Welcome to the exciting world of crypto trading! If you're intrigued by the idea of making money through digital currencies and want to dive into this fast-paced market, then you've come to the right place. In this blog post, we'll take a closer look at Limassol, the leading broker in the industry that can help unlock the secrets of successful crypto trading.

But before we delve into why Limassol is a top choice for traders worldwide, let's first understand what exactly crypto trading entails and how it works. From different types of trading strategies to weighing pros and cons, we'll cover all aspects necessary for your journey towards financial freedom in this ever-evolving field.

So buckle up and get ready to explore the fascinating realm of crypto trading with Limassol as your trusted partner! Let's uncover the mysteries together and discover how you can make smart investment decisions while navigating through volatile markets.

What is Crypto Trading?

crypto trading broker Limassol , short for cryptocurrency trading, is the buying and selling of digital currencies on various online platforms. Unlike traditional stock markets, crypto trading operates 24/7 without any centralized authority overseeing transactions. It allows individuals to speculate on the price movements of cryptocurrencies like Bitcoin, Ethereum, or Ripple.

The process starts with creating an account on a crypto exchange platform such as Limassol. Once registered, users can deposit their funds and start trading. The basic principle behind crypto trading is to buy low and sell high in order to generate profits. Traders analyze market trends through technical analysis tools and chart patterns to make informed decisions.

There are different types of crypto trading strategies employed by traders worldwide. Day trading involves executing multiple trades within a single day to take advantage of small price fluctuations. Swing traders aim to capture longer-term trends by holding positions for days or even weeks. Scalping focuses on making quick profits from small price movements over short time frames.

While there are potential rewards in crypto trading, it's important to be aware of the risks involved too. Volatility is a significant factor in this market – prices can fluctuate wildly within minutes or hours due to various factors like news events or regulatory changes. Additionally, since cryptocurrencies are relatively new assets compared to traditional investments like stocks or bonds, they come with higher uncertainty and less historical data for analysis.

How Does Crypto Trading Work?

Cryptocurrency trading, also known as crypto trading, is the process of buying and selling digital currencies on various online platforms. But how does it actually work? Let's dive into the details.

Cryptocurrencies are decentralized digital currencies that use cryptography for secure transactions. They operate on blockchain technology, which is a distributed ledger maintained by a network of computers.

To start crypto trading, you need to open an account with a reputable broker or exchange platform like Limassol. Once your account is set up, you can deposit funds and choose the cryptocurrency you want to trade.

The next step involves analyzing market trends and making informed decisions about when to buy or sell your chosen cryptocurrency. Traders use technical analysis tools such as charts and indicators to identify patterns and predict price movements.

When you decide to buy a particular cryptocurrency, you place an order through the trading platform at the current market price or set a specific price level at which you want to execute the trade.

Once your order is executed, your purchased cryptocurrency will be stored in your wallet within the exchange platform. You can then choose to hold onto it for potential long-term gains or sell it when its value increases.

It's important to note that crypto trading involves risks due to high volatility in cryptocurrency prices. It requires proper risk management techniques and continuous monitoring of market conditions.

In conclusion,

crypto trading works by using online platforms that facilitate buying and selling digital currencies based on blockchain technology. Traders analyze market trends using technical analysis tools before executing trades at desired prices. While it offers lucrative opportunities, remember that careful research and risk management are crucial in this volatile market.

The Different Types of Crypto Trading

Crypto Trading Forex Brokers in Limassol encompasses a wide range of strategies and approaches, each catering to different types of traders. Let's take a closer look at the various methods used in this dynamic field.

1. Day Trading: Day traders aim to profit from short-term price fluctuations. They execute multiple trades within a single day, taking advantage of market volatility.

2. Swing Trading: This strategy focuses on capturing larger price movements over several days or weeks. Swing traders analyze trends and use technical indicators to identify entry and exit points.

3. Scalping: Scalpers seek to make small profits by executing numerous rapid-fire trades throughout the day. They rely on quick reactions and tight spreads to capitalize on minimal price differentials.

4. Position Trading: Position traders take a long-term perspective, holding onto their positions for weeks or months. They base their decisions on fundamental analysis and macroeconomic factors rather than short-term market fluctuations.

5. Arbitrage: Arbitrageurs exploit price discrepancies between different exchanges or markets by buying low in one place and selling high in another almost simultaneously.

Each type of crypto trading has its advantages and disadvantages, depending on an individual's risk tolerance, time commitment, capital availability, and skill level.

Pros and Cons of Crypto Trading

Crypto trading, like any other investment opportunity, comes with its own set of pros and cons. One of the major advantages is the potential for high returns. The cryptocurrency market can be highly volatile, which means there are opportunities to make significant profits in a short period of time.

Another advantage of crypto trading is the accessibility. Unlike traditional financial markets that require large capital investments or have strict regulations, crypto trading allows anyone with an internet connection and a small amount of money to participate.

Additionally, crypto trading offers anonymity. Transactions carried out on blockchain networks are pseudonymous, meaning users can maintain their privacy while conducting trades.

However, it's important to note that crypto trading also has its drawbacks. The volatility that presents profit opportunities can also lead to substantial losses if not managed properly. Cryptocurrencies are known for their price fluctuations and sudden market crashes.

Security risks are another concern in the world of crypto trading. As digital assets stored in online wallets can be vulnerable to hacking attempts or phishing attacks, investors must take precautions to protect their funds.

Regulatory uncertainty poses challenges for those involved in crypto trading as governments around the world continue to develop policies regarding cryptocurrencies.

In conclusion,

crypto trading offers exciting possibilities but also carries inherent risks. It's crucial for individuals interested in this field to educate themselves about best practices and stay informed about market trends before diving into it headfirst

Why is Limassol the Leading Broker in the Industry?

Limassol has established itself as the leading broker in the crypto trading industry for a multitude of reasons. Their track record speaks for itself. With years of experience and expertise in the field, Limassol has built a reputation for providing top-notch services to traders around the world.

One of the key factors that sets Limassol apart is their commitment to transparency and security. They prioritize the safety of their clients' funds by using advanced encryption technology and implementing strict security protocols.

Another reason why Limassol stands out is its wide range of trading options. Whether you're a beginner or an experienced trader, they offer various account types to cater to different needs and skill levels. Their user-friendly platform also allows traders to easily navigate through markets and execute trades efficiently.

Furthermore, Limassol provides excellent customer support that is available 24/7. Their team of knowledgeable professionals is always ready to assist traders with any inquiries or issues they may have along their trading journey.

Additionally, Limassol offers competitive spreads and low transaction fees, making it cost-effective for traders to engage in crypto trading on their platform.

But certainly not least, Limassol constantly updates its offerings by adding new cryptocurrencies and innovative features to stay ahead in this rapidly evolving market.

In conclusion,

Limassol's dedication to providing exceptional services combined with its strong emphasis on security, variety of trading options, responsive customer support, affordability factor,and continuous innovation are what make it the leading broker in the crypto trading industry today

How to Trade Crypto with Limassol

In this article, we've explored the fascinating world of crypto trading and delved into why Limassol is considered the leading broker in the industry. Now, let's take a closer look at how you can start trading cryptocurrencies with Limassol.

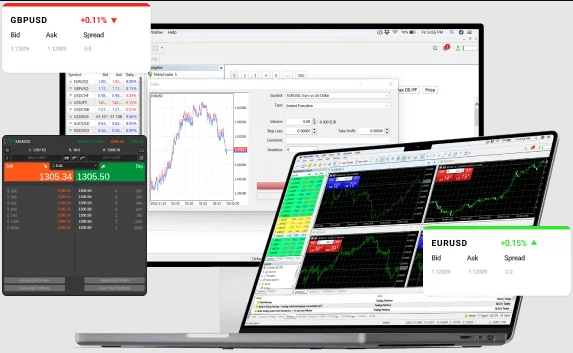

1. Choose Your Trading Platform: Limassol offers a user-friendly and intuitive trading platform that allows you to easily navigate through different markets and execute trades seamlessly. Whether you prefer desktop or mobile trading, Limassol has got you covered.

2. Open an Account: To trade with Limassol, you need to open an account by providing some basic personal information. Rest assured that your data will be kept safe and secure.

3. Fund Your Account: Once your account is set up, it's time to fund it! You can deposit funds using various payment methods such as bank transfers or credit/debit cards. Remember to only invest what you can afford to lose.

4. Choose Your Cryptocurrencies: With Limassol, you have access to a wide range of cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and many more. Research each cryptocurrency thoroughly before making any investment decisions.

5. Develop a Trading Strategy: Successful crypto traders often have a well-defined strategy in place. Consider factors like risk tolerance, market analysis techniques, entry/exit points, and portfolio diversification when formulating your strategy.

6. Track Market Trends: Keep a close eye on market trends using real-time charts and indicators provided by the Limassol platform. This will help you identify potential buying or selling opportunities based on price movements and patterns.

7.Execute Trades Wisely: When executing trades, make sure to set stop-loss orders to protect yourself from significant losses if the market moves against your position. Similarly, consider taking profits by setting target sell orders when prices reach desired levels.

8. Manage Risk Effectively: Crypto trading involves risks, and it's crucial to manage them accordingly.

Comments