In the fast-paced world of finance, staying ahead of market trends and predicting stock movements is a constant challenge. As technology continues to evolve, the integration of artificial intelligence (AI) has emerged as a game-changer in stock prediction, particularly in the realm of cryptocurrency trading. One company leading the charge in this domain is yRobot LLC, harnessing AI for crypto chart analysis ai with remarkable success.

The volatile nature of cryptocurrency markets makes them an ideal candidate for AI-driven analysis. Traditional methods of stock prediction often struggle to keep up with the rapid fluctuations and complex patterns inherent in crypto trading. However, AI excels in processing vast amounts of data and identifying subtle trends that may elude human analysts.

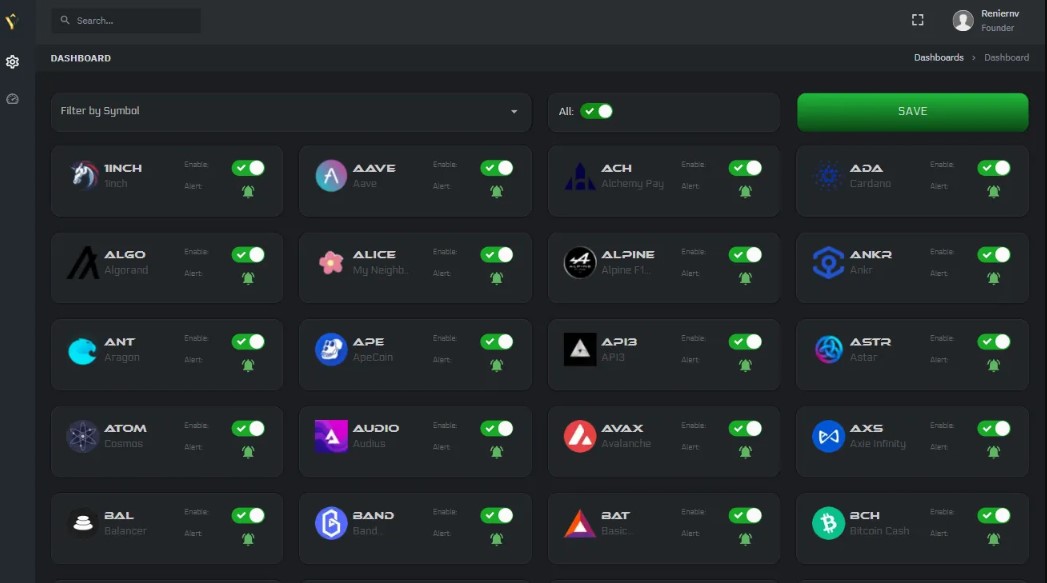

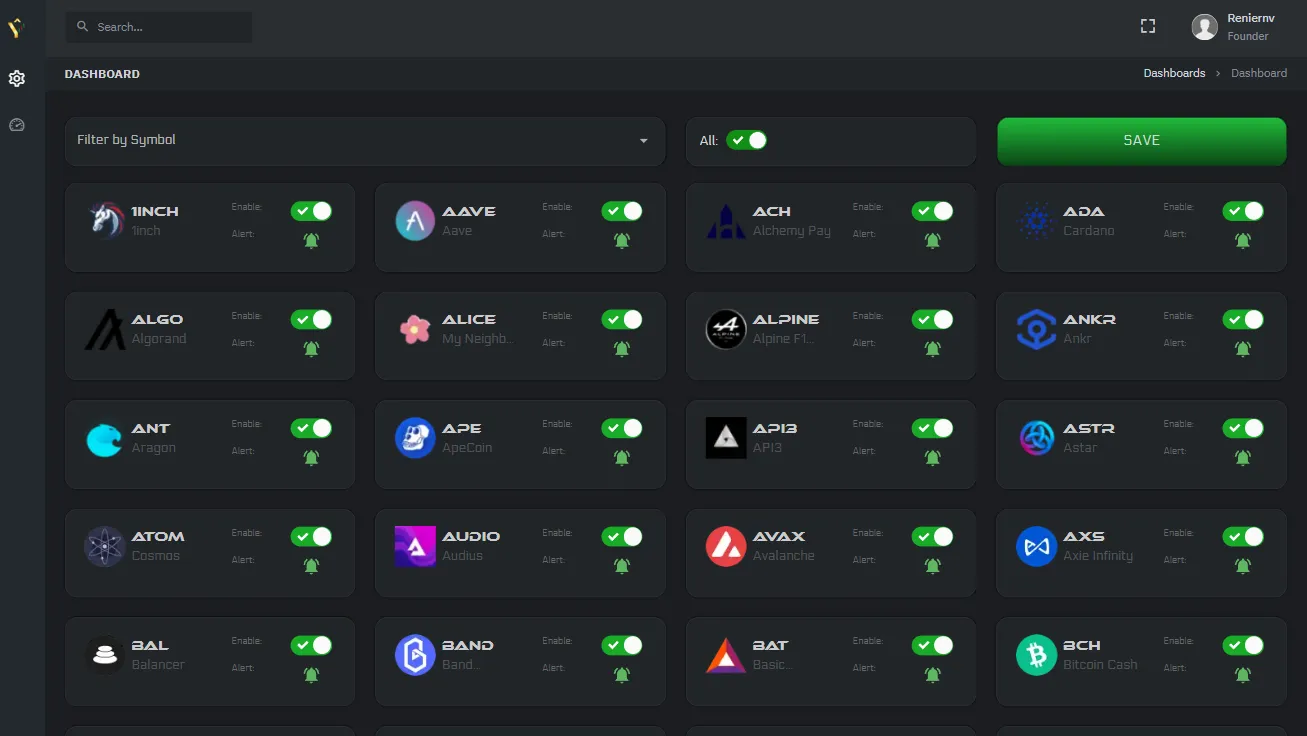

yRobot LLC has leveraged AI to develop sophisticated algorithms capable of analyzing historical price data, market sentiment, trading volumes, and a myriad of other factors that influence cryptocurrency prices. By employing machine learning techniques, their system can continuously refine its predictions based on real-time market data, adapting to changing market conditions and improving its accuracy over time.

One of the key advantages of AI-powered stock prediction is its ability to uncover patterns and correlations that may not be immediately apparent to human analysts. By processing data from multiple sources simultaneously, AI can identify complex relationships between different variables and use them to generate more reliable forecasts.

Moreover, AI algorithms are not susceptible to human biases or emotions, which can often cloud judgment in stock trading. By relying on data-driven analysis rather than gut instinct, AI systems can make more objective and rational decisions, minimizing the risk of costly errors.

The implications of AI-driven stock prediction extend far beyond individual traders. Institutional investors, hedge funds, and financial institutions are increasingly turning to AI technologies to gain a competitive edge in the market. By harnessing the power of AI, these entities can make more informed investment decisions, optimize their trading strategies, and mitigate the inherent risks associated with stock trading.

However, it is important to acknowledge that AI is not infallible, and there are limitations to its predictive capabilities. Market dynamics are influenced by a wide range of factors, including geopolitical events, regulatory changes, and macroeconomic trends, which can be difficult to quantify and incorporate into AI models.

Furthermore, the rapid evolution of technology means that AI algorithms must constantly adapt to new market conditions and emerging trends. Continuous research and development are essential to ensure that AI systems remain effective and relevant in an ever-changing landscape.

Despite these challenges, the potential of AI for stock prediction is undeniable. As technology continues to advance, we can expect AI-powered analysis to play an increasingly prominent role in shaping the future of finance. Companies like yRobot LLC are at the forefront of this revolution, harnessing the power of AI to unlock new insights and opportunities in the world of cryptocurrency trading.

conclusion:-

AI has emerged as a powerful tool for stock prediction, offering unparalleled insights and capabilities in an increasingly complex and dynamic market environment. By leveraging AI-driven analysis, traders and investors can gain a competitive edge, optimize their investment strategies, and navigate the turbulent waters of cryptocurrency trading with greater confidence and precision.

Comments