Small firms must pay extra attention to their financial problems, as most fail due to a lack of funds to maintain production, pay employees, and cover marketing costs. Small business owners don’t need to be financial gurus to be successful entrepreneurs;

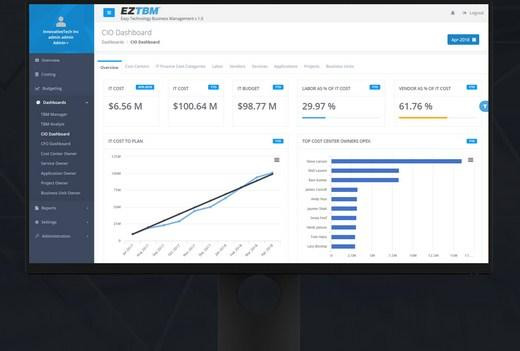

IT Financial Management software can guide their financial decisions and processes, allowing them to understand their financial situation better and make the best decisions for their company’s future.

What are the roles and responsibilities of financial management?

Financial management means “creating strategy, organizing, controlling, and holding the firm’s financial activities, such as purchasing and utilizing cash.”

Financial management plays a vital role in a company’s long-term success.

Therefore, taking the assistance of Financial management software makes it easier and more streamlined for organizations to manage their financial aspects, such as accounts payable, accounts receivable, payroll, etc.

The most significant advantages of financial management are

1. Lessened errors

One of the last places you want to make a mistake is your finances. Financial errors, like tax problems, and payroll errors, may be devastating to a company, especially for smaller or newer businesses. Financial management software aids in automating aspects of the economic process, resulting in significant reductions in errors. It allows organizations to plan better their daily, weekly, monthly, and yearly operations and optimize their cash flow. The software can arrange records for improved budgeting, planning, and forecasting and help categorize spending management and decrease financial errors. It lowers the risk of an incorrect audit and reduces business liabilities.

2. The ability to track progress:

It is very critical for small enterprises. Financial management software solutions provide insight into its growth across markets and products as a company grows and ages. Leadership and finance professionals can leverage built-in analytics and reporting in good financial management software to measure change.

3. An increase in compliance

Tax regulations and accounting standards are subject to change; financial management software can help you keep track of these changes and avoid costly errors caused by revisions. Financial management software can update automatically, allowing organizations to adhere to all national and international accounting requirements without missing essential updates.

Businesses will be able to observe how changes will affect their organization right away and be legally compliant with finance rules. One of the advantages of financial management software is that it allows small businesses to be more flexible and efficient in their financial transactions while growing.

4. Financial and data transparency

Financial management software lets you see how all departments interact to affect your overall financial health. It reduces guesswork and estimates by providing precise facts to financial leaders, allowing them to understand corporate operations better and minimize economic complexity.

It also aids in the reduction of fraud. There is a reduced possibility of fraud since financial management software helps provide greater openness and more accurate spending reporting. Financial management software help businesses avoid failures, stealing, and mismanagement of assets.

5. Increased efficiency

Because small firms frequently have fewer resources – such as money, people, and time – one of the most significant advantages of IT Financial Management Solutions software is its ability to increase efficiencies. Finance departments can make decisions and act faster with the help of business accounting software. Finance departments can make decisions and work more quickly with fewer manual processes and fewer errors.

Take the assistance of modern software like ITBMO as they can help you make smarter IT decisions.

Comments