"Urban money" refers to the financial landscape and opportunities within urban settings, where economic activity, innovation, and diverse financial services converge. In urban areas, individuals, businesses, and institutions engage in various financial endeavors, investment strategies, and money management practices. Here's an overview of urban money and how individuals can navigate financial opportunities in urban settings:

1. Financial Institutions in Urban Areas:

Urban Money settings are home to a multitude of financial institutions, including banks, credit unions, and investment firms.

These institutions offer a range of services such as savings accounts, loans, mortgages, investment products, and financial planning.

2. Access to Banking Services:

Urban residents benefit from convenient access to banking services, with numerous branches and ATMs located throughout the city.

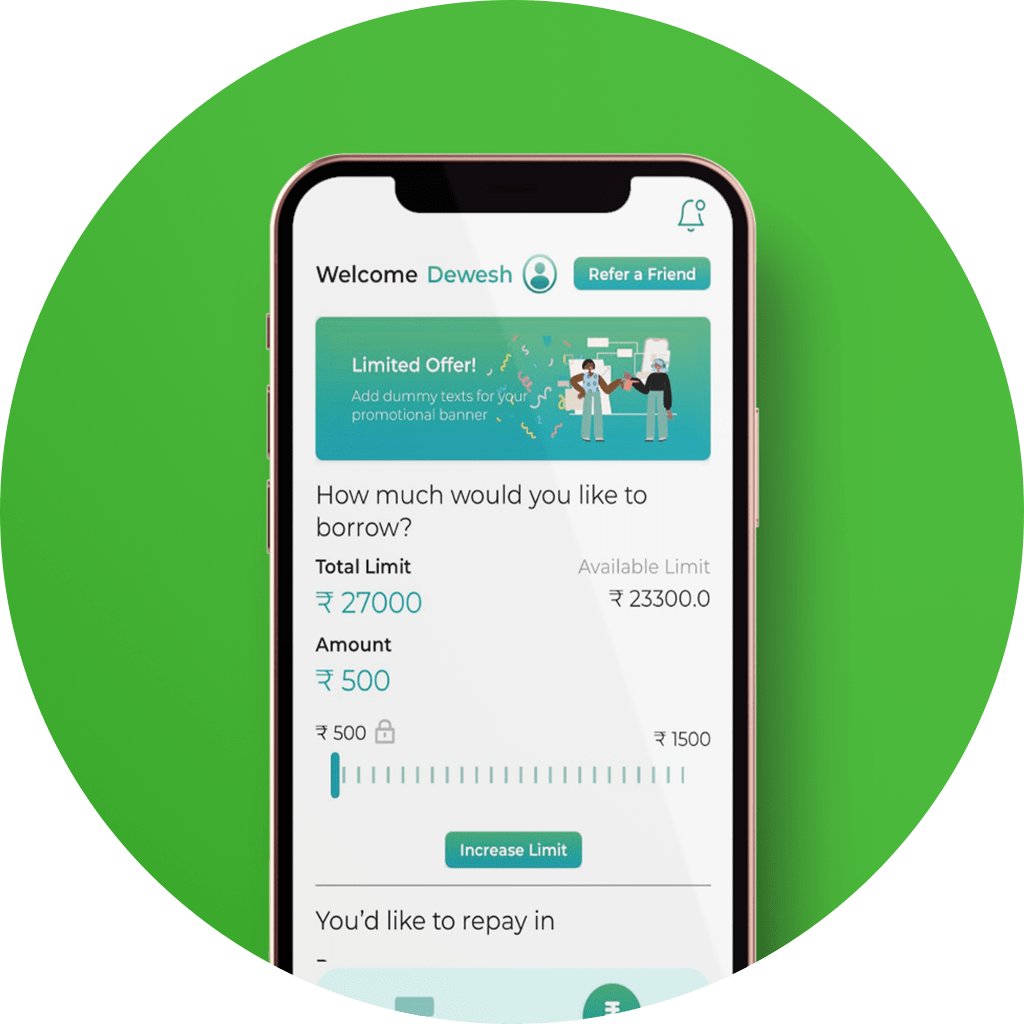

Online and mobile banking apps further enhance accessibility, allowing individuals to manage their finances from anywhere.

3. Investment and Wealth Management:

Urban money often involves investment opportunities in stocks, bonds, mutual funds, and real estate.

Wealth management firms in urban areas cater to high-net-worth individuals, offering tailored investment strategies and portfolio management.

4. Entrepreneurship and Start-up Culture:

Urban centers foster entrepreneurship and start-up culture, providing access to venture capital, angel investors, and incubators.

Entrepreneurs can launch businesses, access funding, and navigate the complexities of scaling a company in urban environments.

5. Real Estate and Property Investment:

Urban real estate presents investment opportunities through property ownership, rental income, and property appreciation.

Individuals can invest in residential or commercial properties, taking advantage of urban growth and development.

6. Financial Technology (Fintech) Innovations:

Urban areas are hubs of fintech innovation, with companies offering digital payment solutions, robo-advisors, peer-to-peer lending, and cryptocurrency services.

Fintech innovations democratize finance, making it more accessible and inclusive for urban populations.

7. Financial Education and Literacy Programs:

Urban money includes initiatives for financial education and literacy, aimed at empowering individuals with money management skills.

Workshops, seminars, and online resources help urban residents make informed financial decisions and plan for the future.

8. Urban Infrastructure Investments:

Cities invest in infrastructure projects such as transportation systems, smart technologies, and green initiatives.

Investors can participate in municipal bonds and infrastructure funds to support urban development while earning returns.

9. Job Opportunities and Income Streams:

Urban areas offer diverse job opportunities across industries, leading to multiple income streams for residents.

Side hustles, freelance work, and the gig economy thrive in urban settings, allowing individuals to supplement their income.

10. Social Impact Investing:

Urban money also encompasses social impact investing, where investors support businesses and projects that create positive social and environmental outcomes.

Impact investing funds in urban areas focus on affordable housing, sustainable energy, healthcare access, and community development.

Navigating Urban Money:

Financial Planning:

Individuals in urban areas benefit from creating comprehensive financial plans that consider their income, expenses, investments, and goals.

Working with financial advisors or using online tools can help in creating a roadmap for financial success.

Diversification and Risk Management:

Urban money management involves diversifying investments across asset classes to manage risk.

Understanding risk tolerance and adjusting investment strategies accordingly is crucial in urban financial planning.

Taking Advantage of Technology:

Embracing digital financial tools and platforms streamlines money management and investment tracking.

Apps for budgeting, investing, and tracking expenses help urban residents stay on top of their finances.

Networking and Learning Opportunities:

Urban environments provide networking opportunities with finance professionals, entrepreneurs, and investors.

Attending financial seminars, industry events, and meetups can expand knowledge and open doors to new opportunities.

Understanding Urban Economics:

Keeping abreast of urban economic trends, policies, and developments is essential for informed financial decision-making.

Monitoring real estate trends, job markets, and infrastructure projects can guide investment choices.

Conclusion:

Urban money represents the financial ecosystem within dynamic urban environments, offering a wide range of opportunities and challenges. Whether it's investing in stocks, starting a business, purchasing real estate, or participating in impact investing, urban settings provide a fertile ground for financial growth and innovation. Individuals navigating urban money can benefit from financial education, strategic planning, technology integration, and a keen understanding of urban economics. By leveraging the resources, networks, and services available in urban areas, individuals can build wealth, achieve financial goals, and contribute to the vibrant economic landscape of cities.

For more info.visit us:

Comments