Report Overview:

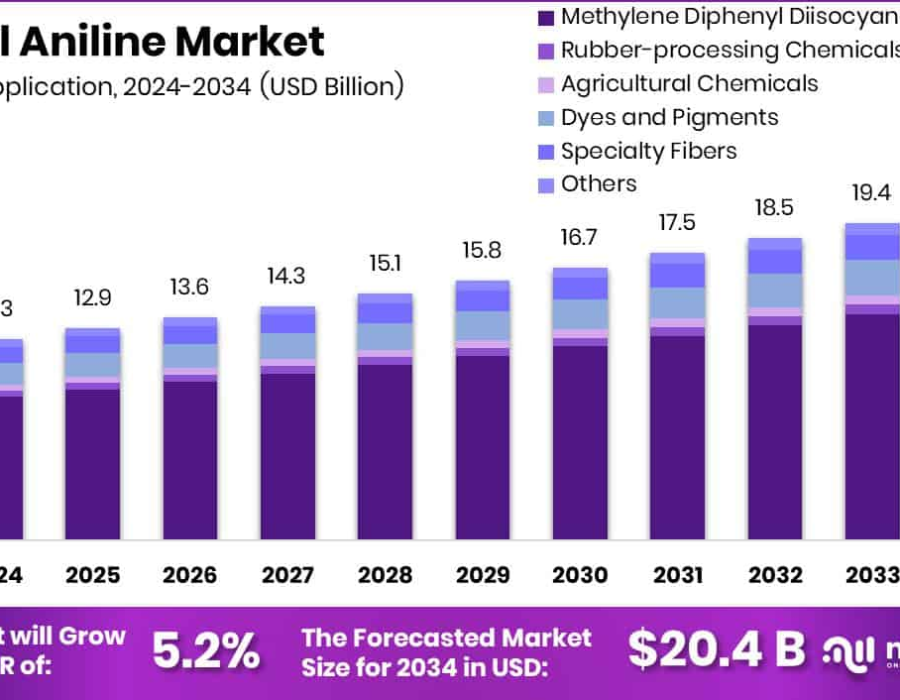

The global aniline market is growing at a stable pace and is expected to continue expanding in the years ahead. Aniline, a colorless to pale yellow liquid with a noticeable smell, is mainly made by reducing nitrobenzene. It’s a key ingredient in many industrial processes, particularly for manufacturing MDI (methylene diphenyl diisocyanate) used to create polyurethane foam. This foam is essential in insulation, furniture padding, and automotive seating. As construction and vehicle production increase worldwide, so does the demand for aniline. The Asia-Pacific region is currently the top consumer, thanks to rapid urban growth and strong industrial activity in nations like China and India. The market is also shifting towards more sustainable practices, including cleaner manufacturing processes. With these factors in play, the aniline industry has a strong foundation for long-term growth.

A significant portion of the aniline produced globally goes into making MDI, which accounts for over 70% of its use. MDI is widely needed in construction and automotive sectors for producing polyurethane foam. Aniline also finds use in products such as dyes, pesticides, rubber chemicals, and some pharmaceuticals. Most aniline is sold directly to large-scale industrial users, highlighting its importance in manufacturing supply chains. Asia-Pacific leads the global market, followed by North America and Europe. The ongoing expansion of infrastructure and industrial projects in developing countries is boosting demand. At the same time, companies are dealing with challenges like changing environmental policies and fluctuations in raw material prices. However, innovations in green chemistry and rising interest in new applications are creating space for fresh growth. With cleaner technologies and regional manufacturing, the industry is moving toward more sustainable and efficient operations.

Key Takeaways

- Aniline demand is increasing, especially for MDI production in insulation and foam.

- The Asia-Pacific region holds the largest market share and continues to grow.

- Most sales happen through direct channels to large manufacturers.

- Polyurethane applications dominate the usage of aniline globally.

- Rising sustainability and bio-based solutions are influencing industry direction.

Download Exclusive Sample Of This Premium Report: https://market.us/report/global-aniline-market/free-sample/

Key Market Segments:

By Application

- Methylene Diphenyl Diisocyanate (MDI)

- Rubber-processing Chemicals

- Agricultural Chemicals

- Dyes and Pigments

- Specialty Fibers

- Others

By End-use

- Building and Construction

- Rubber

- Consumer Goods

- Automotive

- Packaging

- Agriculture

- Others

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retailers

- Specialty Stores

- Chemical Supply Chains

- Others

DORT Analysis

Drivers

The major push for aniline comes from its use in polyurethane foams, which are widely needed in construction and automotive industries. Insulation products, car seats, and furniture are big consumers of these materials. Developing nations are heavily investing in infrastructure, driving more demand. Industries like textiles and agriculture also contribute to growth by using aniline-based products.

Opportunities

Emerging markets in Asia and Latin America provide space for expansion. Cleaner production techniques, such as green or bio-based aniline, are gaining interest. Diversification into high-value segments like medical and specialty chemicals is another promising path. Strengthening local supply chains can reduce reliance on imports and lower costs. Innovation in eco-friendly derivatives will likely attract sustainable-focused industries.

Restraints

Strict safety and environmental rules add to production costs and complexity. Prices for raw materials like benzene can be unpredictable, affecting profit margins. The industry faces strong competition, especially in regions with high capacity. Health risks associated with aniline handling may restrict its use and increase regulatory pressure.

Trends

Green chemistry is making its way into aniline production, with companies exploring sustainable alternatives. Production systems are becoming more automated and energy-efficient. Firms are focused on reducing emissions and meeting stricter environmental standards. More companies are integrating upstream processes like MDI manufacturing. There's growing attention on specialized applications in health and textile chemicals.

Market Key Players:

- BASF Corporation

- BONDALTI

- Borsodchem Mchz

- Covestro AG

- Dow

- GNFC

- Huntsman International LLC

- Jilin Connell Chemical Industry Co., Ltd.

- Mitsubishi Chemical

- Mitsui Chemical

- Petrochina Co. Ltd.

- Sabic

- SP Chemicals Holdings Ltd.

- Sumika Bayer Urethane Co., Ltd.

- Sumitomo Chemical Co. Ltd.

- The Dow Chemical Company

- Wanhua Chemical Group Co. Ltd.

Conclusion:

The aniline market is on a positive path, supported by strong demand from industries like construction, automotive, and furniture. With its core use in MDI production, which drives polyurethane foam manufacturing, aniline remains a critical chemical. Asia-Pacific continues to dominate the market due to its rapid industrial growth and infrastructure expansion.

Even though the market faces hurdles such as regulatory challenges and price swings in raw materials, innovation and sustainability are paving the way forward. Cleaner production methods, along with growing use in high-value sectors, are unlocking new opportunities. The shift toward green chemistry and advanced production technologies is expected to transform the market over the next decade. As companies adapt to global changes and invest in smarter, more efficient systems, the aniline market is well-positioned for steady and long-term growth.

Comments