The world of cryptos is filled with ideas, instruments, and diagrams that detail the present condition of assets and assist in making smart investment choices. One of the key concepts that seasoned traders swear by is market depth. It's not just a fancy term but a vital tool that can make or break your trading strategy. So, whether you're a newbie looking to get a grip on the basics or a seasoned trader wanting to refine your skills, this comprehensive guide is for you. Let's dive into the depths of market depth.

Understanding Market Depth

Market Depth Basics

Market depth refers to the ability of a market to sustain large orders without significantly affecting the price of the security. In simpler terms, it shows the liquidity and volume of buy and sell orders at various price levels. Think of it as a snapshot of the order book, giving you a clear picture of how many buy and sell orders exist and at what prices.

A market with high depth has a large number of orders close to the current market price, allowing traders to execute large trades without causing a big price movement. Conversely, a market with low depth means that large trades can significantly impact the price, leading to higher volatility.

Market Depth Chart

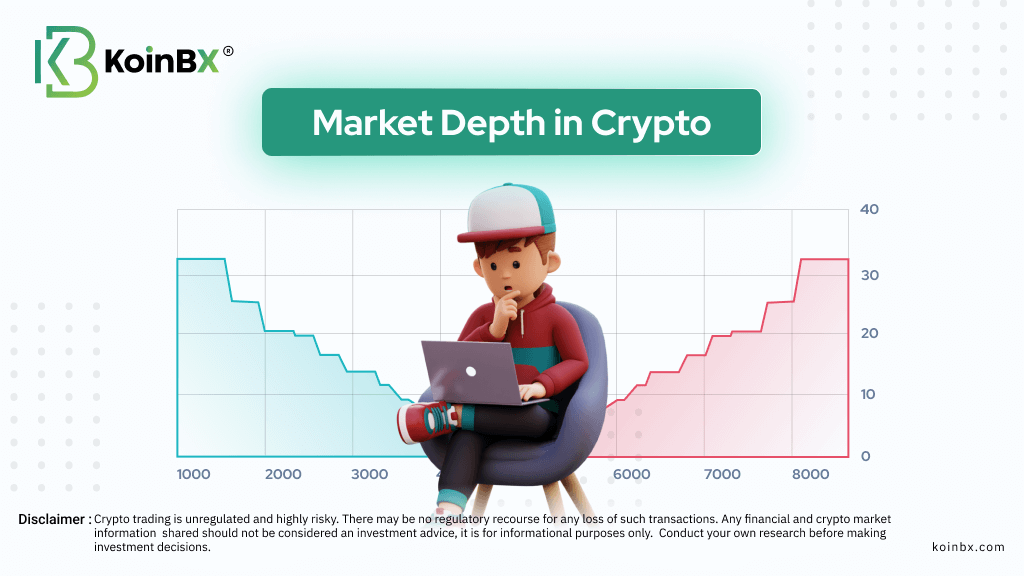

A market depth chart is a visual representation of the order book, displaying the buy and sell orders at different price levels. It's usually divided into two sides.

Bid Side: This shows all the buy orders below the current market price. The higher the number of buy orders, the stronger the support level at that price.

Ask Side: This lists all the sell orders above the current market price. A large number of sell orders indicates a strong resistance level.

The market depth chart is like a tug of war. On one side, you have the buyers pulling the price up with their bids, and on the other, the sellers are pulling the price down with their asks. The balance between these two sides determines the current market price. The chart typically uses a cumulative sum of orders at each price level, helping traders quickly grasp the supply and demand dynamics.

Also Read: RSI in Crypto Trading

Importance of Market Depth in Crypto Trading

Market depth is crucial for several reasons.

Liquidity Assessment

It helps traders assess the liquidity of a market. High liquidity means you can buy or sell large amounts without slippage, making it easier to enter and exit trades.

Identifying Support and Resistance Levels

By examining the depth chart, traders can identify strong support and resistance levels, aiding in making informed trading decisions.

Order Execution Strategy

Understanding market depth allows traders to plan their order execution strategy. For instance, breaking up a large order into smaller chunks can minimize market impact.

Market Sentiment Insight

Depth charts provide insight into market sentiment. A large number of buy orders might indicate bullish sentiment, while a high number of sell orders could suggest bearish sentiment.

Factors Affecting Market Depth in Crypto

Market Depth in crypto is influenced by several factors. Here they are,

Liquidity: Highly liquid markets, like those for Bitcoin and Ethereum, tend to have greater market depth compared to less liquid altcoins.

Bid-Ask Spread: A small difference in price between the highest bid and the lowest ask suggests robust trading and increased market stability. Smaller bid-ask spreads often indicate a more liquid market.

Exchange Popularity and Activity: The depth of a market can vary across different exchanges. Larger exchanges with more active users and higher trading volumes usually offer more depth. Smaller exchanges may lack this depth, making them more vulnerable to the impact of large orders.

Order Distribution and Magnitude: A market with a large number of small orders is considered to be deeper than one with fewer large orders. Small orders contribute to more consistent trading and price stability.

Market Maker Engagement: Market makers play a crucial role in providing liquidity by consistently offering buy and sell prices for digital assets. Their involvement enhances market depth by ensuring the availability of orders on both sides.

Regulatory Framework: The presence of regulations that foster fair trading and transparency aids in deepening the market by encouraging more investors and building trust.

Strategies Utilizing Market Depth

Market depth plays a significant role in various crypto trading strategies. Here’s a look at how different trading approaches leverage market depth to maximize their effectiveness:

Swing Trading

Swing traders aim to profit from short to medium-term price movements, typically holding positions for days or weeks. Market depth helps these traders enter and exit trades at favorable prices. In deep markets, swing traders can execute trades with minimal slippage, which ensures that the price at which they enter or exit their position is close to their intended price. Shallow markets, however, may cause slippage, where the execution price deviates from the expected price due to insufficient liquidity.

Arbitrage

Arbitrage trading involves exploiting price differences of the same asset across various exchanges or markets. Market depth affects the ease and cost of executing these trades. In deep markets, arbitrage opportunities are more accessible, and the risk of slippage is reduced before the price discrepancy is corrected. Traders need to be able to execute large trades without significantly impacting the price to capitalize on these differences effectively.

Position Trading

Position traders focus on long-term trends, holding assets for months or even years. While market depth is less critical for short-term transactions, it remains important for entering and exiting substantial positions. Deep markets allow position traders to buy or sell large quantities without causing major price fluctuations. This ensures that they can liquidate their holdings in the future without facing significant market impact.

Scalping

Scalpers make numerous trades to profit from tiny price changes, aiming for small, frequent gains. Deep markets are ideal for scalping, as they offer high liquidity, enabling swift entry and exit without causing notable price shifts. Scalpers depend on tight bid-ask spreads and rapid execution, making market depth crucial for their trading success.

Algorithmic Trading

Algorithmic trading uses computer codes to carry out transactions according to set rules. These algorithms analyze market depth to optimize trade execution, seeking the best times to buy or sell to minimize costs and market impact. For high-frequency trading algorithms, deep markets are essential, providing the liquidity needed for efficient operation and reducing the risk of significant price moves.

Also Read: Spot vs. Futures Trading

Bottom Line

Market depth is a powerful tool in the arsena of any serious crypto trader. It provides invaluable insights into the supply and demand dynamics of the market, helping traders make informed decisions. By understanding market depth, you can assess liquidity, identify support and resistance levels, and play effective trading strategies.

Remember, the crypto market is risky. Staying informed about market depth can give you a significant edge. So, next time you gear up for a trading session, make sure to dive into the depths of the market and navigate your way to success.

Download KoinBX Android App | Download KoinBX iOS App

Disclaimer: Any financial and crypto market information shared should not be considered investment advice. It is for informational purposes only. Conduct your own research before making investment decisions. Crypto trading is unregulated and highly risky. There may be no regulatory recourse for any loss of such transactions

Comments