For many organizations, budget management and expense tracking remain stubbornly stuck in the past—characterized by cumbersome spreadsheets, manual data entry, and delayed reporting. This outdated approach creates significant challenges: finance teams struggle with inaccurate data, department heads lack visibility into their spending, and executives make decisions based on outdated financial information. However, for companies already using Salesforce as their central business platform, there's a far more efficient approach available. By leveraging native budget control and expense tracking solutions within Salesforce, organizations can transform these critical financial functions from administrative burdens into streamlined, automated processes that provide real-time insights and enhance fiscal discipline across the entire company.

Moving Beyond Spreadsheet Chaos

The limitations of spreadsheet-based budgeting and expense tracking become painfully apparent as organizations grow. Version control issues arise when multiple users need access, formula errors can create significant financial discrepancies, and the manual consolidation of department budgets consumes valuable time. Perhaps most importantly, spreadsheets exist in a vacuum, completely disconnected from the actual business activities happening in Salesforce. This disconnect means budget reports are always historical documents, unable to provide guidance on current spending decisions. Implementing a dedicated solution within Salesforce eliminates these challenges by providing a centralized, secure platform for all budget and expense activities.

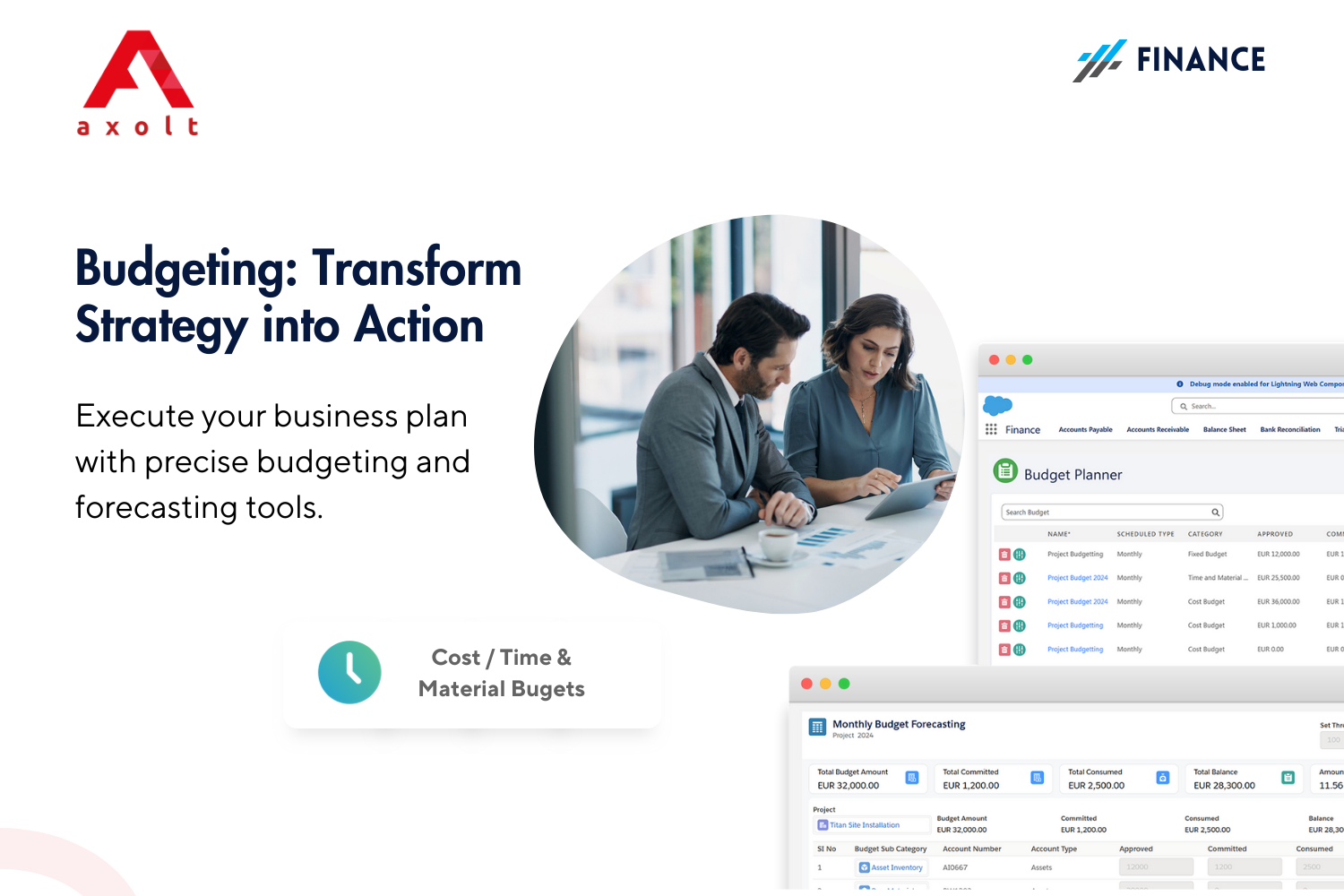

Creating Dynamic, Collaborative Budgets

Modern budget control within Salesforce enables a more dynamic and collaborative approach to financial planning. Instead of static annual budgets created in isolation, finance teams can establish detailed budgets that are directly tied to Salesforce records—whether by department, project, campaign, or even opportunity. Department managers can participate in the budgeting process through customized interfaces that don't require financial expertise. As business conditions change, budgets can be adjusted with proper approval workflows, maintaining a complete audit trail of all modifications. This collaborative approach ensures budgets reflect operational reality while maintaining financial controls.

Automating Expense Capture and Submission

The traditional expense report process—collecting receipts, manually completing forms, and waiting for reimbursement—creates frustration for employees and administrative burden for finance teams. Integrated expense tracking within Salesforce transforms this process through automation and mobile accessibility. Employees can capture receipts using their smartphone camera, with optical character recognition technology automatically extracting relevant details. Expenses can be submitted directly in Salesforce, with automatic categorization based on company rules and direct coding to the appropriate budget category. This automation significantly reduces processing time while improving data accuracy.

Real-Time Visibility into Spending Patterns

The most significant advantage of moving budget and expense management to Salesforce is the transformation from periodic reporting to real-time visibility. Custom dashboards can display current spending against budget allocations at any level of the organization—from enterprise-wide views to individual department or project breakdowns. Managers receive automatic alerts when spending approaches budget thresholds, enabling proactive adjustments rather than reactive corrections. This Real-time Financial Workflow Salesforce visibility helps prevent budget overruns and allows organizations to reallocate resources dynamically based on actual spending patterns and changing business priorities.

Streamlining Approval Workflows and Compliance

Budget and expense management involves multiple layers of approval, from expense reports to budget modifications. Native Salesforce solutions automate these workflows based on customizable business rules. Expenses route automatically to the appropriate managers based on amount, department, or expense type. Budget transfer requests follow predefined approval chains that enforce organizational policies. The system maintains complete audit trails of all approvals, creating inherent compliance with internal controls and external regulations. This automated approach not only accelerates processes but also ensures consistent policy application across the organization.

From Financial Management to Strategic Advantage

When budget control and expense tracking are seamlessly integrated into Salesforce, they evolve from mere administrative functions to strategic capabilities. The combination of financial and operational data enables powerful analysis of return on investment across marketing campaigns, sales initiatives, and customer success programs. Executives can make data-driven decisions about resource allocation based on actual performance metrics rather than historical patterns. This integration ultimately transforms finance from a backward-looking function to a forward-looking strategic partner that helps guide the organization toward more profitable growth and operational efficiency.

Comments