Indian Fertilizer Market 2025-2033

According to IMARC Group's report titled "Indian Fertilizer Market Report by Product Type (Chemical Fertilizers, Biofertilizers), Segment (Complex Fertilizers, DAP, MOP, Urea, SSP, and Others), Formulation (Liquid, Dry), Application (Farming, Gardening), and Region 2025-2033", the report presents a thorough review featuring the market share, growth, share, trends, and research of the industry.

How Big is the Indian Fertilizer Industry?

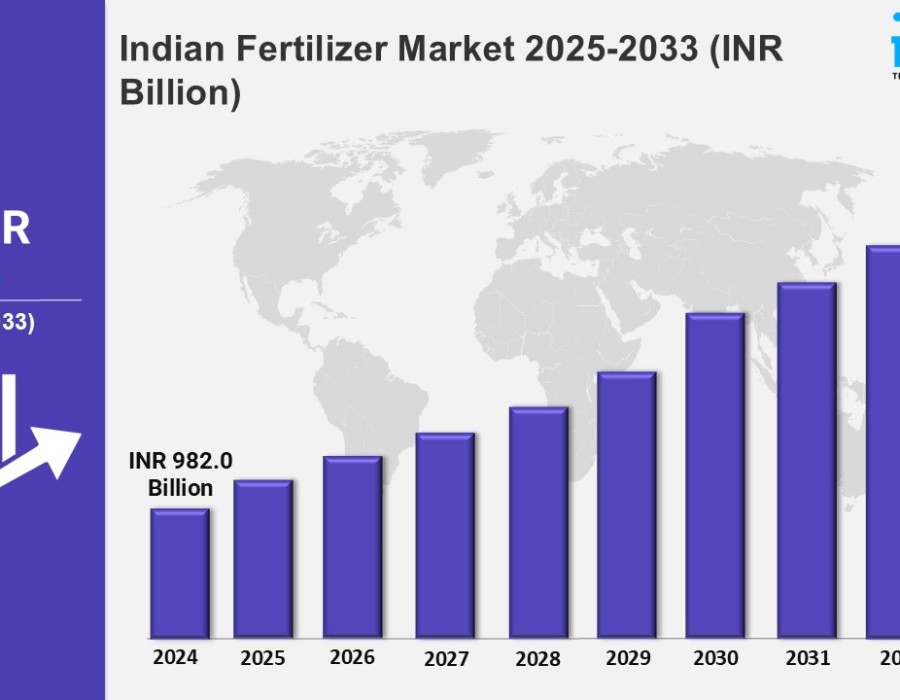

The Indian fertilizer market size was valued INR 982.0 Billion in 2024. By 2033, this figure is projected to reach around INR 1,401.0 Billion, with a compound annual growth rate (CAGR) of 4% over the forecast period (2025-2033).

Indian Fertilizer Market Trends:

The Indian fertilizer market is seeing changing trends because of a combination of technology, policies from the government, and new agricultural practices. There is an increasing focus on sustainable farming and this is driving a demand for organic and bio-fertilizers and a reduction in chemical fertilizers. Additionally, the rising interest in precision farming techniques using digital tools will allow fertilizer to be used more effectively to increase crops, while also being mindful of the environment. The government programs for subsidies, like the Nutrient-Based Subsidy (NBS) program has continued to play an important role in stabilizing cost and making sure purchased fertilizer is affordable for farmers.

The interest in nano-fertilizers and targeted nutrient mixtures is also growing, offering benefits for the environment and increasing efficiency for the crops. Participation from the private sector is also growing as companies are developing new innovative products and applications, for many unique crop requirements. The significance of allowing India's self-sufficiency in urea production and infrastructure growth of domestic manufacturing is also affecting fertilizer product flow in the market. All of this is part of a general trend toward better managing the balanced nutrients needed to deliver long-term productivity in agriculture.

Get Free Sample Report: https://www.imarcgroup.com/indian-fertilizer-market/requestsample

Indian Fertilizer Market Scope and Growth Analysis:

The Indian fertilizer market has massive potential for growth owing to the enormous agricultural sector, boasting one of the largest arable land bases in the world with fast-growing demand for food. Given the inevitable increasing demand for food and consequent fertilizer consumption due to schemes such as the PM-KISAN scheme in India the growth will be steady as long as there are government initiatives such as the PM-KISAN scheme. Enhancing soil fertility with micronutrient-enriched fertilizers is also an emerging area in the market creating opportunities for market participants. The bio-fertilizer segment is growing rapidly due to increasing adoption of organic farming and farmer and consumer awareness of environmental issues. Increased penetration of rural retail distribution networks for fertilizer is also improving access to fertilizers for farmers.

Lastly, the emergence of agri-tech startup collaboration with fertilizer companies in order to provide farmers with data-driven agricultural methods and solutions of nutrient management shows others in the market are innovating too. The emphasis on sustainability in agriculture is also growing globally and it already seems to be part of the ethos in India. The potential for strong exports of fertilizer is also there for the Indian market, coupled with the fact India is a supplier of raw materials. As agricultural technology is promoted and is attracting investment in research and development, product efficacy and sustainability in the Indian market will be improved, promoting and supporting sustainable growth. This list of factors is contributing to a positive outlook of the Indian fertilizer market, likely as a result of it being a strong agri business in India and an essential part of the Indian agrarian economy.

Indian Fertilizer Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Indian fertilizer market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Breakup by Product Type:

- Chemical Fertilizers

- Biofertilizers

Chemical fertilizers represent the most popular product type

Breakup by Segment:

- Complex Fertilizers

- DAP

- MOP

- Urea

- SSP

- Others

DAP holds the largest share in the market

Breakup by Formulation:

- Liquid

- Dry

Dry fertilizers account for the largest market share

Breakup by Application:

- Farming

- Grains and Cereals

- Oilseeds

- Fruits and Vegetables

- Others

- Gardening

Farming holds the largest share of the market

Breakup by Region:

- East India

- North India

- South India

- West India

North India exhibits a clear dominance in the market

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=1044&flag=C

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Comments