What is a crypto payment processor?

A crypto payment processor is a digital currency payment processing service that enables merchants to accept payments in various digital currencies, including Bitcoin, Ethereum, Lite coin, and others. The service works by converting the digital currency into the local fiat currency at the current exchange rate and then transferring the funds to the merchant’s bank account.

Crypto payment processors have become increasingly popular in recent years as more and more businesses start to accept digital currencies as payment. There are several benefits for both merchants and customers when using a crypto payment processor.

For merchants, crypto payment processors offer a fast and easy way to accept payments in digital currencies. They also eliminate the need for costly credit card processing fees. In addition, because crypto payment processors convert digital currency into fiat currency immediately, there is no risk of fluctuating prices.

For customers, paying with digital currency offers several advantages. Digital currencies are often cheaper to send than traditional methods such as wire transfers or credit cards. They can also be used to make purchases anonymously. In addition, customers may receive rewards for using certain digital currencies when paying with a crypto payment processor.

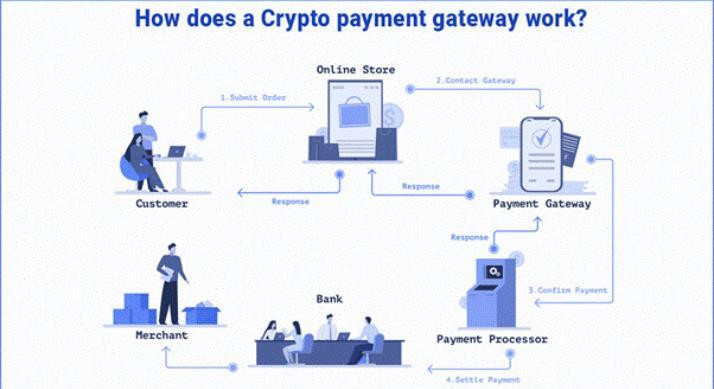

How do crypto payment processors work?

Crypto payment processors are online platforms that allow merchants to accept cryptocurrency payments from customers. These processors convert the cryptocurrency into fiat currency, which is then deposited into the merchant's bank account.

There are a few different ways that crypto payment processors work. The most popular method is through the use of an exchange platform, such as Coin base or Bit Pay. These platforms act as middlemen between the customer and the merchant, holding onto the cryptocurrency until the transaction is complete and then releasing the funds to the merchant in fiat currency.

Another way that crypto payment processors work is by directly integrating with a merchant's point-of-sale system. This allows customers to pay for goods and services using their cryptocurrency wallets without having to go through an exchange platform. Some popular point-of-sale systems that support this type of payment are Shopify and Woo Commerce.

Finally, some standalone crypto payment processors can be used by merchants. These platforms typically have built-in wallets and allow customers to pay directly with their cryptocurrency of choice. Some examples of standalone crypto payment processors include Coin Payments and Go Coin.

Pros and cons of using a crypto payment processor

There are a few pros and cons to using a crypto payment processor. Some pros include the fact that transactions are often faster and more secure than traditional methods. Additionally, crypto payment processors can help you avoid currency exchange fees. Some cons to using a crypto payment processor include the fact that they may not be available in all countries and that they can be volatile.

How to choose a crypto payment processor

When it comes to choosing a cryptocurrency payment processors, there are a few things you need to take into account. Here are some important factors to consider when selecting a crypto payment processor:

- Security: One of the most important things to look for in a payment processor is security. You want to make sure that your transactions are secure and that your personal information is safe. Make sure to check out the security features of any processors you're considering.

- Fees: Another important factor to consider is fees. Some processors charge higher fees than others. Make sure to compare the fees charged by different processors before making a decision.

- Supported currencies: If you're looking to accept payments in multiple cryptocurrencies, then you'll need to make sure that the processor you choose supports the currencies you want to accept. Not all processors support all currencies, so this is an important point to consider.

- Ease of use: You'll also want to consider how easy the processor is to use. Some processors have more user-friendly interfaces than others. If you're not comfortable using a particular processor, then it's probably not the right choice for you.

- Customer support: Finally, make sure to check out the customer support offered by the payment processor you're considering. You'll want to be able to contact customer support if you have any questions or problems with the service

Comments