Stock selection for the next trading day can be classified into two parts:

A. During the current market hours before closing the market, i.e. BTST (Buy today and Sell Tomorrow) or STBT (Sell today and Buy Tomorrow).

B. Select the Stocks After market hours, based on EOD (End of Day) data and place either AFO (After Market Order) of next day once market opens.

In both the above cases, there are few data points mentioned below which might help you to take your decision.

For BTST & STBT:

- Last 45 minutes price action and volume change, this is something which can help for BTST (Buy today Sell tomorrow) or STBT (Sell today Buy Tomorrow). If the price action of last 45 minutes is considerably high compared to the entire day price action, with high in volume, then that stock has high probability to move up or down the next trading session.

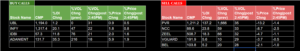

The below Screenshot is taken from our DTM Premium tool, where our Algo based system screens BTST and STBT probable stocks based on volume change percentage and price change percentage from

With EOD Data:

- The End of Day candlestick pattern which might help you to get the probable reversal signal. For long : A Hammer pattern at the bottom of any downtrend. For Short: A hanging man at the top of an uptrend. Even if there is no exact hammer or hanging man, but with some upper shadow or lower shadow respectively, that might help you to consider as probably reversal trend.

- Traded with High volume, if any stock is traded with high volume percentage compared to previous day and also compared to its average volume of last week, then that is an indication that the stock might move in the similar direction. The volume change should be considered with its respective price action, if price action is upward, then the same stock is good for long position and visa versa.

- Good Delivery at EOD, if the stock traded with high volume has high delivery percentage compared to its traded quantity then there is a high probability that the stock shall move up.

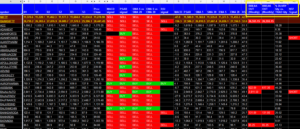

Below is the Screenshot of our DTM premium screener, which captures few important data points, i.e. weekly breakout, Monthly breakout, NR7 stocks and delivery %. These might help trader to select stocks for next trading session.

At the end of the day its all about probability, data points help us to predict market, but can’t assure anything, any aftermarket news can ruin all data analysis and change the direction all together.

Visit: algo trading india

Source: https://dailytrademantra.com/stock-selection-for-next-trading-day/

Comments