India Fintech Market 2025-2033

According to IMARC Group's report titled "India Fintech Market Report by Deployment Mode (On-Premises, Cloud-Based), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), End User (Banking, Insurance, Securities, and Others), and Region 2025-2033", The report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

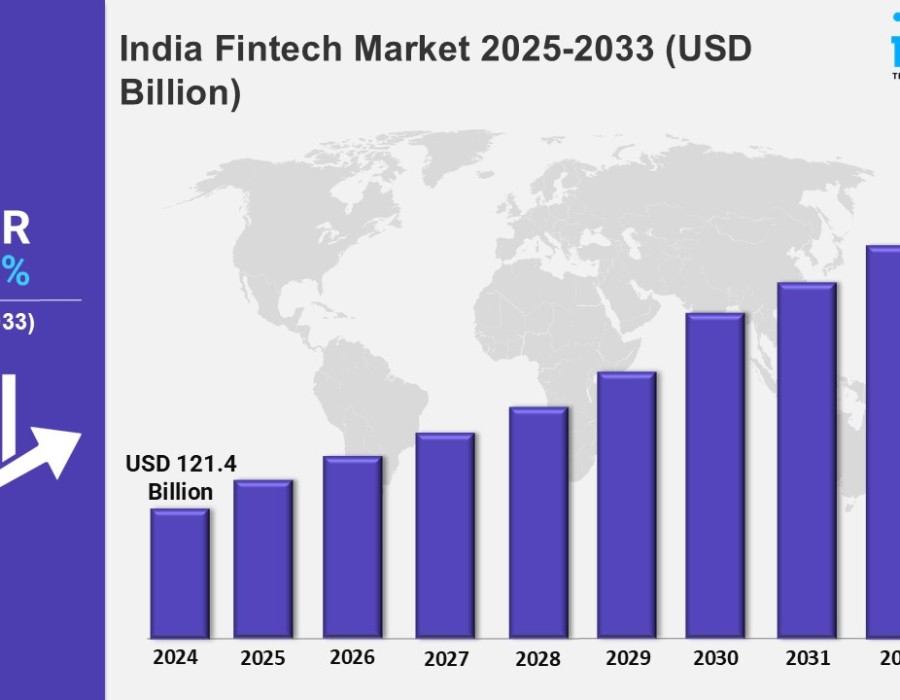

How Big is the India Fintech Market ?

The India fintech market size was valued at USD 121.4 Billion in 2024 and is projected to grow to USD 550.9 Billion by 2033, with an expected compound annual growth rate (CAGR) of 17.4% from 2025 to 2033.

The India Fintech Market is growing exponentially, and that is because technology is progressing and more people are getting digital, and the government is also helping in the process. Among the most outstanding developments is a massive rise in digital payments, which is backed by the popularization of UPI (Unified Payments Interface) that has transformed the peer-to-peer and merchant-based payments. Also, the emergence of neobanks and online lending companies is changing conventional banking, providing easy to use, paperless, and quick financial solutions. Also, the trend of embedded finance, which offers financial services as integrated on non-financial platforms (e-commerce apps and ride-hailing apps, among others), is rising, making customers more convenient. The increased use of blockchain and AI in fintech solutions as a means of enhancing security, anti-fraud countermeasures, and customized financial advice is another major trend.

Besides, regulatory sandboxes proposed by the Reserve Bank of India (RBI) are also promoting innovation by enabling fintech startups to test new products in a controlled environment. Fintech is gaining at an alarming rate, especially in rural and semi-urban settings, due to the growing permeation of the smartphone and affordable internet access. Also, the priority placed on the concept of financial inclusion by use of fintech is filling in the credits, insurance, and even investment capability gaps, among underserved populations. In the Asia Pacific market of India Fintech Market, such dynamic trends are expected to transform the financial marketplace, lowering the barrier of any financial ability, streamlining, and customizing packages through customer-centricity.

Request Free Sample Report: https://www.imarcgroup.com/india-fintech-market/requestsample

India Fintech Market Scope and Growth:

The Indian Fintech market is a massively growing market and is backed by a large unbanked population, increased disposable income, and a young technologically agile generation. It is also expected that statistical lending is one of the fastest growing segments where fintech companies are using alternative data and AI-based underwriting to lend to people and to small and medium size enterprises which might not have a credit history. The insurance technology (InsurTech) industry is also growing at a rapid rate, which provides online tailored, on-demand insurance solutions.

Besides, wealth technology platforms are on the rise as a larger volume of Indians want to avail automated and inexpensive investments solutions such as robo-advisors and micro-investment apps. The government initiative to make the economy cashless, initiatives such as Digital India and Jan Dhan Yojana, have only increased the use of fintech. As well, it can be seen that through strategic alliances between the conventional banks and the emerging fintechs, both their services are being improved, in a combination of trust and innovation. Keep in mind that foreign investments in fintech, as well as venture capital investments in India, increased, which indicates the high levels of confidence in the potential of the industry. The growing attention to cybersecurity and data privacy laws helps guarantee a sustainable growth as well because it helps build consumer confidence. The India Fintech Market is going to keep on thriving with relentless innovations and a conducive regulatory system, to the demands of a variety of financial requirements both in urban and rural settings.

We explore the factors propelling the India fintech market growth, including technological advancements, consumer behaviors, and regulatory changes.

India Fintech Market Forecast and Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India fintech market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Breakup by Deployment Mode:

- On-Premises

- Cloud-Based

Breakup by Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Breakup by Application:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Breakup by End User:

- Banking

- Insurance

- Securities

- Others

Breakup by Region:

- North India

- South India

- West and Central India

- East India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=10442&flag=C

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Comments