The “Non-Viral Transfection Reagents and Systems Market (2nd Edition), 2023-2035” report features an extensive study of the current landscape and likely future potential of companies developing non-viral transfection reagents and systems

Key Inclusions

§ An executive summary of the insights captured during our research. It offers a high-level view on the current state of non-viral transfection reagents and systems market and its likely evolution in the mid-long term.

§ A general overview of non-viral transfection reagents and systems, highlighting details on transfection methods and its applications, such as advanced therapy medicinal product development, gene silencing, bioproduction of therapeutic protein and stem cell engineering. It also provides information on the different methods of transfection (viral and non-viral), types of viral vectors (AAV, adenoviral, lentiviral, retroviral and others), along with details on chemical methods (lipoplexes, polyplexes, lipoplexes and others) and physical methods (electroporation, gene gun, sonoporation, magnetofection and others) of transfection.

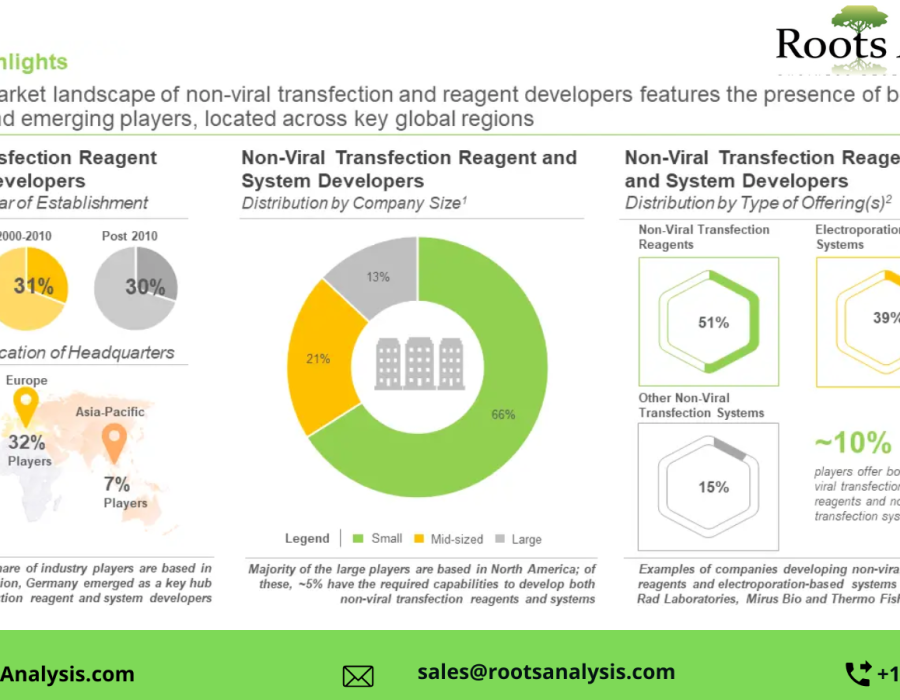

§ A detailed assessment of the overall market landscape of the companies developing non-viral transfection reagents, based on several relevant parameters, such as type of carrier used (lipid-based carrier, polymer-based carrier, protein-based carrier, nanotechnology-based carrier, calcium phosphate-based carrier and minicircle-based carrier), compatible cell type (human cell, monkey cell, murine cell and other cell), type of molecule delivered (DNA and RNA), and serum compatibility (serum free and serum compatibility). It also features information on the non-viral transfection reagent suppliers, highlighting the year of establishment, company size and location of headquarters.

§ A detailed assessment of the overall market landscape of the companies developing electroporation-based non-viral transfection systems. The relevant parameters used for the assessment include, compatible cell type (human mammalian cells and other mammalian cells) and type of molecule delivered (DNA and RNA). It also features information on the electroporation transfection systems suppliers, highlighting the year of establishment, company size and location of headquarters.

§ A detailed assessment of the overall market landscape of the companies developing other non-viral transfection systems. The relevant parameters used for the assessment include, compatible cell type (human mammalian cells and other mammalian cells) and type of molecule delivered (DNA and RNA). It also features information on the other non-viral transfection systems suppliers, highlighting the year of establishment, company size and location of headquarters.

§ An in-depth company competitiveness analysis of non-viral transfection reagent and system suppliers based in North America, Europe and Asia-Pacific. The analysis compares various suppliers based on supplier strength (in terms of years of experience and company size) and product portfolio strength (type of carrier used, compatible cell type, type of molecule delivered and serum compatibility).

§ A detailed technology competitiveness analysis of electroporation transfection systems and other non-viral transfection systems, taking into consideration the supplier strength (based on the year of establishment and company size of developer) and product portfolio strength (in terms of compatible cell type and type of molecule delivered).

§ Tabulated profiles of key players engaged in the development of non-viral transfection reagents and systems (shortlisted based on the type of carrier used, compatible cell type, type of molecule delivered and serum compatibility). Each profile includes a brief overview of the company, financial information (if available), recent developments and an informed future outlook.

§ An in-depth analysis of over 80 cell (including TCR and CAR-T cell) and gene therapy developers that are likely to partner with non-viral transfection reagent and system suppliers, based on several relevant parameters, such as pipeline maturity (which takes into account the phase of development), supplier strength (in terms of number of employees), pipeline strength (based on the number of non-viral transfection reagents in pipeline), and type of therapy.

§ A review of the various non-viral focused initiatives undertaken by big pharma players (shortlisted on the basis of the revenues generated in 2021), featuring various insightful representations, based on year of initiative, type of initiative (in terms of collaborations and funding), type of therapy (in terms of cell and gene therapies) and target therapeutic area.

§ An in-depth analysis of close to 870 patents that have been filed / granted related to non-viral transfection systems, since 2019, highlighting key trends associated with these patents, across type of patent, publication year, application year, geography, type of applicant, CPC symbols, emerging focus areas, leading players (in terms of number of patents granted / filed). In addition, the chapter includes a detailed patent benchmarking and an insightful valuation analysis.

§ A detailed analysis of more than 450 peer-reviewed, scientific articles focused on non-viral transfection reagents and systems that have been published since 2015, based on year of publication, type of publication, type of molecule delivered, target therapeutic area, key focus areas, popular cells and cell lines. The chapter also highlights the leading publishers across different geographies, key journals (in terms of number of articles published).

§ An insightful framework to understand the pricing strategy of the non-viral transfection reagents offered by a company, along with its competitive position in the market. In addition, it presents the equation devised to calculate the likely price of non-viral transfection reagents based upon their characteristics.

The future opportunity within the non-viral transfection reagents and systems market has been analyzed across the following segments:

§ Non-Viral Based Transfection Methods

§ Chemical-based Methods

§ Physical-based Methods

§ Other Methods

§ End-Users

§ Academic And Research Institutions

§ Stem Pharmaceutical Companies

§ Other End-Users

§ Area Of Application

§ Clinical Applications

§ Research Applications

§ Key Geographical Regions

§ North America

§ Europe

§ Asia-Pacific

§ Rest of the World (RoW)

Key Questions Answered

§ How is the research and development (R&D) activity evolving in the non-viral transfection reagents and systems market?

§ How many companies offer non-viral transfection reagents and systems?

§ What are the different types of initiatives being undertaken by big pharma players for the manufacturing of non-viral transfection reagents and systems?

§ Which segment is likely to capture the largest share in the non-viral transfection reagents and systems market?

§ How is the non-viral transfection reagents and systems market likely to evolve in the coming years?

To view more details on this report, click on the link:

https://www.rootsanalysis.com/reports/view_document/non-viral-transfection/307.html

Learn from experts: do you know about these emerging industry trends?

Medical Device Coatings and Modification Technologies

The Future of Dentistry: Dental 3D Printing

Learn from our recently published whitepaper: -

Next Generation Biomanufacturing – The Upcoming Era of Digital Transformation

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Learn more about Roots Analysis consulting services:

Roots Analysis Consulting - the preferred research partner for global firms

Contact:

Ben Johnson

+1 (415) 800 3415

Comments