Money management is critical in any business, and creating a proper payment agreement helps secure your financial transactions. Whether you’re providing a service, lending money, or setting up an installment plan, a payment agreement template will ensure you're protected if the client defaults. In this guide, we cover what a payment agreement entails and provide free templates you can use to secure your money.

What Are Payment Agreements?

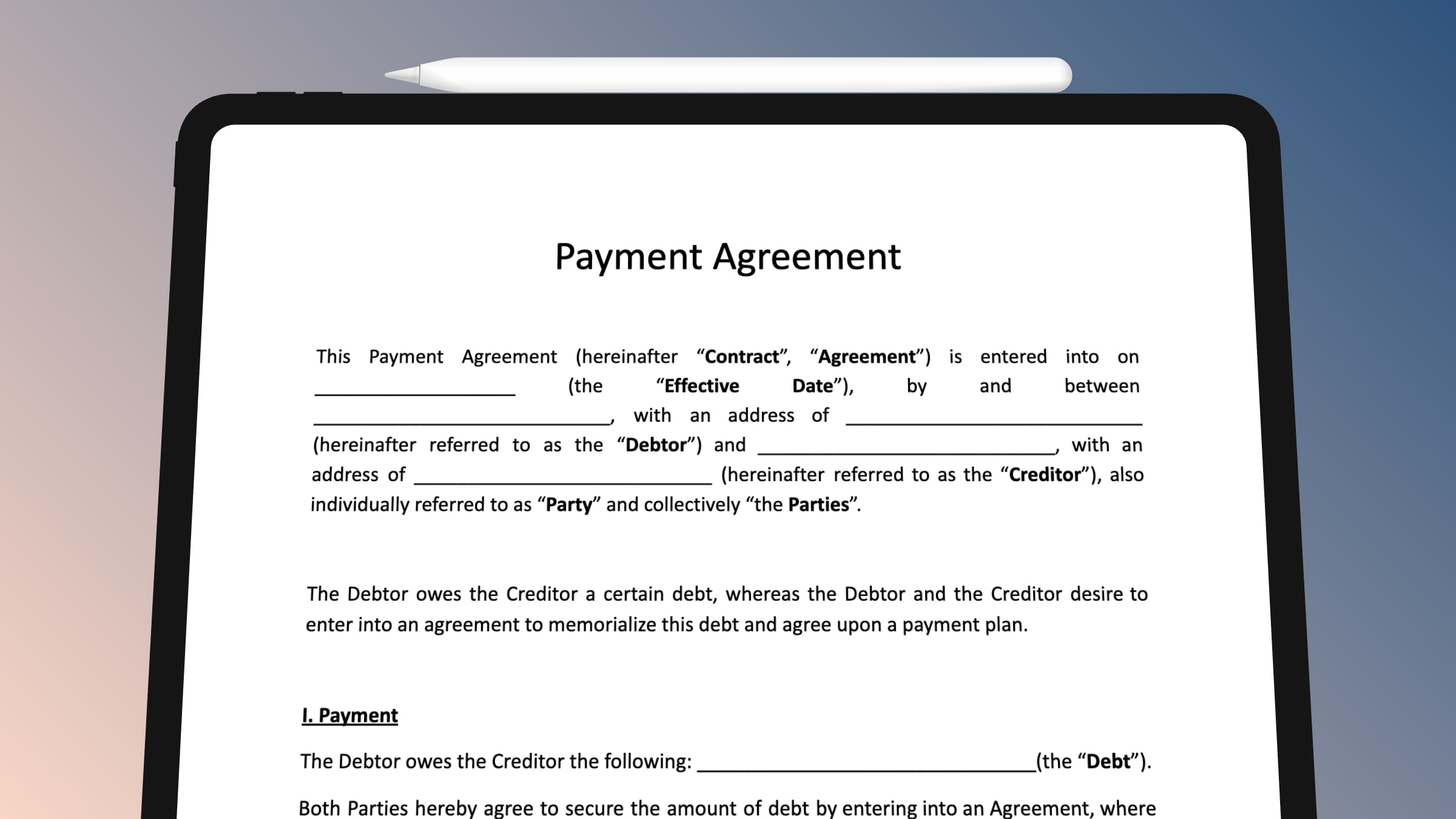

A payment agreement is a legal document outlining the payment terms between two parties, typically a creditor and a debtor. It details how and when payments will be made, providing a safeguard for businesses lending money or offering services with deferred payments. In essence, it ensures that both parties agree on the payment conditions, preventing misunderstandings and providing a legal basis for action if payments are not made.

Why is a Payment Agreement Contract Relevant for Your Company?

Payment agreements are vital for protecting your company from risks related to unpaid debts. When clients don’t adhere to verbal agreements, having a written contract ensures you have legal standing to recover your money. It establishes clear terms for repayment and allows you to plan your cash flow better. For instance, if a client promises to pay in installments, a payment agreement locks down the amount, frequency, and consequences of missed payments.

What Should a Payment Agreement Contain?

To be legally binding and effective, your payment agreement should contain the following key elements:

1. The Debt Amount

Clearly state the total amount owed by the debtor. Understanding why the debtor needs the loan can also help you evaluate their creditworthiness.

2. The Payment Schedule

Outline the payment frequency, such as weekly, monthly, or another agreed-upon schedule. Be specific about dates to ensure clarity for both parties.

3. Payment Defaults

Define what happens if the debtor fails to meet payment deadlines. You can include penalties such as interest rates or legal fees if payments are missed.

4. Severability of Provisions

State that if any provision of the agreement is found unenforceable, the rest of the agreement remains valid.

5. Dispute Resolution

Include a clause for handling disputes, whether through arbitration, negotiation, or other methods.

6. Amendments

Allow for changes to the agreement, with both parties agreeing to and signing any amendments.

7. Signatures

Ensure both parties sign the document to make it legally binding. This serves as proof of the agreement between creditor and debtor.

Payment Agreement Templates

Here are some free templates you can use to streamline the process:

1. Free Dental Payment Plan Agreement

This template is perfect for dental offices that offer payment plans to clients. It outlines all terms clearly, including the payment schedule and default conditions.

Download here: Eforms

2. General Debt Payment Agreement Template

A general-purpose template for creditors offering loans. It covers the essential terms and conditions, providing a solid foundation for your agreement.

Download here: Eforms

3. Free Basic Payment Agreement Template

This simple template is ideal for small businesses or individuals needing a straightforward agreement. It’s only two pages long but covers the necessary details.

Download here: Signaturely

4. Vehicle Payment Agreement Template

Use this template for car sales with payment plans. It outlines the agreement between buyer and dealer, specifying when full ownership transfers to the buyer.

Download here: Wordtemplatesonline

Tips for Security in a Payment Agreement

- Legal Expertise: It's advisable to have a legal expert draft your payment agreements to ensure they’re enforceable.

- Secure Signing: Have the agreement signed in the presence of a notary or use a secure online signature service.

Microsoft Word for a Payment Agreement Template

Most payment agreement templates are available in Microsoft Word format. To access these templates and customize them to your needs, you’ll need Microsoft Office. You can get Microsoft Office 2021 Professional Plus at an affordable price from RoyalCDKeys.

Bottom Line

A payment agreement is a vital document for ensuring that both parties agree on the terms of payment. It offers security for creditors and clarity for debtors. With the free templates provided and the guidance on creating your own agreement, you can protect your business from non-payment risks and ensure smoother financial transactions.

For more tips and templates, check out our blog, where we regularly post articles related to business contracts, financial security, and more!

Source: https://royalcdkeys.com/blogs/news/a-payment-agreement-template-to-assure-your-money-back

(1).png)

Comments