Radomes are critical components in modern radar and telecommunication systems, providing protection for antennas while maintaining signal integrity. The radome market is experiencing significant growth driven by advancements in radar technology, increased defense spending, and expanding applications in aerospace and telecommunications. This article explores the current growth trends, market dynamics, and opportunities within the radome industry.

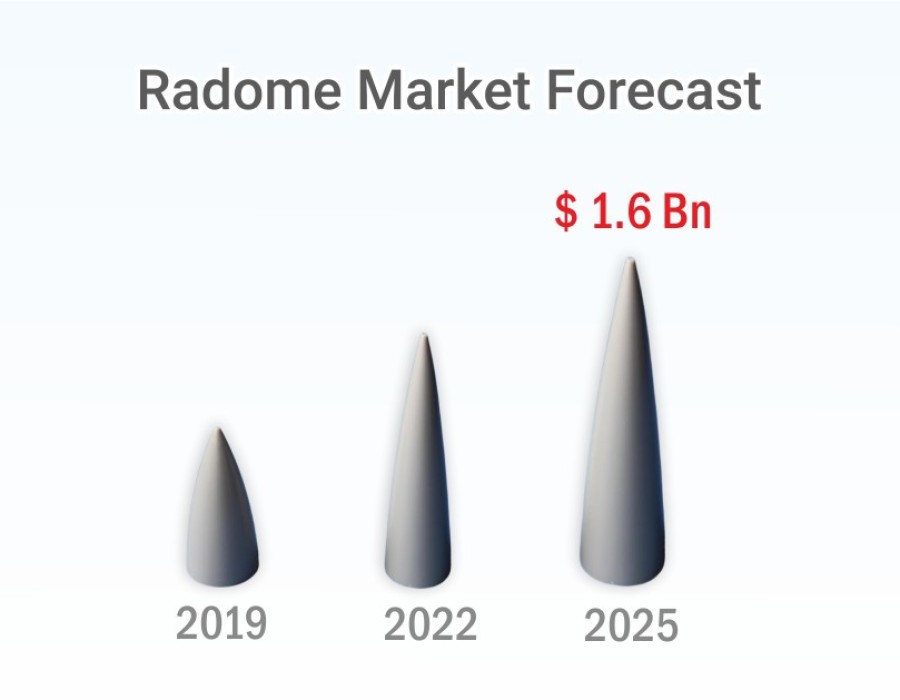

According to Stratview Research, the radome market is projected to grow at a healthy CAGR of 5.2% over the next five years to reach an estimated value of USD 1.6 billion in 2025.

Growing Demand in Aerospace and Defense

The aerospace and defense sectors are the primary drivers of the radome market. Radomes are integral to radar systems used in military aircraft, ships, and ground-based installations. As defense agencies worldwide upgrade their radar capabilities to enhance situational awareness and defense capabilities, the demand for high-performance radomes is increasing. Key factors driving growth include:

Radar System Upgrades: Modernization programs in defense forces across the globe are boosting the demand for advanced radome solutions capable of withstanding harsh environmental conditions and minimizing radar cross-section (RCS).

Stealth Technology: Radomes play a crucial role in reducing the RCS of aircraft and naval vessels, contributing to stealth capabilities and enhancing survivability in combat scenarios.

Technological Advancements

Technological innovations are propelling the radome market forward, enabling manufacturers to develop lightweight, durable, and high-performance radome solutions. Key advancements include:

Advanced Materials: The use of composite materials such as fiberglass, carbon fiber, and Kevlar enhances the strength-to-weight ratio of radomes, making them more resilient to impact and environmental factors.

Radome Design Optimization: Computational modeling and simulation tools are improving the design and performance of radomes, optimizing their aerodynamic and electromagnetic properties.

Manufacturing Technologies: Additive manufacturing (3D printing) and automated production techniques are streamlining radome manufacturing processes, reducing lead times and costs.

Emerging Applications in Telecommunications

Beyond defense applications, radomes are finding increasing use in telecommunications, particularly for satellite communication systems. Radomes protect satellite antennas from weather conditions, electromagnetic interference, and mechanical damage, ensuring reliable and uninterrupted communication services. The expansion of 5G networks and the growing demand for satellite broadband services are driving the adoption of radome technologies in the telecommunications sector.

Market Dynamics and Challenges

While the radome market presents lucrative opportunities, it also faces several challenges:

Cost Pressures: The high cost of advanced materials and manufacturing processes can challenge the profitability of radome manufacturers, particularly in competitive market environments.

Regulatory Compliance: Radome manufacturers must comply with stringent regulatory standards, particularly in defense applications, ensuring that radomes meet military specifications and safety requirements.

Future Outlook

Looking ahead, the radome market is poised for continued growth and innovation:

Increasing Defense Budgets: Rising defense expenditures globally, particularly in regions such as Asia-Pacific and the Middle East, will drive demand for radomes in military applications.

Technological Advancements: Ongoing advancements in materials science, manufacturing technologies, and radar systems will continue to drive innovation in radome design and performance.

Expanding Telecommunications Infrastructure: The expansion of satellite communication networks and the deployment of 5G technology will create new opportunities for radome manufacturers in the telecommunications sector.

Conclusion

In conclusion, the radome market is experiencing robust growth driven by advancements in radar technology, increasing defense spending, and expanding applications in aerospace and telecommunications. As defense forces and telecommunications providers continue to prioritize radar capabilities and satellite communication, the demand for high-performance radome solutions will remain strong. Manufacturers and stakeholders in the radome industry are well-positioned to capitalize on these growth opportunities by investing in technological innovation and strategic partnerships to meet evolving market demands.

Comments