Tax season in the United States is a high-pressure period for CPAs, tax firms, and businesses alike. With increasing client demands and tight deadlines, the need for reliable tax preparation support is more important than ever. One of the most efficient solutions gaining traction is to Outsource US Tax returns India, a move that combines cost-effectiveness with high-quality expertise.

The Rising Trend of Outsourcing Tax Returns

Over the past decade, outsourcing tax return preparation to India has grown into a mainstream business strategy for U.S.-based tax professionals and accounting firms. This shift is driven by the availability of highly skilled tax experts in India who are trained in U.S. tax codes, IRS compliance, and the latest financial software platforms like Drake, UltraTax, and Lacerte.

The time zone advantage also plays a critical role. While firms in the U.S. close for the day, teams in India continue working, ensuring 24-hour turnaround times on crucial filings and reviews.

Key Benefits of Tax Return Outsourcing

There are several compelling reasons why outsourcing is the go-to option during peak tax seasons:

- Cost Savings: Labor costs in India are significantly lower than in the U.S., allowing firms to increase profitability without compromising on quality.

- Scalability: Firms can quickly scale their operations during tax season without needing to hire and train temporary staff.

- Accuracy & Compliance: Professionals in India follow a strict review process to ensure IRS-compliant returns, reducing error rates and audit risks.

- Focus on Core Tasks: Outsourcing frees up time for firms to focus on client relationships, advisory services, and business development.

By delegating tax prep work to a trusted offshore team, U.S. tax firms can meet deadlines more efficiently while also reducing stress on their internal staff.

Why Choose AKM Global?

AKM Global, a well-established outsourcing and advisory firm, offers specialized services in tax preparation and compliance for U.S.-based clients. Known for their precision and dedication, their team of tax professionals supports CPA firms, accounting agencies, and enterprises with a high standard of accuracy and confidentiality.

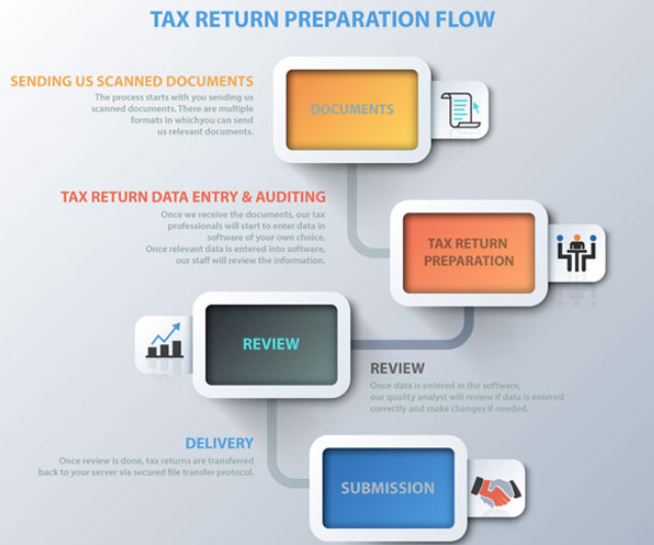

AKM Global has developed a robust workflow that includes secure data handling, multi-level reviews, and dedicated account managers to ensure seamless service. With decades of industry experience and clients from various sectors, the firm is a preferred partner for outsourcing critical tax operations.

Trusted by Firms in the USA

Though headquartered in India, AKM Global works with several clients in the USA, offering tailor-made tax outsourcing solutions that align with U.S. tax regulations. Their approach focuses on collaboration, transparency, and long-term partnerships, making them a trusted name in global tax services.

Conclusion

As tax regulations grow more complex and workloads continue to rise, U.S. firms need efficient, scalable solutions. Choosing to Outsource US Tax returns India allows firms to deliver faster, more accurate results at a fraction of the cost. If you're looking to improve turnaround times and reduce in-house pressure, outsourcing tax return preparation to India could be your smartest business move this tax season.

Comments