Roots Analysis has done a detailed study on TCR-based Therapies, covering key aspects of the industry’s evolution and identifying potential future growth opportunities.

Key Market Insights

§ More than 100 industry and non-industry players are currently evaluating the potential of over 190 TCR-based immunotherapies for the treatment of various oncological and non-oncological disorders

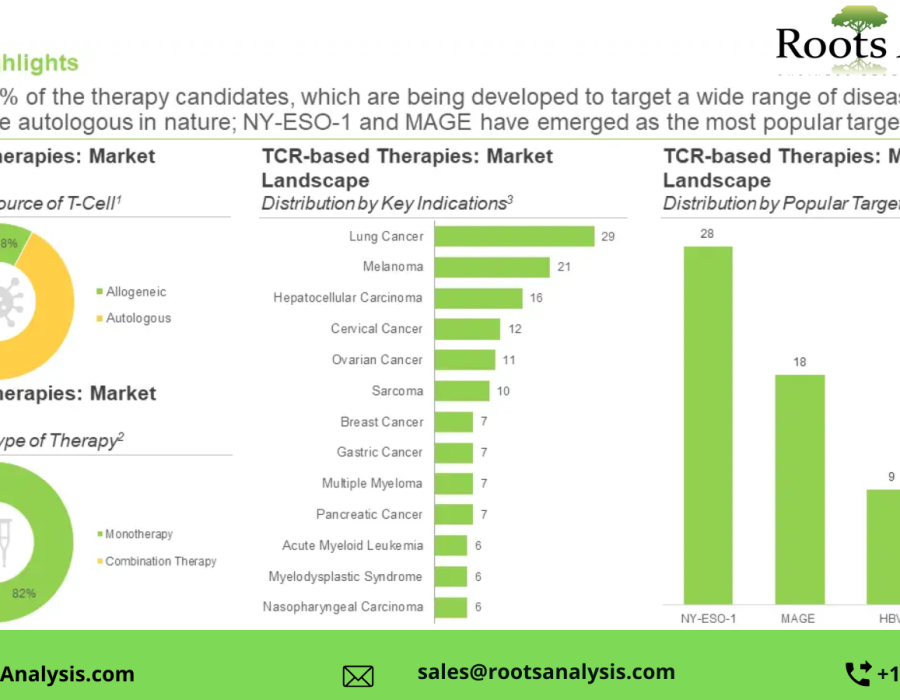

§ More than 90% of the therapy candidates, which are being developed to target a wide range of disease indications are autologous in nature; NY-ESO-1 and MAGE have emerged as the most popular target antigens

§ In the last 10 years, close to 110 clinical trials have been registered across different geographies for the evaluation of TCR-based therapies; extensive efforts are underway to improve the successive generations of such therapies

§ Close to 60 scientists from renowned universities are presently involved in the clinical development of TCR-based therapies; majority of these KOLs are primarily based in the US and China

§ Close to 200 players claim to have the required capabilities to manufacture different types of cell therapies; such firms also offer a wide range of services across different stages of product development

§ A growing interest in this field is reflected from the increase in the partnership activity, involving both international and indigenous stakeholders; majority of such deals were signed between players based in North America

§ Several investors, having realized the opportunity within this upcoming segment of T-cell immunotherapy, have invested USD 11 billion, across 140 instances, since 2007

§ More than 75 patents have been filed / granted by various stakeholders in order to protect the intellectual property generated within this field

§ With a growing focus on the development pipeline and encouraging clinical results, the TCR Therapy market is anticipated to witness an annualized growth rate of 51%, in the next decade

Table of Contents

1. PREFACE

1.1. Introduction

1.2. Key Market Insights

1.3. Scope of the Report

1.4. Research Methodology

1.5. Key Questions Answered

1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

3.1. Chapter Overview

3.2. Pillars of Cancer Therapy

3.3. Overview of Immunotherapies

3.4. Fundamentals of Cancer Immunotherapy

3.5. Classification of Cancer Immunotherapies

3.5.1. By Mechanism of Action

3.5.1.1. Active Immunotherapy

3.5.1.2. Passive Immunotherapy

3.5.2. By Type of Target

3.5.3. By Approach

3.5.3.1. Activation and Suppression Immunotherapy

3.5.4. By Product Class

3.5.4.1. Monoclonal Antibodies

3.5.4.2. Bispecific Antibodies

3.5.4.3. Cytokines

3.5.4.4. Oncolytic Virus Therapy

3.5.4.5. Therapeutic Cancer Vaccines

3.5.4.6. Cell-based Therapies

3.6. T-Cell Immunotherapies

3.6.1. Historical Evolution

3.6.2. Key Considerations for Developing T-Cell Immunotherapies

3.6.3. Strategies Employed for the Redirection of T-Cells

3.6.4. Manufacturing of Engineered T-Cells

3.6.5. T-Cell Transduction and Transfection Methods

3.6.5.1. Retroviral Vectors

3.6.5.2. Lentiviral Vectors

3.6.5.3. Non-viral Transfection Methods

3.7. T-Cell Receptor (TCR)-based Cell Therapy

3.7.1. Development History

3.7.2. Anatomical Layout of TCR

3.7.3. Development of TCR Therapy

3.7.4. Differences between CAR-T and TCR-based Therapies

3.8. Concluding Remarks

4. TCR-BASED THERAPIES: MARKET LANDSCAPE

4.1. Chapter Overview

4.2. TCR-based Therapies: Overall Market Landscape

4.2.1. Analysis by Type of Developer

4.2.2. Analysis by Phase of Development

4.2.3. Analysis by Therapeutic Area

4.2.4. Analysis by Phase of Development and Therapeutic Area

4.2.5. Analysis by Key Target Indication

4.2.6. Analysis by Key Target Antigen

4.2.7. Analysis by Source of T-Cells

4.2.8. Analysis by Route of Administration

4.2.9. Analysis by Phase of Development and Route of Administration

4.2.10. Analysis by Dosing Frequency

4.2.11. Analysis by Target Patient Segment

4.2.12. Analysis by Type of Therapy

4.2.13. Analysis by Phase of Development and Type of Therapy

4.2.14. Most Active Industry Players: Analysis by Number of TCR-based Therapies

4.2.15. Most Active Non-Industry Players: Analysis by Number of TCR-based Therapies

4.3. TCR-based Therapies: Overall Developer Landscape

4.3.1. Analysis by Year of Establishment

4.3.2. Analysis by Company Size

4.3.3. Analysis by Location of Headquarters

5. POPULAR TARGET ANTIGEN ANALYSIS

5.1. Chapter Overview

5.2. Competitive Analysis: Popular Target Antigens of TCR-based Therapies

5.2.1. Popular Targets Related to Hematological Malignancies

5.2.2. Popular Targets Related to Solid Tumors

6. CLINICAL TRIAL ANALYSIS

6.1. Chapter Overview

6.2. Scope and Methodology

6.3. TCR-based Therapies: Clinical Trial Analysis

6.3.1. Analysis by Trial Registration Year

6.3.2. Analysis by Trial Registration Year and Enrolled Patient Population

6.3.3. Analysis by Trial Status

6.3.4. Analysis by Trial Registration Year and Trial Status

6.3.5. Analysis by Trial Phase

6.3.6. Analysis of Enrolled Patient Population by Trial Phase

6.3.7. Analysis by Target Patient Segment

6.3.8. Analysis by Type of Sponsor / Collaborator

6.3.9. Analysis by Study Design

6.3.10. Most Active Industry Players: Analysis by Number of Registered Trials

6.3.11. Most Active Non-Industry Players: Analysis by Number of Registered Trials

6.3.12. Word Cloud Representation Analysis: Emerging Focus Areas

6.3.13. Analysis of Clinical Trials by Geography

6.3.14. Analysis of Enrolled Patient Population by Geography

7. KEY OPINION LEADERS

7.1. Chapter Overview

7.2. Assumptions and Key Parameters

7.3. Methodology

7.4. TCR-based Therapies: Key Opinion Leaders

7.4.1. Analysis by Type of Organization

7.4.2. Analysis by Affiliated Organization

7.4.3. Analysis by Qualification

7.4.4. Analysis by Geographical Location of KOLs

7.4.5. KOL Activeness versus KOL Strength

7.4.6. Most Prominent KOLs: Analysis by RA score

7.4.7. Most Prominent KOLs: Comparison of RA Score and Third-Party Score

8. TCR-BASED THERAPY PROFILES

8.1. Chapter Overview

8.2. Kimmtrak® / IMCgp100 / Tebentafusp (Immunocore)

8.2.1. Therapy Overview

8.2.2. Clinical Trial Information

8.2.3. Clinical Trial Endpoints

8.2.4. Clinical Trial Results

8.2.5. Estimated Sales Revenues

8.3. GSK3377794 / NY-ESO-1C259 T-cells / Letetresgene Autoleucel (GlaxoSmithKline)

8.4. ADP-A2M4 / Afamitresgene Autoleucel / Afami-cel (Adaptimmune Therapeutics)

8.5. JTCR016 (Juno Therapeutics)

8.6. TBI-1301 (Takara Bio)

8.7. MDG1011 (Medigene)

9. PARTNERSHIPS AND COLLABORATIONS

9.1. Chapter Overview

9.2. Partnership Models

9.3. TCR-based Therapies: Partnerships and Collaborations

9.3.1. Analysis by Year of Partnership

9.3.2. Analysis by Type of Partnership

9.3.3. Analysis by Year of Partnership and Type of Partnership

9.3.4. Analysis by Type of Partner

9.3.5. Most Popular Products: Analysis by Number of Partnerships

9.3.6. Most Active Industry Players: Analysis by Number of Partnerships

9.3.7. Most Active Non-Industry Players: Analysis by Number of Partnerships

9.3.8. Analysis by Geography

9.3.8.1. Intercontinental and Intracontinental Deals

9.3.8.2. International and Local Deals

10. FUNDING AND INVESTMENT ANALYSIS

10.1. Chapter Overview

10.2. Types of Funding

10.3. TCR-based Therapies: Funding and Investment Analysis

10.3.1. Analysis of Instances by Year

10.3.2. Analysis of Amount Invested by Year

10.3.3. Analysis by Type of Funding

10.3.4. Analysis by Type of Investor

10.3.5. Most Active Players: Analysis by Number of Instances

10.3.6. Most Active Investors: Analysis by Amount Invested

10.3.7. Analysis of Amount Invested by Geography

10.3.8. Most Active Investors: Analysis by Number of Funding Instances

11. PATENT ANALYSIS

11.1. Chapter Overview

11.2. Scope and Methodology

11.3. TCR-based Therapies: Patent Analysis

11.3.1. Analysis by Patent Publication Year

11.3.2. Analysis By Patent Application Year

11.3.3. Analysis by Geography

11.3.4. Analysis by Type of Player

11.3.5. Analysis by CPC Symbols

11.3.6. Analysis by Key Focus Area

11.3.7. Leading Player: Analysis by Number of Patents

11.3.8. TCR-based Therapies: Patent Benchmarking

11.3.9. Analysis By Patent Characteristics

11.3.10. TCR-based Cell Therapies: Patent Valuation

12. CASE STUDY: CELL THERAPY MANUFACTURING

12.1. Chapter Overview

12.2. Overview of Cell Therapy Manufacturing

12.3. Cell Therapy Manufacturing Models

12.3.1. Centralized Manufacturing Model

12.3.2. Decentralized Manufacturing Model

12.4. Scalability of Cell Therapy Manufacturing Processes

12.4.1. Scale-Up

12.4.2. Scale-Out

12.5. Types of Cell Therapy Manufacturers

12.6. Key Challenges Related to Manufacturing of Cell Therapies

12.7. Important Factors for Cell Therapy Manufacturing

12.7.1. Characterization

12.7.2. Cost of Goods

12.8. Automation of Cell Therapy Manufacturing Processes

12.9. Cell Therapy Manufacturing Supply Chain

12.10. Comparison of Player Having In-House Capabilities and Contract Manufacturers

12.11. Regulatory Landscape

12.12. Future Perspectives

13. COST PRICE ANALYSIS

13.1. Chapter Overview

13.2. Factors Contributing to the High Price of Cell / Gene Therapies

13.3. Pricing Models for T-Cell Immunotherapies

13.3.1. Based on Associated Costs

13.3.2. Based on Availability of Competing Products

13.3.3. Based on Patient Segment

13.3.4. Based on Opinions of Industry Experts

13.4. Reimbursement related Considerations for T-cell Immunotherapies

13.4.1. Case Study: The National Institute for Health and Care Excellence (NICE) Appraisal of CAR-T Therapies

14. MARKET FORECAST AND OPPORTUNITY ANALYSIS

14.1. Chapter Overview

14.2. Scope and Limitations

14.3. Key Assumptions and Forecast Methodology

14.4. Global TCR-based Therapies Market, 2022-2035

14.4.1. TCR-based Therapies Market: Analysis by Target Indication

14.4.2. TCR-based Therapies Market: Analysis by Target Antigen

14.4.3. TCR-based Therapies Market: Analysis by Key Players

14.4.4. TCR-based Therapies Market: Distribution by Geography

14.4.5. Product Wise Sales Forecast

14.4.5.1. Kimmtrak® (IMCgp100 / Tebentafusp) (Immunocore)

14.4.5.1.1. Sales Forecast (USD Million)

14.4.5.1.2. Net Present Value (USD Million)

14.4.5.1.3. Value Creation Analysis

14.4.5.2. GSK3377794 (GlaxoSmithKline)

14.4.5.3. YT-E001 (China Immunotech)

14.4.5.4. ADP-A2M4 / Afamitresgene Autoleucel / Afami-cel (Adaptimmune Therapeutics)

14.4.5.5. EBV-specific TCR-T cell with Anti-PD1 Aauto-secreted Element (TCRCure Biopharma)

14.4.5.6. NTLA-5001 (Intellia Therapeutics)

14.4.5.7. TBI-1301 (Takara Bio)

14.4.5.8. LMBP2-specific TCR-T (Xinqiao Hospital of Chongqing / TCR CURE Biopharma Technology)

14.4.5.9. FH-MCVA2TCR (TCRCure Biopharma)

15. PROMOTIONAL ANALYSIS

15.1. Chapter Overview

15.2. Channels Used for Promotional Campaigns

15.3. Kimmtrak: Promotional Analysis

15.3.1. Drug Overview

15.3.2. Product Website Analysis

15.3.2.1. Message for Healthcare Professionals

15.3.2.2. Message for Patients

15.3.2.3. Informative Downloads

15.3.3. Patient Support Services

16. COMPANY PROFILES

16.1. Chapter Overview

16.2. Adaptimmune Therapeutics

16.3. Alaunos Therapeutics

16.4. Company Profiles

16.5. Bristol Myers Squibb

16.6. Cellular Biomedicine Group

16.7. Gilead Sciences

16.8. Cellular Biomedicine Group

16.9. GlaxoSmithKline

16.10. Immatics

16.11. Immunocore

16.12. Lion TCR

16.13. Takara Bio

16.14. Zelluna immunotherapy

17. CONCLUDING REMARKS

18. EXECUTIVE INSIGHTS

18.1. Chapter Overview

18.2. Celyad

18.2.1. Interview Transcript: Vincent Brichard, Vice President, Immuno-Oncology

18.3. Kite Pharma

18.3.1. Interview Transcript: Adrian Bot, Vice President, Scientific Affairs

18.4. Lion TCR

18.4.1. Interview Transcript: Victor Lietao Li, Co-Founder and Chief Executive Officer

18.5. TxCell

18.5.1. Interview Transcript: Miguel Forte, Chief Operating Officer

19. APPENDIX 1: TABULATED DATA

20. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

To view more details on this report, click on the link:

https://www.rootsanalysis.com/reports/tcr-based-therapies-market.html

You may also be interested in the following titles:

Pharmaceutical Polymers / Medical Polymers Market

You may also like to learn what our experts are sharing in Roots educational series:

CAR-T Cell Therapies: Addressing Key Unmet Needs Across Various Oncological Indications

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415

+44 (122) 391 1091

Comments