In forex trading, grasping the difference between lot size and position size is fundamental for effective risk management and trade execution. While these terms are often used interchangeably, they represent distinct concepts that influence how traders control exposure in the market. A lot size calculator helps clarify these differences by providing precise calculations tailored to individual trading parameters, enabling traders to make informed decisions and maintain consistent risk levels.

What Is Lot Size in Forex Trading?

Lot size refers to the standardized quantity of currency units that a trader buys or sells in a single forex transaction. The forex market uses specific lot sizes to facilitate trading, with the standard lot being 100,000 units of the base currency. Beyond the standard lot, there are smaller options such as mini lots (10,000 units), micro lots (1,000 units), and nano lots (100 units), which cater to traders with varying capital and risk appetites. Understanding lot size is crucial because it directly impacts the value of each pip movement and the overall potential profit or loss of a trade.

Defining Position Size and Its Relationship to Lot Size

Position size is the total number of units or contracts held in a trade, which may be expressed in terms of lots or directly in currency units. Essentially, position size reflects the actual exposure a trader has in the market. While lot size is a unit measurement, position size is the practical application of that measurement based on how many lots are traded. For example, if a trader buys 0.5 lots of EUR/USD, the position size is 50,000 units of the base currency. Position size is what ultimately determines the financial impact of price movements on the trader’s account.

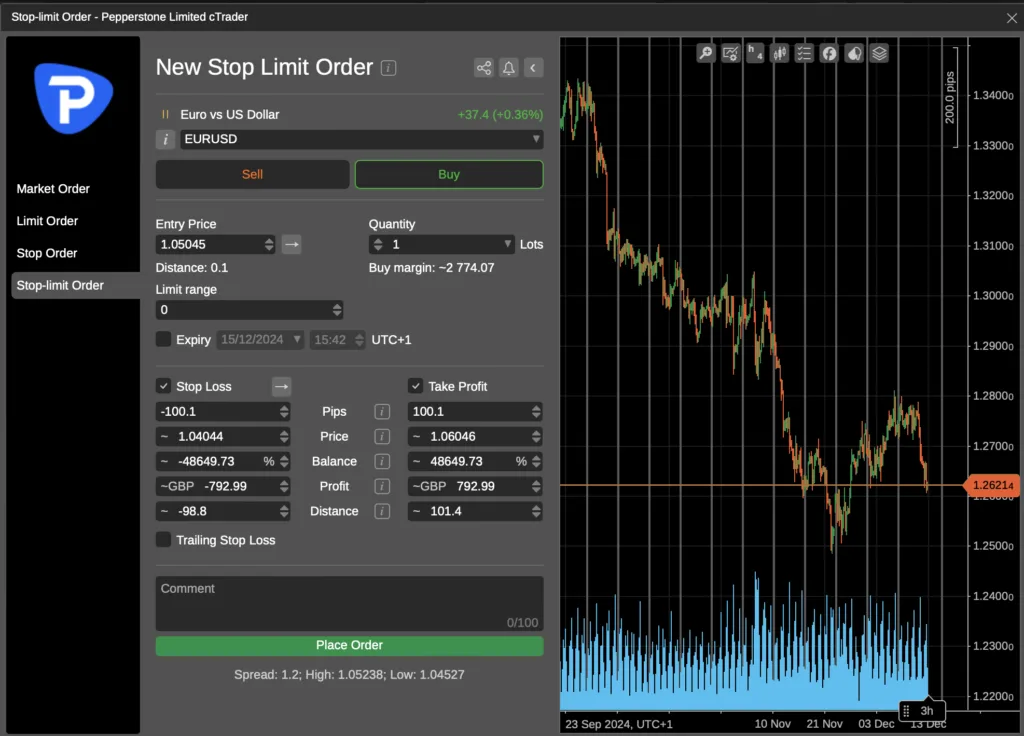

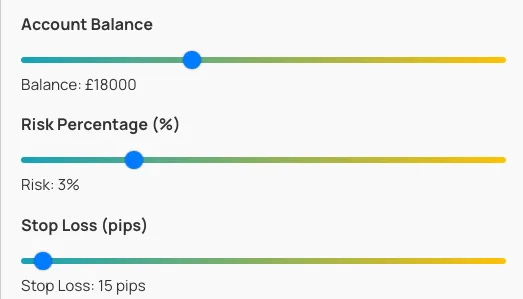

How a Lot Size Calculator Bridges the Gap

A lot size calculator is a vital tool that helps traders convert their desired risk level and stop-loss distance into an appropriate position size expressed in lots. By inputting key variables such as account balance, risk percentage, stop-loss in pips, and the currency pair, the calculator outputs the exact lot size to trade. This bridges the gap between theoretical lot sizes and practical position sizing, ensuring that traders do not risk more than they intend on any single trade. It simplifies complex calculations, making risk management accessible to traders at all levels.

Why Understanding the Difference Matters for Risk Management

Confusing lot size with position size can lead to miscalculations in risk exposure. Traders who focus solely on lot size without considering the actual position size relative to their account balance and stop-loss may inadvertently take on excessive risk. Properly understanding and calculating position size ensures that losses are kept within acceptable limits, preserving capital and enabling sustainable trading. The lot size calculator enforces this discipline by aligning trade sizes with predefined risk parameters.

Factors Influencing Lot Size and Position Size Decisions

Several factors affect how traders determine their lot and position sizes. These include the size of their trading account, risk tolerance, volatility of the currency pair, and the distance of the stop-loss. For instance, a trader with a smaller account or lower risk appetite will opt for smaller lot sizes to limit potential losses. Conversely, experienced traders with larger capital might trade bigger lots but still manage risk through precise position sizing. The lot size calculator accommodates these variables, providing tailored recommendations for each trade.

Practical Example of Calculating Lot Size and Position Size

Consider a trader with a $10,000 account willing to risk 2% on a trade with a 50-pip stop-loss on EUR/USD. Using the lot size calculator, the trader inputs these figures along with the pip value for the pair (approximately $10 per pip for a standard lot). The calculator determines that the appropriate lot size is 0.4 lots, which translates to a position size of 40,000 units. This ensures that if the stop-loss is hit, the loss will be limited to $200, or 2% of the account, demonstrating how lot size and position size work together to manage risk effectively.

Conclusion: Mastering Lot Size and Position Size for Successful Trading

Understanding the distinction between lot size and position size is essential for any forex trader aiming to control risk and trade systematically. A lot size calculator is an indispensable tool that simplifies this process by converting risk parameters into actionable trade sizes. By mastering these concepts, traders can protect their capital, maintain consistency, and improve their chances of long-term success in the dynamic forex market.

Comments