Retirement data plays a crucial role in understanding and preparing for the changing landscape of retirement. With shifting demographics, evolving financial landscapes and emerging trends, staying informed about the latest retirement trends can help make informed decisions to secure a fulfilling retirement.

We will delve into the key retirement statistics for 2023. Whether you are in the early stages of retirement planning or nearing the transition, these facts can help you gain insight into the current retirement landscape. Plus, we’ve included some helpful retirement budgeting tips to help guide you.

Key Takeaways

- 55% of Americans say they’re behind on retirement savings.

- A 65-year-old retiring this year may anticipate spending an average of $157,500 on health care.

- Nearly 50% of American workers do not have an available retirement plan.

- Over $1 trillion in Social Security benefits will be distributed in 2023.

- World Health Organization research estimates 80% of senior citizens will reside in low- and middle-income areas by 2050.

Retirement Savings and Spending Statistics

When it comes to retirement, it’s important to ensure that your savings last and that you have enough to live the lifestyle you want. Here are some facts about saving and spending trends for retirees.

- About 28% of nonretired individuals had no retirement savings, but more than three-fourths of them had at least some. (Federal Reserve)

- Approximately 7 in 10 retirees said they have three months of emergency savings in a recent study. (EBRI)

- Outside of official retirement accounts, 47% of nonretirees with a disability have retirement savings.

- On average, retirees reported that nearly one-third of their monthly income goes toward housing expenses.

- According to the American Society of Pension Professionals & Actuaries, the average retirement account balance for an IRA was $135,600 in 2021.

- According to a study from the Employee Benefit Research Institute, about half of retirees said they spend less than $2,000 a month.

- Out of 10 retirees, nine stated that the most common financial fear in retirement is inflation, according to a study.

- The most common types of outstanding debt among a group of retirees were credit cards, mortgage loans, and car loans.

- Retirees with debt reported an easily manageable level of debt or no debt.

- Among the top 1% of individuals, those between 65 and 69 years saved, on average, nearly 2.7 million U.S. dollars for retirement

- Adjusted for 2023, the U.S. Census reports the median retirement income is $47,620.

Health and Life Expectancy Trends

Life expectancy is increasing, and so are health care costs. Read more about these key facts about health and life expectancy for seniors.

- A 65-year-old’s life expectancy was almost 14 years in 1940; by 2023, it will be more than 20 years.

- For the duration of retirement, a 65-year-old retiring this year may anticipate spending an average of $157,500 on health care.

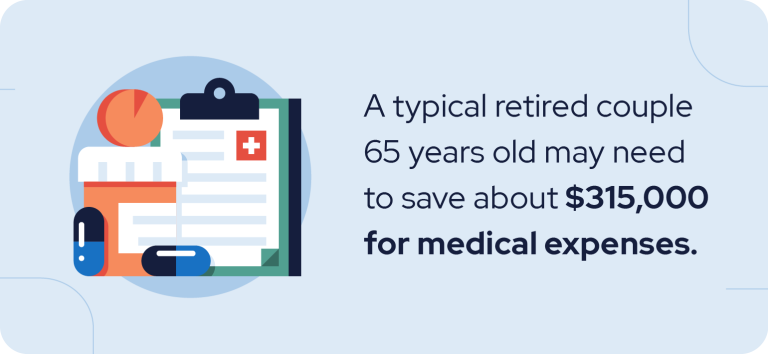

- For health care expenses, a typical retired couple 65 years old in 2023 may need to save about $315,000.

- Due to chronic illness, women and persons of color are more likely to incur higher treatment expenditures and greater wage losses.

- Health care treatment for Alzheimer’s and Dementia in adults aged 60+ costs an average of $48,701 per year as of 2022.

- Hearing loss, cataracts and refractive errors, back and neck pain and osteoarthritis, chronic obstructive pulmonary disease, diabetes, depression, and dementia are the most common ailments among older people.

- 30 percent of retirees in a survey from the Federal Reserve said that a health problem was a factor in their decision of when to retire.

- A retiree typically pays $4,300 out of pocket each year for health care costs.

- The baseline monthly premium for Medicare Part B is $164.90 in 2023.

- On a scale from 1 to 10, retirees rate their satisfaction in retirement as 7.0 in 2022 on average, compared with 7.4 in 2020.

- 31% of the respondents were very confident about having enough money to take care of medical expenses during retirement in a study from Statista.

Retirement and the Workforce Statistics

With the rising costs of day-to-day expenses, the amount of Americans working during retirement has increased. Explore these facts about retirement and the workforce below:

- According to AARP, those who work at small businesses are less likely to have access to a retirement plan than workers at larger businesses.

- 57% of Americans expect to work after retirement.

- To afford the cost of living, 54% of people would work in retirement.

- 53% of people worry about health issues while working in retirement.

- As of March 2022, life insurance is available to 57% of private industry workers.

- 62% of American civilian workers had access to a defined contribution retirement plan in 2022.

- Even though some adults in 2022 were still working in some form, 27% of them considered themselves retired.

Social Security Trends

Many retirees plan to rely on Social Security benefits to support them during retirement. For more Social Security retirement statistics, keep reading:

- Women made up about 55% of adult Social Security claimants in 2021.

- In 2021, beneficiaries who were disabled workers had an average age of 55.3.

- 40% of seniors rely on Social Security funds for their retirement.

- In 2023, an average of 67 million Americans will receive Social Security benefits each month.

- Over $1 trillion in Social Security benefits will be distributed in 2023.

- As of Dec. 31, 2022, almost 90% of those 65 and older were receiving Social Security benefits.

- Retired workers and their dependents received 76.9% of all benefits handed out in 2022.

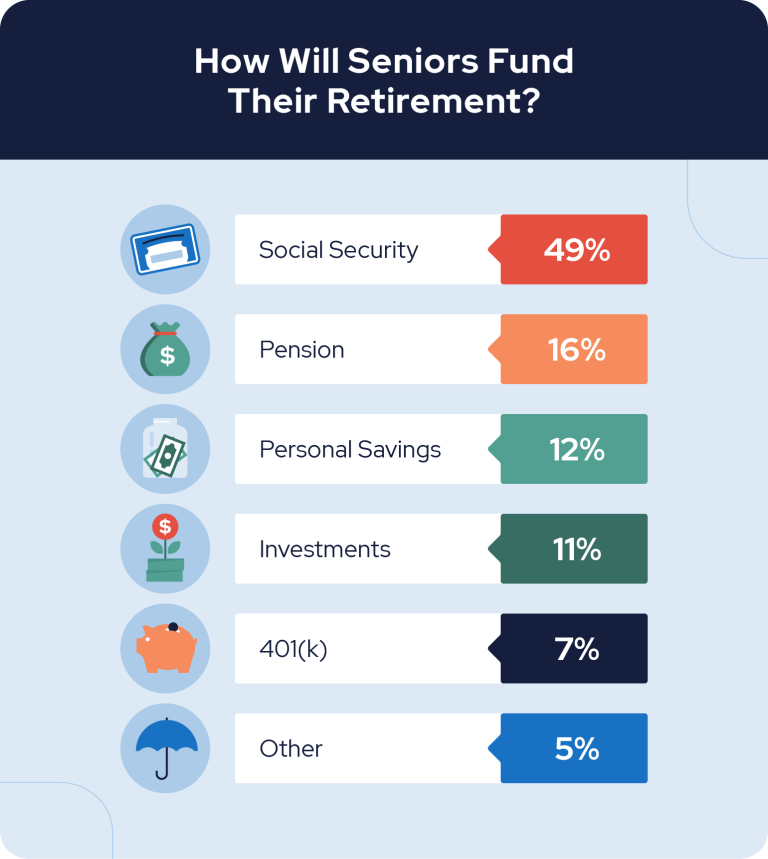

- The most prevalent source of retirement income is Social Security as of 2023.

- For January 2023, the anticipated average monthly Social Security retirement payout is $1,827.

- The number of retired workers receiving Social Security benefits increased from approximately 34.59 million in 2010 to 48.59 million in 2022.

- Almost two-thirds of beneficiaries’ retirees receive 50% or more of their total income from monthly Social Security checks.

Retirement Demographics

There are differences in retirement experiences for men and women, different ethnicities, and age groups. Check out more demographic retirement statistics below:

- The full retirement age is 66 if you were born from 1943 to 1954.

- One in six persons worldwide will be 60 or older by 2030.

- 80% of senior citizens will reside in low- and middle-income areas by 2050.

- The percentage of people over 60 in the world will increase from 12% to 22% between 2015 and 2050.

- Older women (60+) make up 56% of those who lost their jobs due to chronic illness.

- The lowest household incomes and highest out-of-pocket medical costs are both experienced by women aged 60+.

- Because they have a higher prevalence of and/or more expensive chronic conditions, individuals of color aged 60+ have 15% higher average annual treatment expenses than white seniors.

- Maine is currently the state with the highest state population percentage of those aged 65+ (21.8%).

- According to a study, women are far behind men in terms of retirement contributions, savings, and retirement confidence.

- Women reported contributing an average of $5,421 to their retirement savings, while men contributed an average of about $9,578 — a gap of 43%.

- By 2060, there will be around 94.7 million Americans that are the age 65 or older.

- The average monthly Social Security benefit for a male retiree in 2022 was $2,020.38, up from a monthly benefit of $94.49 dollars in 1967.

5 Retirement Budgeting Tips

With the rise in day-to-day living costs, it’s important to prepare for retirement by saving as much as possible and becoming more aware of where your money is going. A financial advisor is a great resource that can help you with your retirement planning and goals.

Comments