One person on Reddit said they watched Netflix when taking an academic survey. Another person said they chose to do the dishes halfway through a survey over a $10 gift coupon that was promised at the end. Pretty sure most of us feel that way?

As part of our efforts to understand this better, we interviewed a group of marketing experts and customers independently.

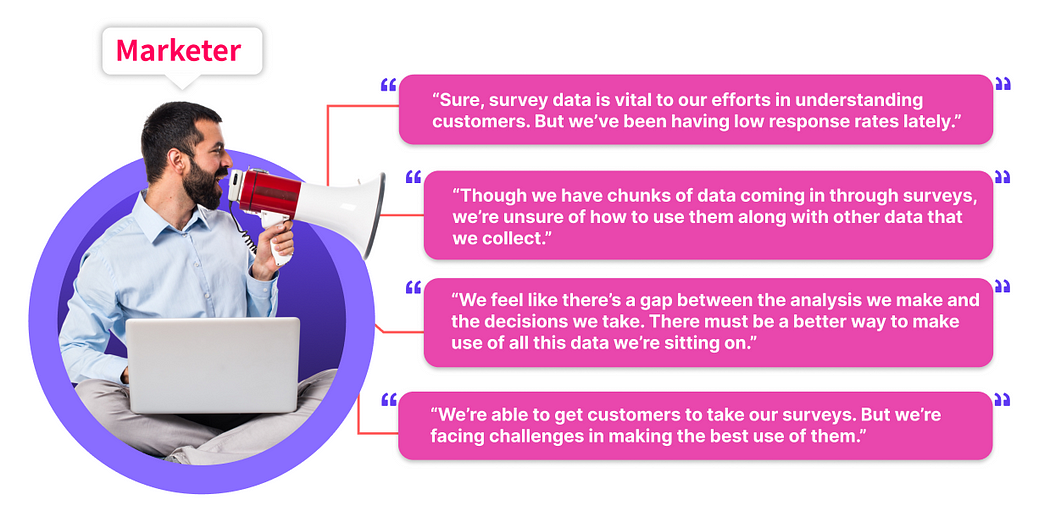

Here’s what the marketers told us:

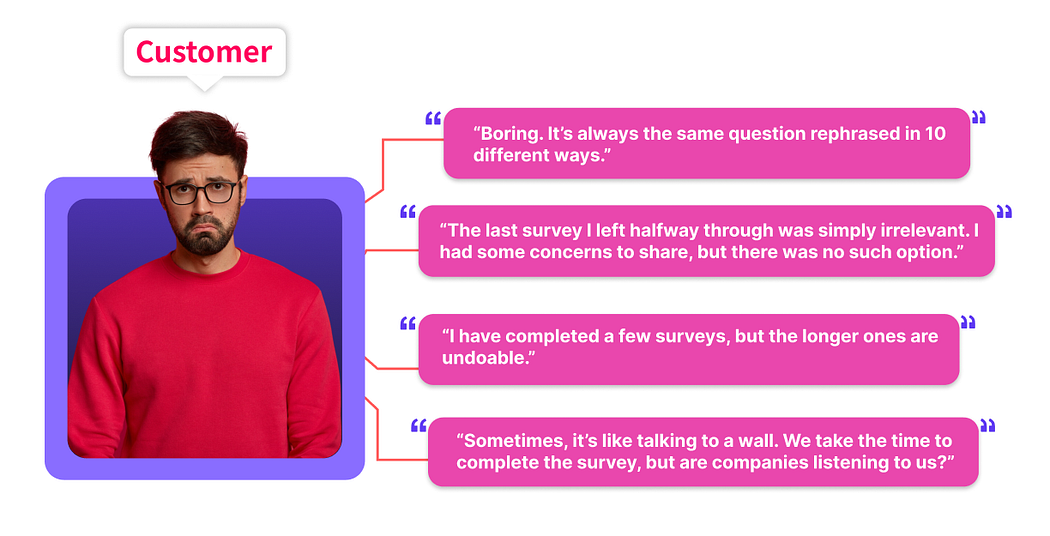

We’re sure a lot of marketers resonate with the above concerns. And customers’ opinions of surveys shouldn’t appear surprising either:

- Gap 1: Between the customers and marketers, primarily in marketers’ ability to persuade them to complete surveys.

- Gap 2: Between the marketers and the survey data collected, there is a lack of a strategy for making the best use of it.

We’re here to bridge all the gaps, one after another.

Bridging gap 1: Converse. Don’t interrogate.

Marketers often swear by surveys as a sure-shot way of understanding customer behavior. And they’re not wrong. Surveys are often good indicators of a customer’s choices and preferences, both at an individual and collective scale. For example, an analysis of an online bookstore’s survey data may reveal that customer A loves reading hard-boiled fiction, customer B likes crime fiction set during the 90s, and so on. It offers a microscopic view of the customer’s likes, dislikes, choices, and preferences. And when extrapolated, it may show a growing interest in crime fiction, a collective preference. In a similar manner, periodic surveys are a great way for marketers to look at the general shift in the trend and adapt to meet those. They’re also useful in gathering honest “plainspoken” feedback from customers. And this often signals what needs to change.

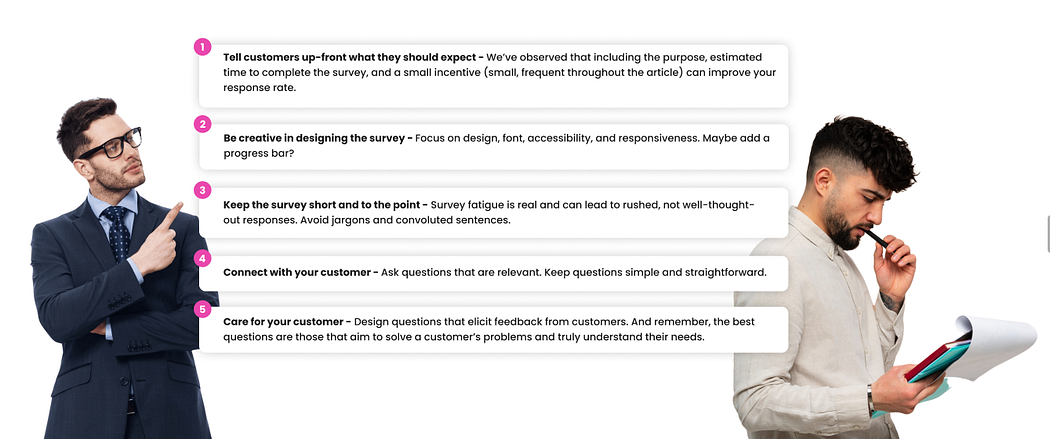

Attention, marketers! The only way to get customers to complete surveys is to:

Let’s start with an example to understand this better:

“Your Choice” is a retail brand planning to invest resources into better understanding its customers. They plan to collect survey data over a period from customers across different segments. After careful consideration, they chose Typeform to design their surveys. Often chosen by marketers for its minimalist and aesthetic UI and AI-powered (and fully customizable) survey-maker tool, Typeform quickly became our go-to tool too.

The data types collected from surveys are both quantitative and qualitative. Here are some examples for reference:

Survey: Introduction

Customer Satisfaction Survey (Quantitative)

There’s no better metric than a customer satisfaction survey to quantify customer sentiment and happiness. Combined with other sources of data, it can contribute to assessing and predicting customer churn! Here are some sample questions:

How satisfied are you with your recent visit to Your Choice?

Choose an item.

Did our products meet your expectations?

- ⬜ Yes

- ⬜ No

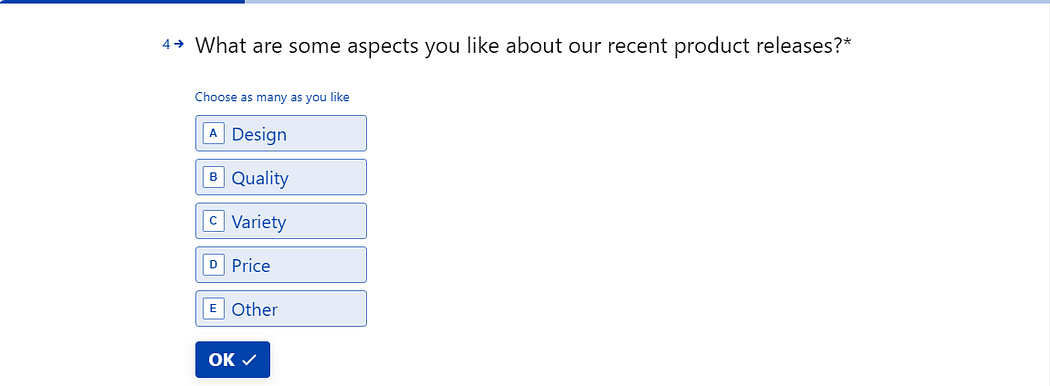

Product Feedback Survey (Qualitative)All well-designed surveys have a question or two related to product quality and experience. It’s a great way to understand a customer’s perception of the product and explore their likes, dislikes, and preferences. An in-depth analysis (text and sentiment analysis) of this data can help companies work towards the betterment of their products based on the feedback they receive. Some sample questions include:

What’s the one thing you love about our recent product releases?

- ⬜ Design

- ⬜ Quality

- ⬜ Variety

- ⬜ Price

- ⬜ Other (please specify)

Can you share any challenges or difficulties you’ve encountered while using our product?

- ⬜ Difficulty finding specific items or sizes in our physical or online store

- ⬜ Issues with the fit, sizing, or quality of clothing items

- ⬜ Limited availability of certain styles or collections.

- ⬜ Difficulties in exchanging or returning items.

- ⬜ Challenges in making payments either at the store or online

- ⬜ Impolite staff at the store

- ⬜ Other (please specify)

Net Promoter Score (NPS) Survey (Quantitative)

NPS is a good metric to assess customer loyalty and how likely they are to recommend the product to others. Over a period, it is also an accurate indicator of customer churn. Some sample questions: On a scale of 0 to 10, how likely are you to recommend Your Choice to a friend or colleague?On a scale of 0 to 10, how likely are you to recommend Your Choice to a friend or colleague?

Would you consider Your Choice as your go-to store for fashion needs?

- ⬜ Yes

- ⬜ No

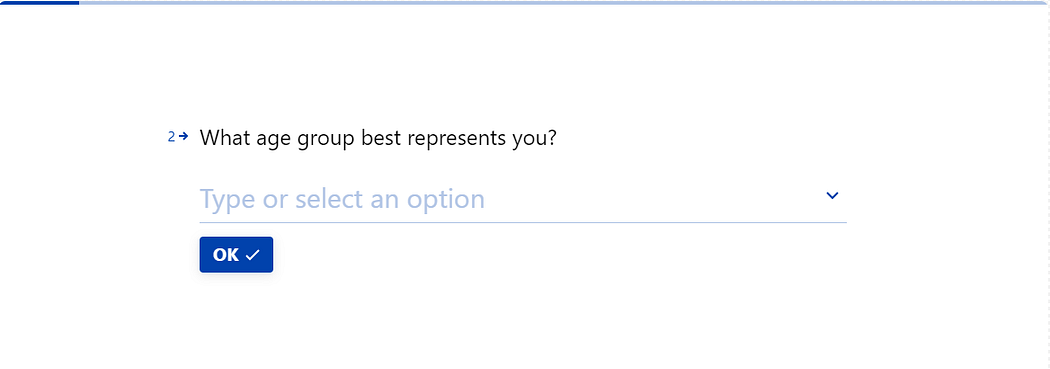

Demographic Survey (Qualitative)

Collecting demographic-related data is helpful in understanding your customer base better. Combined with other data sources, it can help anticipate future buying behavior across different segments. Sample questions include:

What age group best represents you?

18–24

Tell us a little about your fashion preferences and style.

- ⬜ Casual

- ⬜ Formal

- ⬜ Bohemian

- ⬜ Vintage

- ⬜ Other (please specify)

Online Shopping Behavior Survey (Quantitative)

This is vital to understanding a customer’s journey and how they engage with the brand. Combined with other data sources, they’re a major contributor to understanding customers on a personal level and tailoring marketing strategies for them. Some sample questions include:

Did you make any online purchases with us in the past month?

- ⬜ Yes

- ⬜ No

What features on our website do you find most helpful during your shopping?

- ⬜ Product recommendations

- ⬜ User reviews

- ⬜ Search functionality

- ⬜ Easy checkout process

- ⬜ Other (please specify)

Seasonal Fashion Trends Survey (Qualitative)

Incorporated with other data sources, data related to seasonal trends (often collected periodically) can be a great aid when designing marketing campaigns or promotional events–by giving detailed insights into product selection, changes in peoples’ choices, and demand. Some questions include:

What upcoming fashion trends or styles are you most excited about for the next season?

- ⬜ Bold colors and patterns

- ⬜ Sustainable and eco-friendly fashion

- ⬜ Minimalist and timeless designs

- ⬜ Athleisure and activewear

- ⬜ Vintage and retro-inspired fashion

Post-Purchase Survey (Qualitative)

When integrated with other sources, post-purchase survey data is vital in understanding “why” customers do what they do–especially in the context of churn, decreased or increased engagement, and purchase patterns.

Ideally, a good survey should also allow customers to provide additional feedback beyond what they have already answered in the survey.

Please share your feedback on the delivery experience for your recent purchase.

- ⬜ Satisfactory

- ⬜ Unsatisfactory

What was the best part of your last shopping experience with us?

- ⬜ Product Quality

- ⬜ Fast delivery

- ⬜ Customer support

- ⬜ Easy returns

- ⬜ Other (please specify)

Do you have any additional feedback that can help us improve?

And a last piece of advice before we move on to the next section: Design your surveys not to be bland questionnaires, but to be a medium of conversation with the customer.

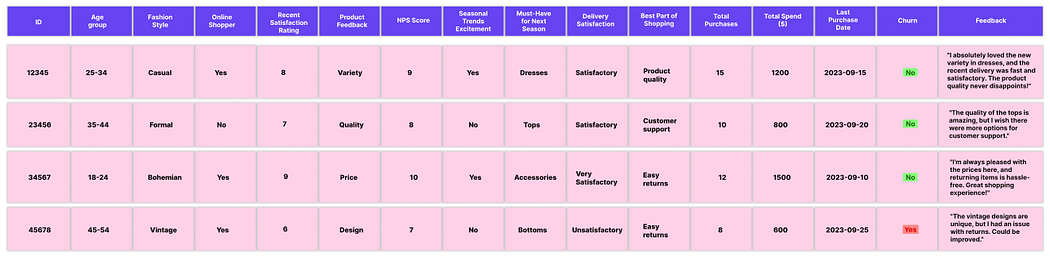

Making the best use of survey data

The table is a gold mine. It combines survey data with other data sources, such as total purchases, total spending, and last purchase data, to provide a unified view. Note that this is only a sample, and any real-world dataset would have over a million rows and 100s of additional columns. Let’s look at two scenarios now, where we learn how best to make use of survey data.

Analyzing survey data in isolation

As you must be already familiar with, conducting analysis on survey data in isolation can help you understand the customer sentiment in relation to the survey questions. Let’s say we’re analyzing the text box section. There are reviews, such as:

- “I had a fantastic shopping experience! The staff was friendly, and I found everything I needed.”

- “The quality of the products was okay. The product collection is meh.”

- “The checkout process was quick and hassle-free. I’ll definitely shop here again.”

- “Terrible service Staff is super rude too!”

Classifying this into positive, negative, and neutral can help the marketing team focus on customer pain points, improve aspects that fall under the neutral category, and continue to maintain areas that customers were impressed/satisfied with.

Going through the four comments, it’s clear that 50% of customers expressed positive sentiments, 25% expressed negative sentiments, and 25% had neutral sentiments. And over time, you would track the % change in people bucketed into each of these categories.

When analyzed in isolation, you can bet on:

- Quicker insights and faster action

- Identifying common issues

- Understanding customer sentiment

What you’ll miss out on:

- The context in which events occur

- Predicting future customer behavior

- Depth of customer insights

It’s best to start with analyzing survey data in isolation, and then work on combining it with other data sources to get richer customer insights.

Several marketers, however, find it challenging to combine/integrate data. Some concerns they shared with us include:

This can be easily addressed by using a one-click integration tool, so it becomes easier to gather fragmented data across multiple sources. While you’re deciding, make sure to look for a tool that helps set up automated data pipelines to collect, ingest, preprocess, and integrate data into a unified view/format.

Combining survey data with other data sources: Correlation

Combining the survey data with other data sources is absolutely necessary for getting a more holistic view of customer behavior. The table above is a merge of survey data along with multiple other data sources. Only through a unified view can you correlate survey responses with factors like demographics, purchase history, or online shopping behavior. Let’s say, for example, customers with high satisfaction ratings usually spend more or that people in a particular age group AND neutral satisfactory ratings may spend less. These correlations are useful in making more informed decisions. But they’re nowhere close to getting you to predicting churn, let alone understanding it, or helping you move from personalization to hyper-personalization. What next, then?

Combining survey data with other data sources: Predictive modeling

Only a tool with predictive modeling capabilities trained on historical and recent data (survey data + other quantitative and qualitative data) can anticipate future customer behavior! Taking the example of the table above, what we want to predict is whether a customer would churn. Multiple variables influence churn, of course. In large datasets, it becomes impossible to understand what factors might cause customers to leave. In such scenarios, a tool with predictive modeling capabilities can find patterns and connections that you didn’t even know existed! And these connections can help you learn “why” customers left. Now you have a list of customers who may churn, how likely they might churn, and the reason for churn. You have all the “drivers of churns”.

With the knowledge of factors that influence churn and the magnitude of their impact, you can re-visit your marketing strategies both at the customer level and overall. At the customer level, you can focus on having one-on-one interactions with at-risk customers to understand their concerns and provide swift resolutions. Overall, you can understand the most common issues that customers face and re-direct resources to resolve them. For instance, if the “un-friendly UI” is a common issue, you can focus on making the website more easy to navigate, accessible, and intuitive. Not only churn, but you can also get a list of high-value customers (those with the lowest churn scores) and focus on cross-selling or up-selling products to them.

From ticket management and marketing campaign optimization to product development, a tool with advanced analytics and predictive modeling capabilities can accelerate your marketing efforts multi-fold! We’ve addressed the gaps. Time for you, marketers, to wave your magic wand now!

CTA

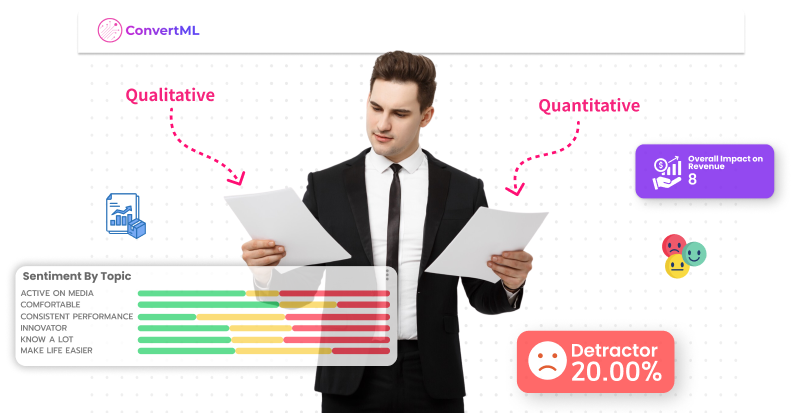

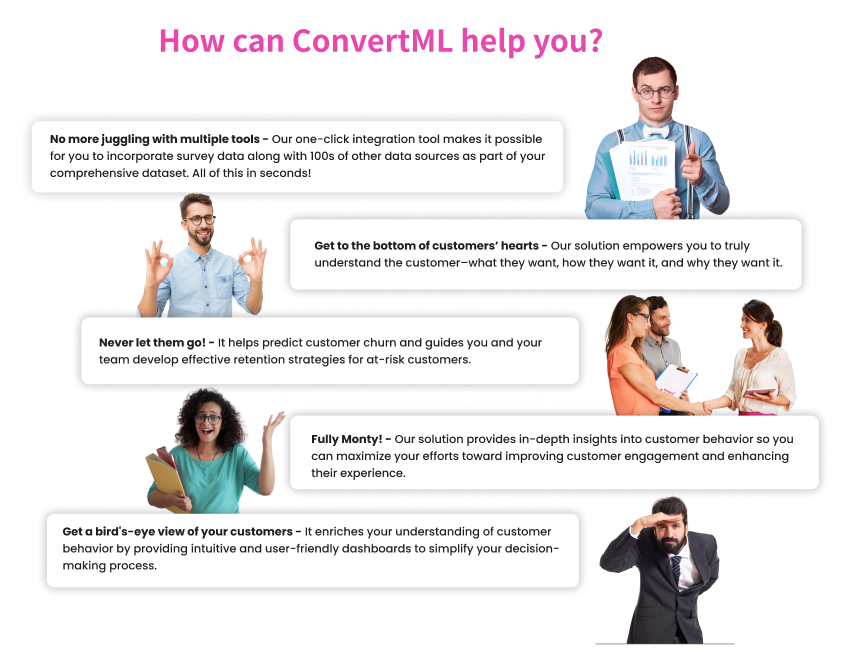

The key to bridging the gaps isn’t straightforward or simple. But with ConvertML, it’s possible.

Choose ConvertML and see your ROI grow 10X, all while staying GDPR and CCPA-compliant! Contact Us with us right away!

Comments