In the realm of retirement planning, fixed annuities stand out as a reliable tool for securing a steady stream of income during one's golden years. With their guaranteed returns and stability, fixed annuities offer a compelling solution for individuals seeking financial security in retirement. In this article, we'll delve into the benefits of fixed annuities, drawing on expert advice from Ryan Cicchelli, a seasoned financial professional with extensive experience in retirement planning and investment management.

Understanding Fixed Annuities

Fixed annuities are a type of annuity contract where the insurance company guarantees a fixed rate of return on the invested principal over a specified period. These annuities offer predictability and stability, making them an attractive option for retirees looking to supplement their retirement income with a reliable source of funds.

Ryan Cicchelli emphasizes the simplicity and security of fixed annuities, making them suitable for individuals who prioritize stability and preservation of capital in their retirement portfolios. Unlike variable annuities, which are subject to market fluctuations, fixed annuities provide a guaranteed return, offering peace of mind to retirees, particularly during periods of economic uncertainty.

Guaranteed Income for Life

One of the key benefits of fixed annuities is the option to receive a guaranteed income stream for life. Ryan Cicchelli highlights this feature as a significant advantage for retirees concerned about outliving their savings or facing unexpected financial challenges in retirement.

With a fixed annuity, retirees can convert a lump sum of money into a reliable source of income that continues for the rest of their life, regardless of market conditions. This ensures financial stability and helps retirees maintain their standard of living throughout retirement, without the worry of depleting their savings prematurely.

Protection Against Market Volatility

Market volatility can pose a significant risk to retirees who rely on traditional investment vehicles such as stocks and bonds for income. Fixed annuities offer a layer of protection against market fluctuations, providing a guaranteed rate of return regardless of how the financial markets perform.

Ryan Cicchelli emphasizes the importance of diversification and risk management in retirement planning, and fixed annuities play a crucial role in mitigating investment risk. By allocating a portion of retirement savings to fixed annuities, individuals can safeguard their financial security and reduce exposure to market volatility, ensuring a more stable and predictable income stream in retirement.

Tax-Deferred Growth

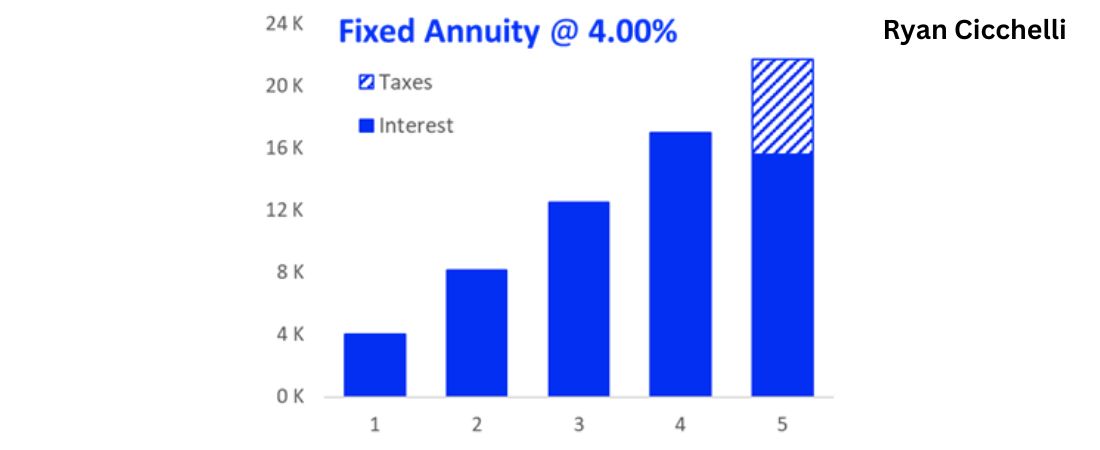

Another benefit of fixed annuities is the opportunity for tax-deferred growth on the invested principal. Ryan Cicchelli explains that unlike taxable investment accounts, where earnings are subject to annual taxation, the growth of funds within a fixed annuity accumulates tax-deferred until withdrawals are made.

This tax-deferred growth allows retirees to maximize the compounding effect of their investments, potentially leading to greater overall returns over time. Additionally, retirees may be in a lower tax bracket during retirement, making withdrawals from fixed annuities more tax-efficient compared to withdrawals from taxable investment accounts.

Flexibility and Customization

Fixed annuities offer flexibility and customization options to suit individual retirement needs and preferences. Ryan Cicchelli advises retirees to explore various payout options and features available with fixed annuities to tailor their income strategy accordingly.

Retirees can choose between immediate or deferred annuity options, depending on their desired timeline for receiving income. Additionally, fixed annuities may offer riders or enhancements, such as inflation protection or spousal continuation benefits, to enhance the annuity contract's features and provide additional peace of mind.

Conclusion

Fixed annuities provide a range of benefits that make them a valuable addition to any retirement income strategy. With their guaranteed returns, protection against market volatility, tax-deferred growth, and flexibility, fixed annuities offer retirees a reliable source of income and financial security in retirement.

As Ryan Cicchelli advises, fixed annuities should be considered alongside other retirement assets and income sources to create a well-rounded and sustainable retirement plan. By leveraging the benefits of fixed annuities and seeking guidance from financial professionals, retirees can enjoy a comfortable and worry-free retirement journey, knowing that their financial future is secure.

Comments