In the ever-expanding universe of cryptocurrencies, digital asset exchanges serve as the backbone of trading activities, facilitating the buying, selling, and exchanging of various crypto assets. With the continuous growth of the crypto market and increasing demand for trading solutions, businesses and entrepreneurs are seeking efficient and customizable avenues to establish their presence in this thriving industry. Enter white label digital asset exchanges – a game-changer for those looking to enter the crypto trading sphere swiftly and seamlessly. In this article, we delve into the concept of white label digital asset exchange, their advantages, and how they offer a gateway to the world of crypto trading.

Understanding White Label Digital Asset Exchanges

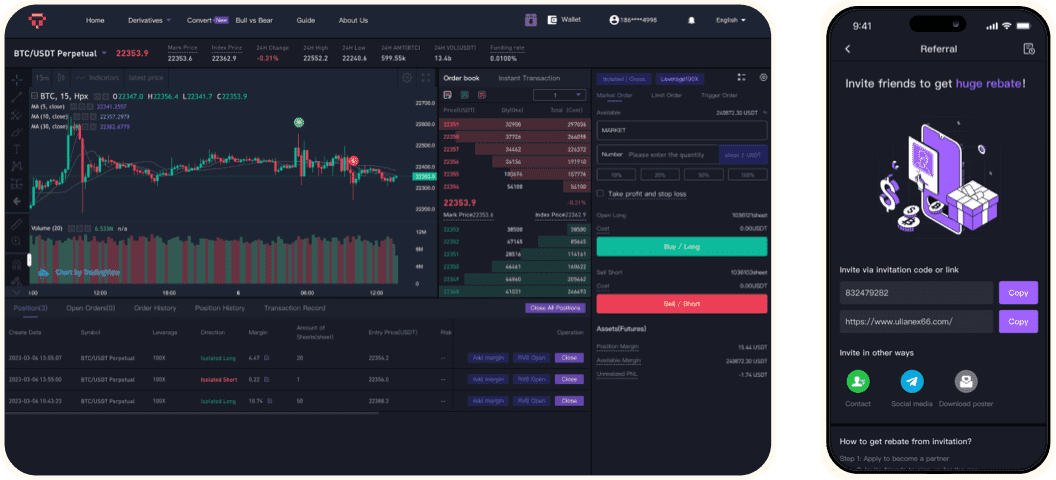

White label digital asset exchanges are pre-built trading platforms that can be licensed by third-party entities and customized to meet their specific branding and operational requirements. These platforms offer a turnkey solution for launching a fully functional exchange without the need for extensive development or technical expertise. White label exchanges come equipped with essential features such as order matching, liquidity management, wallet integration, and user authentication, allowing businesses to enter the cryptocurrency market quickly and cost-effectively.

Advantages of White Label Digital Asset Exchanges

- Speed to Market: One of the most significant advantages of white label digital asset exchanges is their ability to expedite the process of market entry. Instead of spending months or even years developing a trading platform from scratch, businesses can leverage existing infrastructure and deploy a fully operational exchange in a matter of weeks. This rapid deployment enables entrepreneurs to capitalize on market opportunities swiftly and stay ahead of the competition.

- Cost-Efficiency: Building a digital asset exchange independently can be a costly endeavor, requiring substantial investment in development, infrastructure, and security measures. White label solutions offer a cost-effective alternative, allowing businesses to access a fully functional platform at a fraction of the cost. Moreover, white label providers often offer flexible pricing models, enabling businesses to scale their operations without incurring prohibitive expenses.

- Customization Options: While white label digital asset exchange come pre-built with essential features and functionalities, they also offer a high degree of customization. Businesses can tailor the platform to reflect their brand identity, integrate additional features and services, and implement specific trading strategies. This flexibility ensures that the exchange meets the unique requirements of its target audience and enhances the overall user experience.

- Technical Support and Maintenance: White label providers typically offer ongoing technical support and maintenance services, ensuring that the exchange operates smoothly and remains up-to-date with the latest developments in the cryptocurrency space. This alleviates the burden of managing infrastructure and addressing technical issues, allowing businesses to focus on core activities such as customer acquisition and revenue generation.

Key Considerations for Choosing a White Label Provider

- Security: Security is paramount in the cryptocurrency industry, and businesses must ensure that their chosen white label provider adheres to industry best practices for safeguarding digital assets and sensitive information. This includes robust encryption, multi-factor authentication, cold storage solutions, and regular security audits.

- Regulatory Compliance: Compliance with regulatory requirements is another critical consideration, particularly as the cryptocurrency landscape becomes subject to increasing scrutiny from regulatory authorities worldwide. Businesses should choose a white label provider that supports compliance with relevant regulations and can adapt to changes in the regulatory environment.

- Scalability: As the demand for digital asset trading continues to grow, scalability becomes a crucial factor in the long-term success of an exchange platform. Businesses should select a white label provider that offers scalable infrastructure and can accommodate future growth without sacrificing performance or reliability.

- User Experience: A seamless and intuitive user experience is essential for attracting and retaining traders on a digital asset exchange. Businesses should prioritize white label providers that offer a user-friendly interface, responsive design, and comprehensive trading tools to enhance the overall trading experience.

Conclusion

White label digital asset exchanges offer a compelling opportunity for entrepreneurs and businesses looking to enter the cryptocurrency market or expand their existing offerings. By leveraging ready-made platforms that can be customized to their specific needs, businesses can expedite the process of launching a fully operational exchange and focus their resources on driving growth and innovation. However, careful consideration should be given to factors such as security, regulatory compliance, scalability, and user experience when choosing a white label provider. With the right partner and strategic approach, businesses can unlock the full potential of white label digital asset exchanges and capitalize on the vast opportunities presented by the dynamic cryptocurrency market.

Comments