Digital currencies and blockchain technologies have emerged as revolutionary elements in today's financial ecosystem. With the rise of these digital assets, a new need has surfaced - effective management of these assets. This article delves into crypto asset management, exploring its significance, the role of asset management for crypto companies, and how they are reshaping investment strategies in the digital age.

Asset management for crypto: A New Frontier in Investment

Asset management for crypto refers to managing investments in digital currencies and tokens. It's a complex task that involves understanding the volatile nature of cryptocurrencies, staying updated with the latest market trends, and applying traditional investment principles in a non-traditional setting. As cryptocurrencies become more mainstream, the importance of proficient asset management for crypto escalates.

The Role of Asset management for crypto Companies:

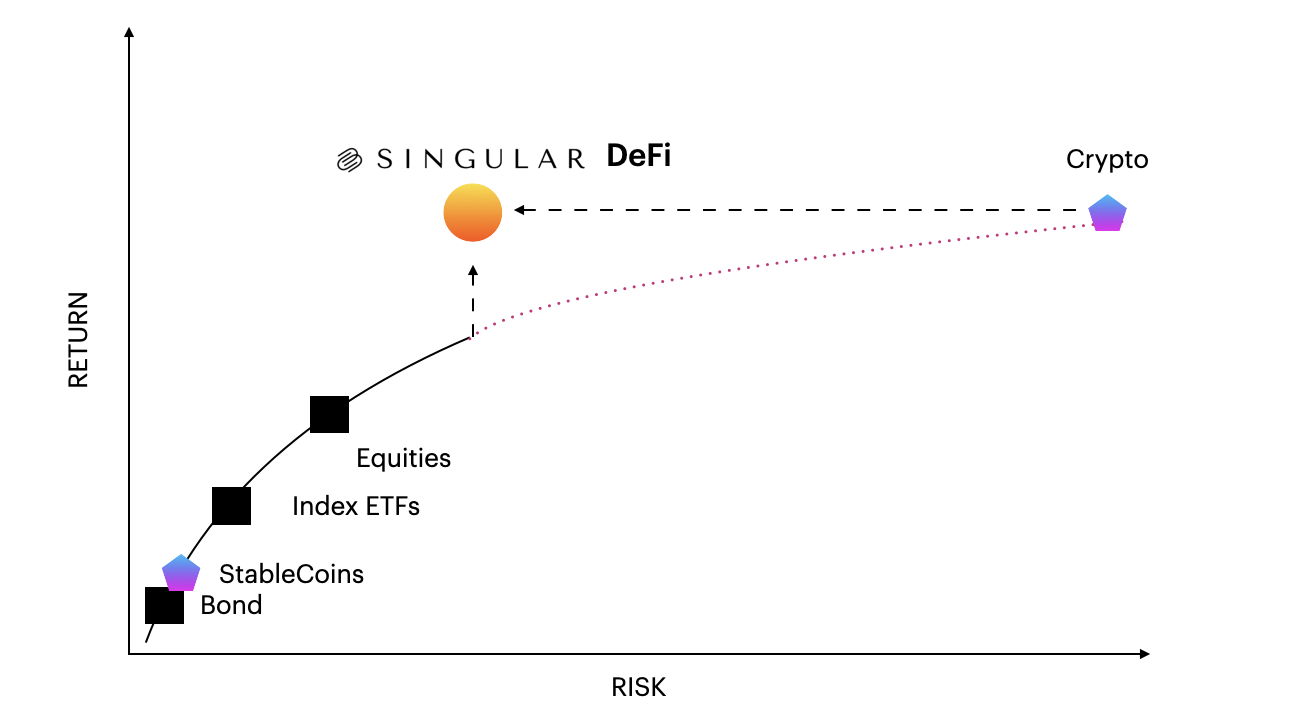

Crypto asset management company play a pivotal role in this ecosystem. These firms specialize in managing digital assets for their clients, offering services such as portfolio management, asset allocation, and risk assessment. They utilize advanced technologies and strategies to maximize returns while mitigating risks associated with crypto investments. Their expertise lies in navigating the digital currency markets, known for their high volatility and unpredictability.

Challenges and Opportunities in Asset management for crypto:

One of the main challenges in asset management for crypto is the need for more regulation and standardization in the crypto market. This unpredictability can lead to high risks. However, these risks are often balanced by the potential for high returns, making crypto investments attractive to a segment of investors. The key is to leverage expert knowledge and tools to make informed decisions.

The Future of Crypto Investments:

As digital currencies continue to gain acceptance; the role of asset management for crypto companies becomes increasingly crucial. They offer a bridge for traditional investors to enter the crypto world, blending traditional financial wisdom and new-age digital expertise. The future of crypto investments is promising, with an expected increase in institutional adoption and further advancements in blockchain technology.

Conclusion:

The landscape of digital finance is rapidly evolving, and with it, the importance of asset management for crypto and the role of asset management for crypto companies has become more pronounced. Partnering with a seasoned asset management company can be a prudent choice for those looking to venture into this dynamic field. One such company that has garnered attention in this domain is singularvest. With their expertise and innovative approaches, they stand as a beacon for investors navigating the complex world of crypto assets.

Blog Source URL:

https://singularvest.blogspot.com/2024/02/digital-finance-landscape-deep-dive.html

Comments