The Air Transport USM market is undergoing transformative changes, driven by a mix of technological advancements, evolving regulatory frameworks, and economic pressures. These dynamics are shaping the industry and offering new opportunities for airlines, maintenance, repair, and overhaul (MRO) providers, as well as parts suppliers. Understanding the key forces at play helps illuminate how the market is evolving and what stakeholders can expect in the coming years.

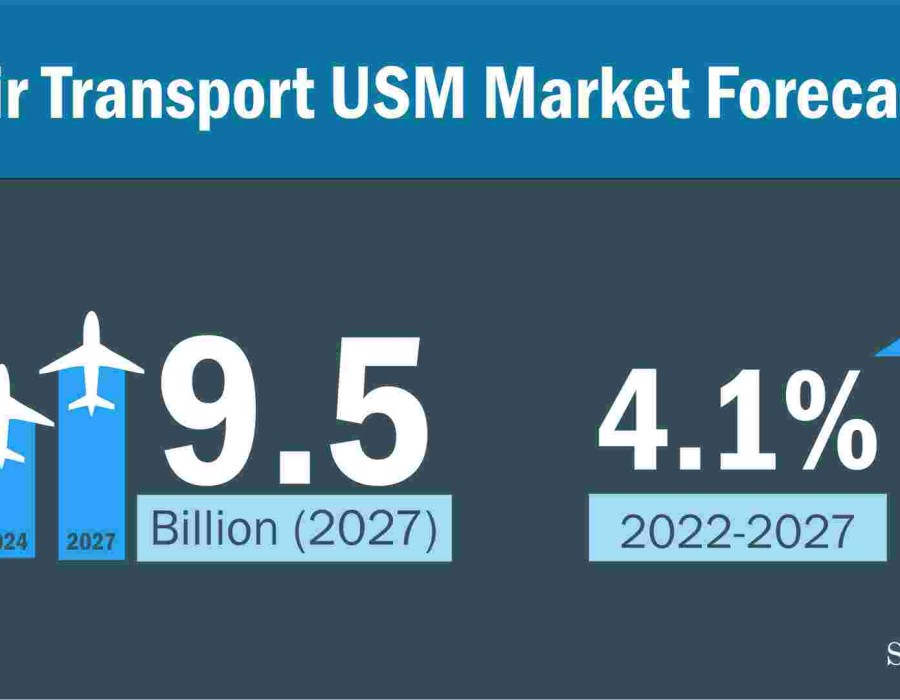

According to Stratview Research, the air transport USM market is likely to grow at a promising CAGR of 4.1% during 2022-2027 to reach an estimated value of USD 9.5 billion in 2027.

1. Technological Advancements in Refurbishment and Testing

One of the key dynamics driving the Air Transport USM market is the continuous technological advancement in the refurbishment and testing of used aircraft parts. These innovations allow USMs to meet or even exceed the standards of new components. Enhanced inspection technologies, such as non-destructive testing (NDT) methods and digital monitoring systems, ensure that refurbished parts are safe, reliable, and capable of performing at optimal levels. This increased confidence in the quality of USMs is enabling airlines to adopt them more widely as a sustainable and cost-effective solution for fleet management.

2. Stricter Environmental and Regulatory Pressures

The global push for sustainability in the aviation industry has put pressure on airlines and MRO providers to adopt environmentally-friendly practices. USMs play a critical role in this shift, as they significantly reduce waste and the environmental impact associated with the manufacturing of new parts. Refurbishing and reusing materials align with the principles of the circular economy, helping reduce resource consumption and minimizing the carbon footprint of the aviation industry. Furthermore, regulatory frameworks are becoming more stringent, driving airlines to explore sustainable alternatives like USMs to comply with new environmental standards.

3. Cost Pressures and Financial Constraints

The cost-efficiency of USMs remains one of the most significant driving forces in the market. Airlines, especially in a post-pandemic world, are facing heightened financial constraints. The ability to purchase refurbished parts at a lower price while maintaining fleet performance is an attractive proposition for many operators. As airlines struggle to recover from pandemic-related losses, USMs provide a way to cut operating expenses without compromising safety or reliability.

4. Supply Chain Disruptions and Component Shortages

The global supply chain disruptions, seen during the COVID-19 pandemic, have emphasized the need for a flexible and diverse approach to sourcing parts. USMs offer a reliable and ready-to-use option during times of crisis or component shortages. With aircraft manufacturers and suppliers facing delays in production, USMs help keep fleets operational and reduce downtime.

Conclusion

The dynamics shaping the Air Transport USM market today revolve around technological innovations, sustainability pressures, cost constraints, and the need for resilience in supply chains. As airlines continue to focus on optimizing their operations, USMs will likely remain a critical part of their strategy for maintaining fleet performance while managing costs and meeting environmental goals.

Comments