With its fertile Mekong Delta and favorable climate, Vietnam has earned a strong position as one of the world’s top rice suppliers. Over the past decade, vietnam rice exports have consistently ranked among the highest globally, feeding millions across Asia, Africa, and beyond. In 2024, the country’s rice export value reached $5.7 billion, marking a 24% year-on-year increase. The momentum continued into early 2025, with customs data showing exports worth $1.14 billion and a total shipment of 2.2 million tons in the first quarter alone.

This guest post explores the latest statistics, key markets, and exporter performance in the rice sector, offering a comprehensive look at Vietnam Rice Exports by Country for 2024–25.

Record-Breaking Rice Export Performance

Vietnam exported approximately 9 million metric tons of rice in the 2024–25 period, an 11% increase in volume from the previous year. The Ministry of Agriculture and Rural Development reported an average export price exceeding $600 per ton—a record high. The Philippines retained its position as the largest importer, with Vietnam ranked as the third-largest rice exporter globally, according to global trade data.

Despite a promising start, 2025 has presented challenges, with mid-year prices dipping to $390 per ton, influenced by increased global supply and India’s return to the export market. For exporters, adapting to price pressures while maintaining quality will be crucial.

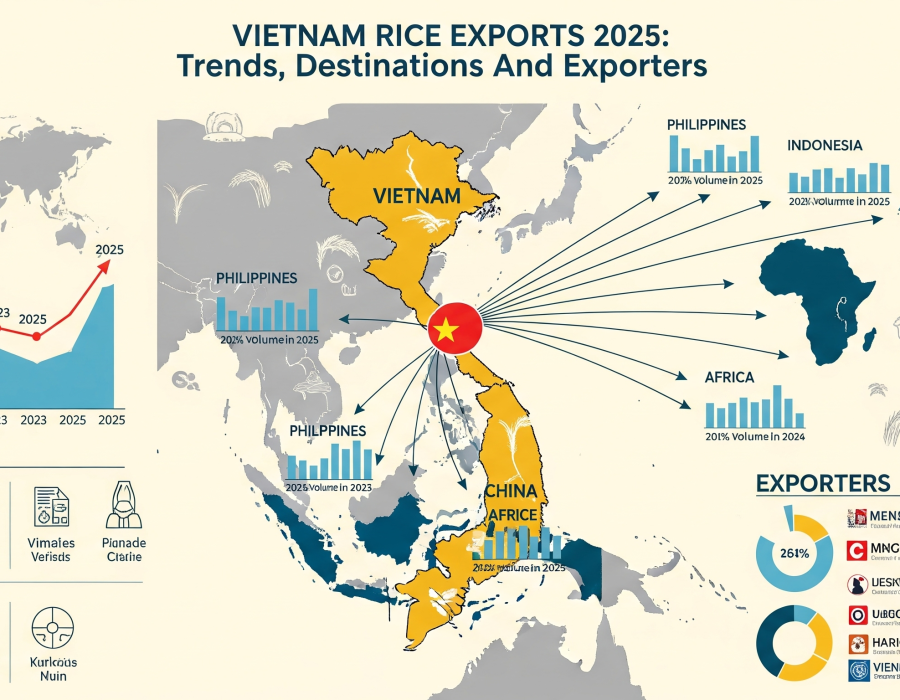

Vietnam Rice Exports by Country: Top 10 Destinations

Vietnam’s rice trade relies heavily on strong relationships with consistent buyers. The Vietnam Rice Exports by Country ranking for 2024–25 highlights the most significant markets:

- Philippines – $1.52 billion (38.4% share)

- Indonesia – $716 million (18.1%)

- China – $494 million (12.5%)

- Ghana – $186 million (4.7%)

- Malaysia – $173 million (4.4%)

- Ivory Coast – $168 million (4.2%)

- Singapore – $113 million (2.9%)

- Iraq – $97 million (2.5%)

- Hong Kong – $79 million (2%)

- UAE – $68 million (1.7%)

The Philippines dominates, purchasing over 3.6–4.2 million metric tons annually, largely consisting of white rice with a 5% broken grade. Indonesia follows closely, driven by high domestic consumption and reliance on imports for food security.

Top Rice Exporters in Vietnam

Vietnam’s rice trade is driven by a mix of state-owned enterprises and private firms. The top exporters for 2024–25, according to customs data, include:

- Intimex Group JSC – $582M (Philippines, Malaysia, Africa)

- Vinafood 1 – $546M (China, Philippines)

- Mekong Food – $501M (Africa, Middle East)

- Gia International – $236M (Africa, Southeast Asia)

- Vinafood 2 – $231M (Philippines, Malaysia)

These companies play a critical role in securing contracts, maintaining quality standards, and ensuring Vietnam’s competitiveness in the international market.

Export Composition by Rice Type

Vietnam rice exports are diverse, catering to different market needs:

- White Rice (5% broken) – $2.96B (main export type, bulk to Asia & Africa)

- Fragrant Rice (ST24, ST25) – $1.13B (premium, high-end markets)

- White Rice (25% broken) – $450M (budget markets)

- Glutinous Rice – $360M (desserts, traditional dishes)

- Japonica Rice – $230M (Japan, Korea)

- 100% Broken Rice – $150M (processing, animal feed)

- Husked Brown Rice – $120M (re-export after milling)

Fragrant varieties are particularly valued in the EU, Japan, and the US, while broken rice remains vital for industrial uses and lower-income markets.

Historical Rice Export Trends

A look at the past decade shows steady growth in vietnam exports of rice:

- 2014: $2.93B

- 2018: $2.62B

- 2020: $2.79B

- 2023: $4.37B

- 2024: $5.70B (record high)

The consistent upward trend reflects strategic market expansion, better quality control, and adaptation to global demand shifts.

2025 Outlook: Price Pressure and Market Shifts

While export volumes remain strong, 2025 has brought a decline in value. From January to May, shipments rose 12.2% year-on-year to 4.5 million tons, but the average export price dropped 18.7% to about $516 per ton. This was due to an abundant supply from competitors and shifting buyer preferences.

Forecasts suggest a total export volume of 7.9 million tons in 2025, with Vietnam potentially overtaking Thailand as the second-largest rice exporter globally.

Key Trends Shaping Vietnam’s Rice Exports

- Product Diversification – Exporters are expanding offerings beyond standard white rice to include organic, fragrant, and specialty varieties.

- Sustainability Initiatives – Eco-friendly cultivation methods, water-saving technologies, and organic farming are gaining traction.

- Digital Trade Growth – E-commerce platforms, blockchain tracking, and online trade facilitation are streamlining transactions and opening new markets.

Conclusion: Opportunities and Challenges Ahead

Vietnam rice exports remain a cornerstone of the country’s agricultural economy, with a strong presence in Asia and growing reach into Africa and the Middle East. The performance in 2024 set a record, driven by robust demand and competitive pricing. However, the 2025 market will require agility—navigating lower prices, increased competition, and evolving consumer demands.

For traders, focusing on high-value varieties, securing long-term contracts, and leveraging trade agreements will be essential. Continuous monitoring of Vietnam Rice Exports by Country, pricing patterns, and market shifts will help maintain Vietnam’s standing as a global rice powerhouse.

If you need verified, detailed Vietnam rice export data—by type, buyer, or HS code—contact VietnamExportdata at [email protected] for a customized report, including a list of top rice exporters in Vietnam.

Comments