Summary:

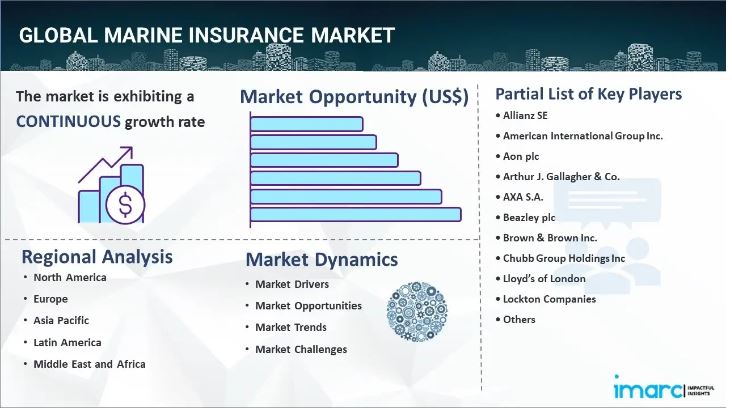

- The global marine insurance market size reached USD 33.9 Billion in 2023.

- The market is expected to reach USD 45.2 Billion by 2032, exhibiting a growth rate (CAGR) of 3.1% during 2024-2032.

- Europe leads the market, accounting for the largest marine insurance market share.

- Cargo insurance accounts for the majority of the market share in the type segment as businesses prioritize protecting their shipments against damages, loss, and theft.

- Wholesalers holds the largest share in the marine insurance industry, owing to their established relationships with insurers and customers.

- Traders remain a dominant segment in the market, as they rely on marine insurance to protect their investments in goods and ensure financial stability in case of losses.

- The increasing volume of trade across the globe is a primary driver of the marine insurance market.

- Technological advancements and the rising adoption of digital tools are reshaping the marine insurance market.

Request to Get the Sample Report: https://www.imarcgroup.com/marine-insurance-market/requestsample

Industry Trends and Drivers:

- Growing Trade and Marine Traffic:

The expansion of trade and the increasing volume of maritime traffic across the globe is one of the major factors boosting the market growth. Moreover, the increasing number of goods transported across oceans, creating the demand for comprehensive insurance coverage to protect against risks such as cargo damage, accidents, and piracy, is fostering the market growth.

Additionally, the rising reliance among countries on marine transport for economic growth, increasing the need for insurance to secure the financial interests of shippers and carriers, is favoring the market growth. Besides this, the development of new trade routes that open new shipping lanes that need insurance protection is fueling the market growth. Additionally, the surge in e-commerce, contributing to an increase in international shipping, is enhancing the market growth.

- Increasing Maritime Regulations and Compliance:

The imposition of maritime safety regulations by governments and international bodies is positively impacting the market growth. These regulations require shipping companies and vessel operators to carry insurance policies that cover environmental liabilities, accidents, and cargo protection.

Along with this, the increasing concerns over pollution and environmental damage caused by shipping accidents, prompting countries to implement laws that hold shipping companies accountable for oil spills, hazardous material leaks, and other environmental risks, is catalyzing the market growth. Moreover, the rising need to comply with international conventions on ship safety, pollution prevention, and seafarer welfare, necessitating the need for comprehensive insurance coverage, is fueling the market growth.

- Rapid Technological Advancements in Risk Assessment:

The rapid technological advancements that enhance risk assessment and management are contributing to the market growth. Besides this, the rising adoption of digital tools, including artificial intelligence (AI), predictive analytics, and the Internet of Things (IoT) devices, that allow insurers to evaluate risks associated with marine transport is fostering the market growth.

These technologies give insurers access to gather real-time data on vessel conditions, weather patterns, and cargo security, leading to more accurate risk profiling and pricing of insurance policies. For instance, IoT-enabled sensors installed on ships provide continuous updates on the condition of the vessel, alerting insurers and ship operators to potential mechanical failures or environmental hazards.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=4690&flag=C

Marine Insurance Market Report Segmentation:

Breakup By Type:

- Cargo Insurance

- Hull and Machinery Insurance

- Marine Liability Insurance

- Offshore/Energy Insurance

Cargo insurance account for the majority of shares due to the high volume of goods transported globally.

Breakup By Distribution Channel:

- Wholesalers

- Retail Brokers

- Others

Wholesalers hold the majority of shares as they act as intermediaries, offering tailored insurance packages to a wide network of clients.

Breakup By End User:

- Ship Owners

- Traders

- Others

Traders exhibit a clear dominance as they frequently engage in international trade, exposing them to higher risks during shipping.

Breakup By Region:

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East and Africa

Europe holds the leading position owing to a large market for marine insurance driven by high its extensive maritime infrastructure and significant export-import activity across various industries.

Top Marine Insurance Market Leaders: The marine insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Allianz SE

- American International Group Inc.

- Aon plc, Arthur J. Gallagher & Co.

- AXA S.A

- Beazley plc

- Brown & Brown Inc.

- Chubb Group Holdings Inc

- Lloyd's of London

- Lockton Companies

- Marsh & McLennan Companies Inc.

- QBE Insurance Group Ltd

- Swiss Re Ltd

- Willis Towers Watson plc

- Zurich Insurance Group Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145

Comments