As the calendar year ends, nonprofits and donors alike reflect on their philanthropic impact and future strategies. For many charitable foundations, December marks a crucial period for foundation giving, with decisions driven not only by mission alignment but also by tax considerations.

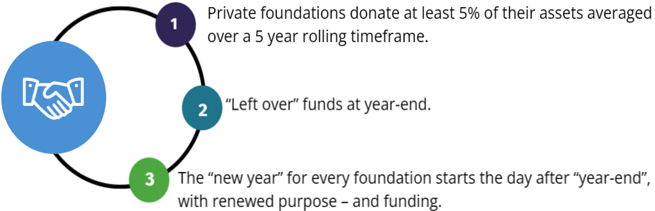

One key factor influencing year-end donations is guidance from the Internal Revenue Service (IRS). U.S.-based foundations must meet annual distribution requirements to maintain tax-exempt status, prompting many to accelerate donations in the final quarter. This surge, often called the "January Effect," highlights the strategic planning foundations use to optimize their giving.

When foundations donate at year-end, they often target pressing social issues, seasonal campaigns, or organizations that have demonstrated strong outcomes throughout the year. This strategic giving benefits nonprofits by providing timely funding for holiday initiatives and year-start planning.

Ultimately, year-end giving serves as a bridge between compliance and compassion. As nonprofits prepare for the upcoming year, understanding the motivations and patterns behind foundation giving especially in light of IRS expectations can unlock new opportunities for impactful partnerships.

Comments