Report Overview:

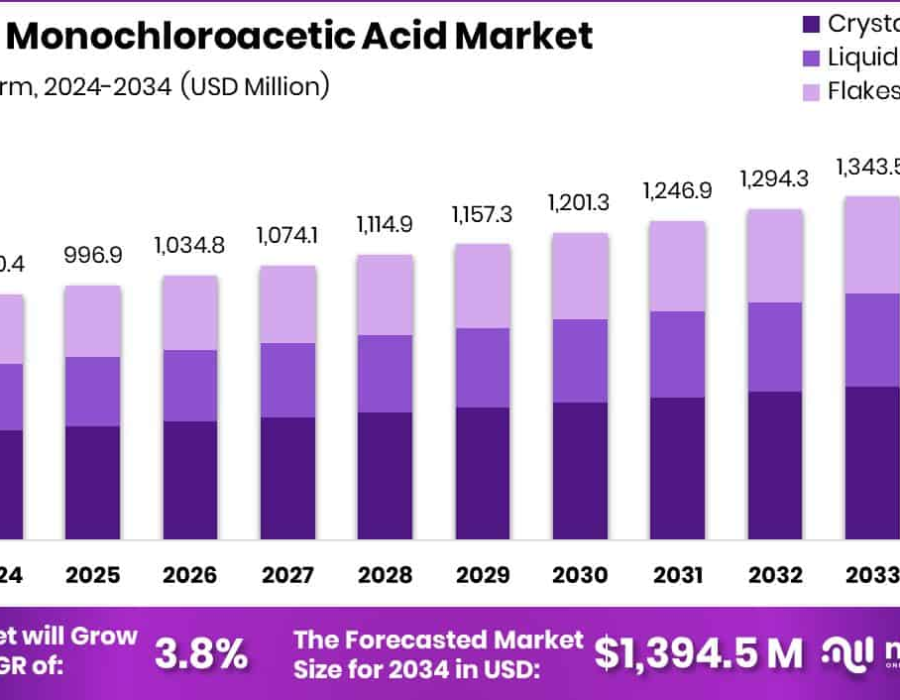

The global monochloroacetic acid market was valued at around USD 960.4 million in 2024 and is projected to reach USD 1,394.5 million by 2034, growing at a CAGR of 3.8%. Crystalline MCAA holds the largest share of 44.8% because of its purity and ease of handling. MCAA is widely used as a chemical intermediate in the production of carboxymethyl cellulose (CMC), agrochemicals, surfactants, and medicines. Asia-Pacific is the top consumer, especially countries like China and India, due to growing demand in agriculture, textiles, and personal care sectors. The rising use of MCAA in essential industries helps support steady market growth. However, unstable prices of raw materials and strict environmental policies are key challenges. Even with these obstacles, MCAA continues to be in demand as it plays a vital role in the manufacturing of daily-use and industrial products.

Monochloroacetic acid plays an important role in chemical manufacturing. Its crystalline form is widely preferred because it’s easy to store and has better stability. One of the main uses of MCAA is in making carboxymethyl cellulose (CMC), which is commonly found in food items, detergents, and cosmetic products. Nearly 34.7% of MCAA is used for CMC production, while 29.4% goes to agrochemicals. With global demand for crop protection and better agricultural productivity, the need for MCAA continues to grow. Still, the industry faces challenges such as rising feedstock costs and strict rules regarding environmental safety. These issues can affect profit margins and production levels. On the bright side, new uses of MCAA in personal care, surfactants, and specialty chemicals present good growth opportunities. As demand increases in emerging markets and companies focus more on sustainable solutions, MCAA remains essential for various industries.

Key Takeaways

- Market size will grow from USD 960.4 million in 2024 to USD 1,394.5 million by 2034, with a CAGR of 3.8%.

- Crystalline form dominates with 44.8% share due to better stability and ease of handling.

- Around 34.7% of MCAA is used for CMC production; agrochemicals account for 29.4%.

- Asia-Pacific is the largest market, generating over USD 408.1 million in 2024.

Download Exclusive Sample Of This Premium Report:

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-monochloroacetic-acid-market/free-sample/

Key Market Segments:

By Form

- Crystalline

- Liquid

- Flakes

By Application

- Carboxymethylcellulose (CMC)

- Agrochemicals

- Surfactants

- Thioglycolic Acid (TGA)

- Others

By End-use

- Agrochemicals

- Personal Care and Pharmaceuticals

- Geological Drillings

- Dyes and Detergents

- Others

DORT Analysis

Drivers

The increasing demand in agriculture and pharmaceuticals is a major driver for MCAA. Its use in CMC also supports growth in food and personal care products. An aging global population increases the need for medicines, where MCAA plays a key role. Growing textile and detergent industries, especially in Asia, are adding to the demand.

Opportunities

There is strong potential for MCAA in the production of eco-friendly agrochemicals and surfactants. Demand for glycine and specialty chemicals is increasing across multiple sectors. Emerging economies are opening up new markets for MCAA. Asia-Pacific offers low-cost manufacturing options. Companies can benefit from investing in backward integration to manage raw material costs better.

Restraints

Fluctuating prices of raw materials like acetic acid and chlorine can reduce profit margins. Environmental laws are becoming stricter, increasing operational costs. Global competition especially from Asian producers keeps market prices low. Delays in supply chains and regulatory approvals can also slow down market growth.

Trends

Crystalline MCAA is becoming more common due to its safety and easy handling. Asia-Pacific continues to grow as the key production and consumption hub. Cleaner production processes are being introduced. Governments are placing more focus on pollution control and emissions. New applications in personal care and chemical manufacturing are emerging.

Market Key Players:

- Akzo Nobel NV

- Alfa Aesar

- Anugrah In-Org (P) Limited

- CABB Group GmbH

- Denak Co. Ltd

- Henan HDF Chemical Company Ltd

- Merck KGaA

- Meridian Chem Bond Pvt. Ltd

- Niacet Corporation

- Nouryon

- PCC Group

- Puyang Tiancheng Chemical Co. Ltd

- Shandong Minji New Material Technology Co. Ltd

- TerraTech Chemicals (I) Pvt. Ltd

Conclusion:

The monochloroacetic acid market is showing steady growth, backed by solid demand in key industries like agriculture, food, pharmaceuticals, and textiles. With an expected market value of USD 1,394.5 million by 2034, MCAA continues to be a vital part of industrial chemistry. Its wide use in CMC, agrochemicals, and personal care items keeps it in strong demand.

The Asia-Pacific region plays a leading role, thanks to its growing manufacturing base and expanding end-use industries. However, challenges such as volatile raw material costs and increasing environmental regulations could impact the pace of growth. Companies that focus on cost control, innovation, and greener solutions will be better positioned for success. The outlook for MCAA remains positive, especially as it supports both traditional applications and new, sustainable technologies. Overall, the market is stable and evolving, with plenty of room for advancement through innovation and smart investment.

Comments