Fraud Detection and Prevention (FDP) refers to systems and techniques used to identify, assess, and mitigate fraud activities, particularly in the financial sector. These mechanisms analyze data for patterns indicating fraudulent transactions, employing advanced analytics, machine learning, and artificial intelligence. They are essential in sectors such as banking, insurance, and e-commerce, safeguarding against identity theft, payment fraud, and various financial crimes.

In 2023, the Payment Fraud segment held a dominant market position in the Fraud Detection and Prevention (FDP) market, capturing more than a 47.5% share. This prominence can be primarily attributed to the increasing digitalization of financial transactions globally.

Read more @https://market.us/report/fraud-detection-and-prevention-fdp-market/

Key Factors

Factors driving the market include the exponential rise in online transactions and digital payments, which have simultaneously heightened vulnerabilities to fraudulent activities. This necessitates robust systems capable of swiftly identifying and mitigating potential threats before they impact users and businesses.

Emerging Trends

- AI and Machine Learning: Increasing adoption of AI and machine learning algorithms for real-time fraud detection and predictive analytics.

- Behavioral Biometrics: Integration of behavioral biometrics such as keystroke dynamics and voice recognition to enhance authentication and fraud prevention.

- Real-Time Monitoring: Shift towards real-time monitoring and adaptive fraud detection systems to respond swiftly to evolving threats.

- Advanced Data Analytics: Leveraging big data analytics and data mining techniques to uncover hidden patterns indicative of fraudulent activities

Application

- Payment Fraud

- Money Laundering

- Identity Theft

- Other Applications

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

End-Use Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Retail & E-commerce

- Manufacturing

- Government

- Other End-Use Industries

Major Challenges

Navigating the landscape of fraud prevention involves addressing several critical challenges. These include adapting to increasingly sophisticated fraud techniques such as account takeover attacks and synthetic identities. Another key consideration is navigating complex data privacy regulations while ensuring effective fraud prevention strategies remain intact. Integrating FDP solutions into existing IT infrastructures and workflows poses additional challenges due to integration complexity. Managing costs associated with implementing and maintaining advanced FDP technologies is also crucial for organizations looking to balance effective security measures with financial feasibility. Lastly, addressing the shortage of skilled professionals with expertise in cybersecurity and fraud prevention remains a pressing issue, highlighting the need for continuous skill development and recruitment efforts in these specialized fields.

Market Opportunity

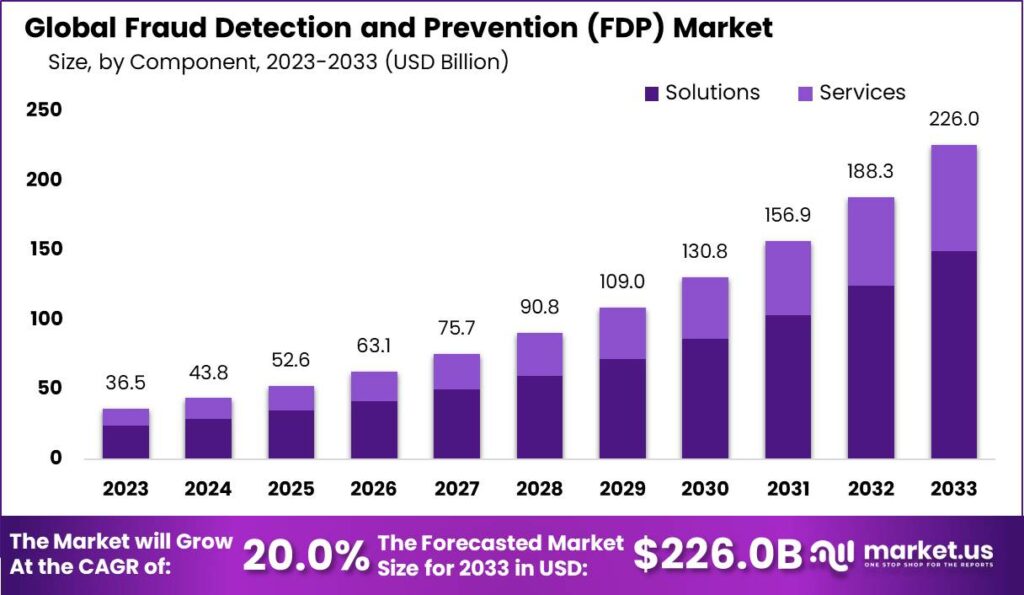

The FDP market presents substantial opportunities for growth and innovation, driven by the escalating need for robust security measures across industries. As businesses increasingly prioritize fraud prevention to protect financial assets, customer trust, and regulatory compliance, there is a growing demand for scalable and effective FDP solutions. Emerging markets, technological advancements, and strategic partnerships are expected to further fuel market expansion in the coming years.

Conclusion

The Fraud Detection and Prevention (FDP) market is poised for significant growth, driven by technological advancements, regulatory pressures, and evolving fraud tactics. Key players in the FDP space are leveraging AI, machine learning, and advanced analytics to strengthen their fraud detection capabilities and stay ahead of emerging threats. Despite challenges such as data privacy concerns and integration complexities, the market's potential remains robust, offering ample opportunities for stakeholders to innovate and capitalize on emerging trends.

Comments