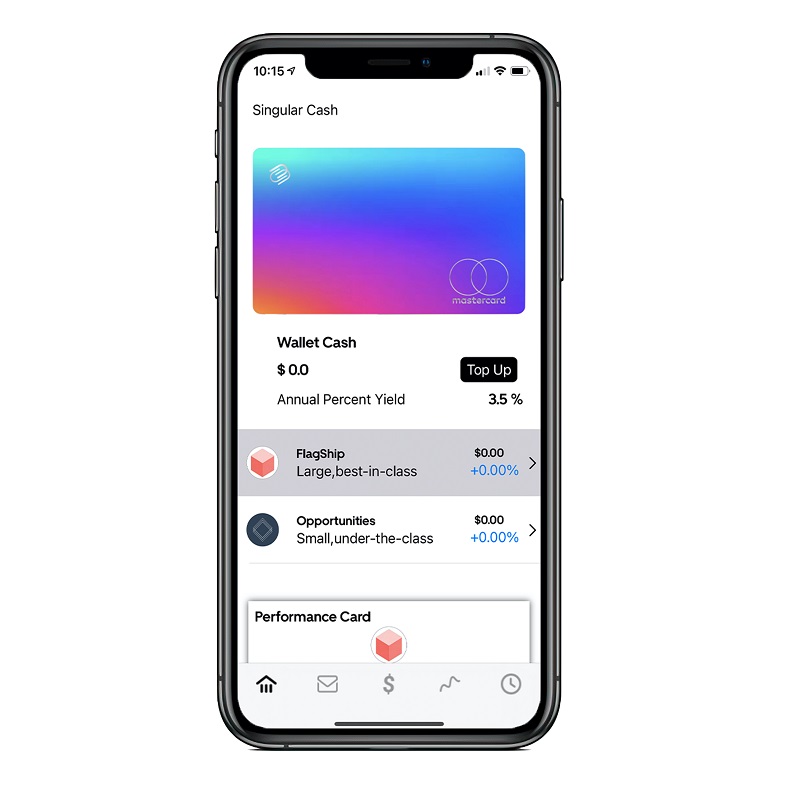

This organization is a prominent player in the crypto fund management domain, offers comprehensive information and tools to assist investors in making informed decisions. The platform empowers users with insights into various crypto funds, helping them identify opportunities that align with their investment goals.

Crypto Fund Management: Navigating the Volatility:

The cryptocurrency market is known for its price volatility, which can present both opportunities and risks. Effective crypto fund management is essential to navigate these turbulent waters successfully. Fund managers employ a range of strategies, including active trading, rebalancing, and risk mitigation, to optimize returns while managing risk.

Investors in crypto funds benefit from the expertise and experience of these managers. Their ability to adapt to changing market conditions and make informed decisions can significantly enhance the performance of the fund. This level of professionalism and diligence is particularly crucial in the crypto space, where market sentiment can shift rapidly.

Security and Custody:

handling of cryptocurrency funds also entails the responsibility of safeguarding the digital assets within the fund. Security and custody solutions are paramount in this regard. Robust security measures, such as cold storage and multi-signature wallets, are essential to protect against theft and hacking attempts.

Investors should prioritize funds that have implemented rigorous security protocols to ensure the safety of their investments.

Conclusion:

In the dynamic world of cryptocurrency, Investment in cryptocurrency fundsand management have become indispensable tools for both newcomers and experienced investors. As the market continues to evolve, platforms like singularvest.com play a pivotal role in providing access to top-notch crypto funds and ensuring the security and success of investors. Whether you are looking to diversify your investment portfolio or navigate the complexities of handling of cryptocurrency funds, This organization offers the expertise and resources needed to thrive in this exciting landscape. As you embark on your journey into the world of crypto funds, remember that informed decisions and diligent research are crucial to unlocking the full potential of this innovative asset class.

Blog Source URL:

https://singularvest.blogspot.com/2023/12/unlocking-potential-of-crypto-fund.html

Comments