Aadhaar Enabled Payment Service or otherwise AEPS is a particular Aadhaar based payment solution that enables AEPS agents to somehow provide some basic banking services including such card transaction, bank transfer, balance inquiry as well as mini-declaration. It is an initiative of NPCI to actively support perhaps the best Unbanked India Financial Inclusion Programme. Just it somehow empowers bank users for completing a basic financial transaction just without any debit card or otherwise credit card or check book, using just only their Aadhaar card and otherwise biometric authentication.

How this works:

- Agent barely registers now for AEPS Automated Banking Service now. Aeps White Label Price is also reasonable.

- The customer shall provide the individual with their Aadhaar number and otherwise bank name. Aeps White Label Provider should be very good.

- The agent chooses the type of transaction: Currency withdrawal or otherwise balance I have.

- The client immediately enters a basic thumb print for authenticating the purchase.

- The customer's account shall be debited and therefore the basic merchant's wallet account shall be paid in real time whole along with the extra commission sum. Aeps White Label Software is usually very good.

- The AEPS agent will then receive another receipt of the transaction and therefore the customer will receive an SMS acknowledgement from the bank. Aeps White Label Solution is also very good.

AEPS Advantages for Customers:

- Fully Protected & Secured Payment System.

- There is no need to somehow carry the Debit/Credit Card or other Cheque Book.

- Easy to do, you only need your Aadhaar code. Just choose the best Aeps Service Provider.

- Delete your money quickly, without entering any ATMs.

- Stop waiting in long lines at the local bank or the whole ATM.

- No need for driving long distances, visit the nearest AEPS Representative.

- Fast operation, it just takes another minute to somehow now complete the transaction.

AEPS special agent and AEPS Distributor:

- Minimum commitment for full returns.

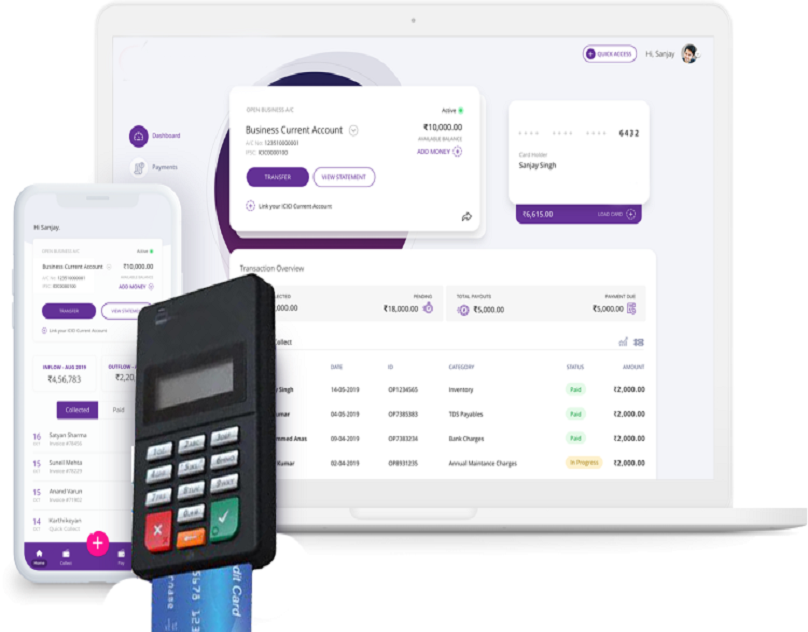

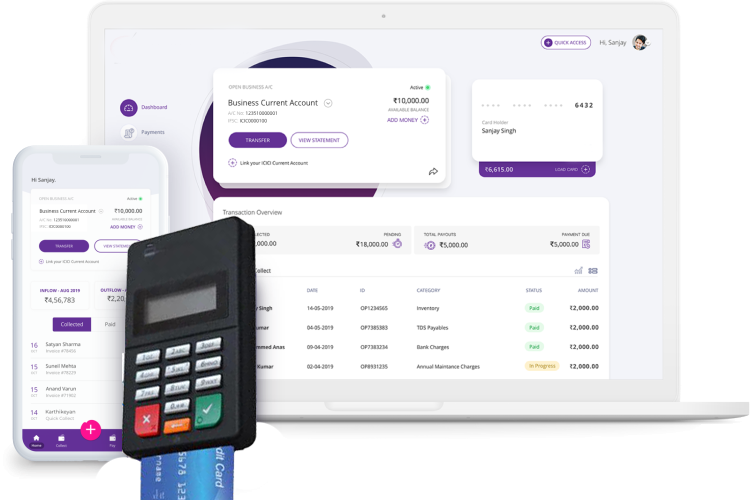

- The Mobile Phone & Biometric System is the only prerequisite to set up a company.

- Receive Lucrative Commission for each purchase.

- Quick real-time payment of each transaction.

- Accessible in both the Web and the Program.

- Fast process, it takes less than just a minute to somehow complete the transaction.

- Full use of cash in hand.

The composition of the Commission:

AEPS Agents, now with AEPS agents, have the ability to somehow earn up to 7-10 rupees per each transaction, based on the amount of transactions carried out. You are going to get immediate wallet settlement, and now more of the volume, bigger the particular commission.

AEPS Dealers have a chance to receive up to Rs.50, 000 per month. All the dealer needs to do is register/register with us and otherwise appoint agents under him. The higher the basic number of further AEPS agents that he gets to appoint more is the basic revenue on a regular basis as he receives a commission fee in real time on each transaction made by his particular appointed agents. You should always find the Best Aeps Service Provider in India.

AEPS is the foundation of all other Aadhaar-enabled specific banking services. Another kind of goal it seeks to somehow achieve is therefore the digitization of further retail payments. With the total increase here in the use of further digital financial services, the basic need for the cash withdrawal will only increase now with time. It is therefore a good kind of business opportunity with much lesser investment.

Comments