Market Overview:

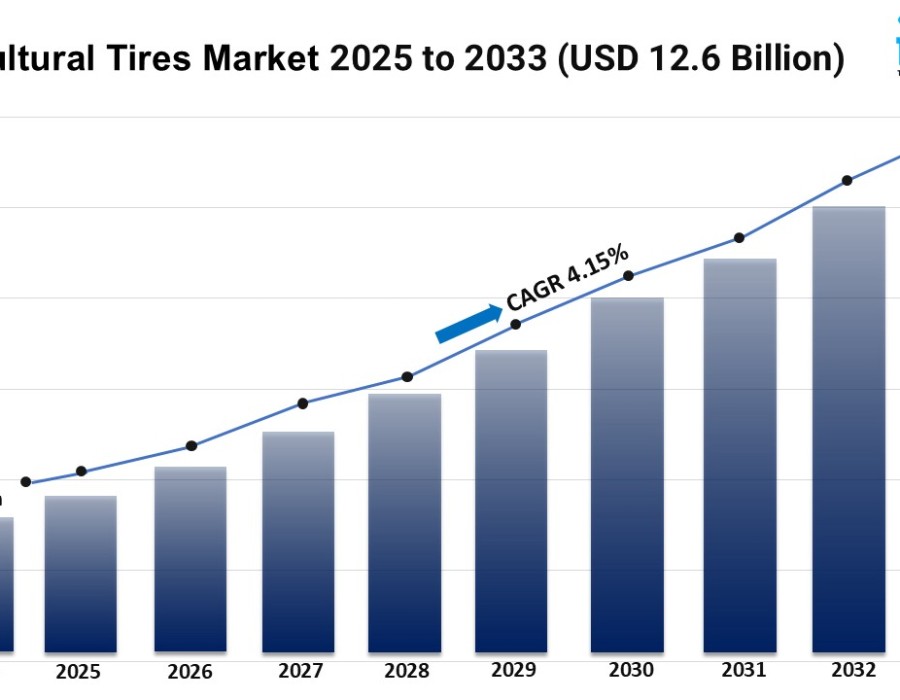

According to IMARC Group's latest research publication, "Agricultural Tires Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global agricultural tires market size reached USD 8.39 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Agricultural Tires Market

- AI-powered precision farming technologies enable real-time tire pressure monitoring and tread wear optimization, extending tire lifespan by 15-20% and reducing operational costs significantly.

- Smart tire sensors integrated with AI systems provide instant data analysis on soil conditions, allowing farmers to adjust tire pressure automatically for optimal traction and minimal soil compaction.

- Government-backed precision agriculture programs, valued at USD 9.3 Billion in 2024 with a 9.66% CAGR, drive demand for AI-equipped agricultural machinery requiring advanced tire technologies.

- Companies like John Deere's acquisition of Blue River Technology demonstrate AI integration in tractors, creating synergies with intelligent tire systems for enhanced field performance.

- AI-driven predictive maintenance platforms reduce tire-related equipment downtime by 25%, enabling farmers to maximize productivity during critical planting and harvesting seasons.

Download a sample PDF of this report: https://www.imarcgroup.com/agricultural-tires-market/requestsample

Key Trends in the Agricultural Tires Market

- Shift Toward Radial Tire Technology: Farmers increasingly adopt radial tires over bias tires for superior fuel efficiency, durability, and reduced soil compaction. While bias tires hold 57.6% market share, radial technology gains traction with innovations like Bridgestone's Regency Plus portfolio launched in March 2024.

- Rise of Precision Farming Equipment: The precision agriculture market's growth to USD 9.3 Billion with a 9.66% CAGR drives demand for specialized tires. Equipment manufacturers like International Tractors Limited launched electric and HAT tractors in October 2023, requiring advanced tire solutions.

- Low-Pressure and VF Tire Adoption: Variable Flexion (VF) and low-pressure tires gain popularity for minimizing soil compaction while carrying heavier loads. CEAT's SPRAYMAX tires carry 40% more load than standard radials, addressing large-scale farming needs.

- Aftermarket Segment Dominance: With 32.8% market share, the aftermarket thrives as farmers prioritize tire replacements and upgrades. Customized solutions for tractors, harvesters, and specialized machinery drive repeat purchases and brand loyalty.

- Sustainability and Eco-Friendly Solutions: Environmental consciousness pushes manufacturers toward sustainable tire production. Green tires with improved fuel efficiency and reduced emissions align with Europe's farming practices, where agriculture contributes USD 238.14 Billion to GDP.

Growth Factors in the Agricultural Tires Market

- Escalating Global Food Demand: FAO projects food production must rise 70% by 2050 to feed 9.1 Billion people, compelling farmers to adopt mechanized equipment. Over 360,000 tractors and combines sold in North America in 2021 reflect this mechanization trend.

- Declining Agricultural Labor Force: Labor shortages accelerate machinery adoption as India's agricultural workforce dropped from 158.2 Million in 2022 to 147.9 Million in 2023. The Indian Council of Food and Agriculture anticipates a 25.7% decline by 2050.

- Government Subsidies and Support Programs: India's Macro-Management Scheme provides 25% subsidies on tractors up to 35 PTO HP, while Canada's Agricultural Loans Act offers USD 500,000 loans. Canada invested USD 860,000 in agricultural innovation programs in March 2022.

- Technological Advancements in Tire Manufacturing: Apollo Tires' Virat range launched in May 2022 features "industry-best traction," while Trelleborg increased production by 20% at its South Carolina facility to meet demand for mobility-enhancing, soil-protective tires.

- Large-Scale Farming Operations Expansion: The U.S. Midwest's 127 million acres of corn and soybean crops require specialized tires for diverse terrains. Southern states' citrus farming on sandy soils necessitates stability-focused tire solutions.

Leading Companies Operating in the Global Agricultural Tires Industry:

- Apollo Tyres Limited

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- CEAT Ltd. (RPG Group)

- Continental AG

- JK Tyre & Industries Ltd.

- MRF Limited

- Specialty Tires of America Inc.

- Sumitomo Rubber Industries Ltd.

- TBC Corporation (Michelin)

- The Carlstar Group LLC

- Titan International Inc.

- Trelleborg AB

- Yokohama Off-Highway Tires America Inc. (Yokohama Rubber Company)

Agricultural Tires Market Report Segmentation:

Breakup By Product:

- Bias Tires

- Radial Tires

Bias tires account for the majority of shares at 57.6% on account of their robust construction, affordability, and superior load-carrying capacity for heavy-duty applications.

Breakup By Application:

- Tractors

- Harvesters

- Forestry

- Irrigation

- Trailers

- Others

Tractors dominate the market with 32.2% share due to their versatility in performing various farming tasks such as plowing, tilling, planting, and harvesting.

Breakup By Distribution:

- OEM

- Aftermarket

Aftermarket leads with 32.8% market share due to continuous tire replacement needs driven by wear and tear, maintenance requirements, and performance upgrades.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position with over 37.1% market share, driven by extensive agricultural lands, government subsidies for mechanization, and high adoption of advanced farming equipment.

Recent News and Developments in Agricultural Tires Market

- March 2024: Bridgestone Americas introduced an improved Regency Plus bias tire portfolio for Firestone Ag, offering cost-effective options for various applications including fronts, implements, utility, light construction, and lawn and garden equipment.

- October 2023: International Tractors Limited (ITL) launched three new series of Solis tractors, including an electric tractor that charges in 3-3.5 hours, N series for narrow farm use, C series with Stage-V engines, and H series with Hydrostatic Automatic Transmission.

- May 2022: Apollo Tires launched the Virat range of next-generation agricultural tires in India, featuring industry-best traction and unique design for high performance in agricultural and haulage vehicles.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Comments